Italy, Spain among biggest losers of corporate tax to Netherlands, analysis of billions in tax abuse reveals

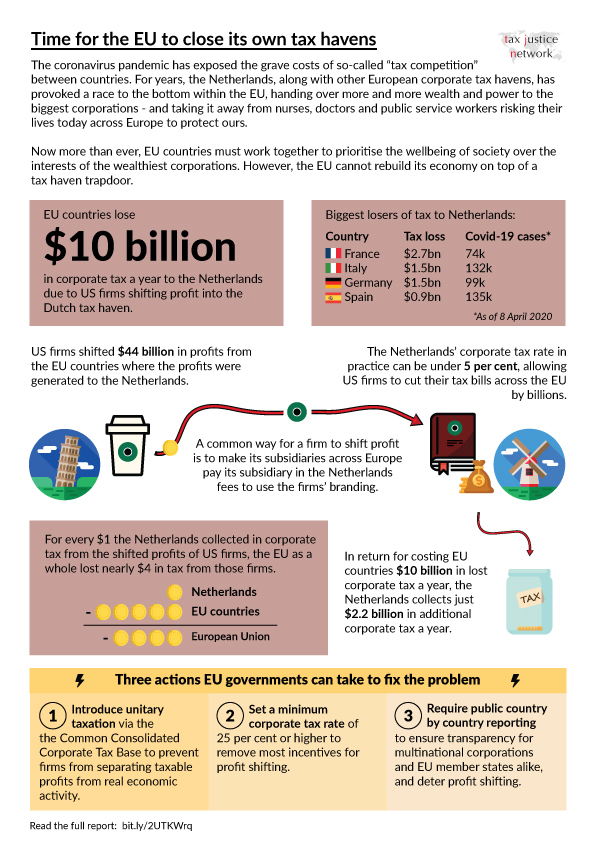

EU countries locked in negotiations over a recovery plan to help member states hit hardest by the Covid-19 pandemic have been revealed to be losing over $10 billion in corporate tax a year to the Netherlands. New analysis shows that the EU countries with the highest reported cases of Covid-19 have been the biggest historical losers of corporate tax to the Netherlands, which is currently a leading opponent to solidarity measures proposed by the EU.

The Tax Justice Network is urging the EU to stop tolerating tax havenry within the EU, cautioning that the European economy cannot be rebuilt on top of an “economic trapdoor”.

The report1 from the Tax Justice Network analyses data published this year by the US detailing where US firms declared their costs and profits in the EU in 2016 and 2017. Instead of declaring profits in the EU countries where they were generated, US firms have shifted billions in profits into the Dutch tax haven each year ($44 billion in 2017) where corporate tax rates in practice can be under 5 per cent. This resulted in huge, yearly reductions in tax bills for some major US firms on their operations across the European Union. Tax losses were biggest in the four EU countries with the highest reported cases of Covid-192: France, with over 74,000 cases, lost over $2.7 billion in corporate tax to the Netherlands, Italy, with over 132,000 cases, lost over $1.5 billion, Germany, with over 99,000 cases, also lost over $1.5 billion and Spain, with 135,000 cases, lost nearly $1 billion to the Dutch tax haven.

The new findings come as EU countries struggle to agree on a recovery plan3. The Netherlands, understood to be a leading opponent to the EU’s proposed measures, received harsh criticism last week for opposing the EU’s proposal to issue joint debt to EU member states afflicted by Covid-194. The Netherlands, which ranks as the world’s fourth greatest enabler of corporate tax avoidance on the Corporate Tax Haven Index 20195, has proposed6 that EU countries could “gift” contributions to an EU emergency fund to support economically weaker EU countries. The Netherlands said it is willing to donate €1 billion ($1.08 billion) to the fund – falling short of $1.5 billion in corporate tax Italy is estimated to lose to the Netherlands on a yearly basis. In comparison, Italy’s $1.5 billion annual tax loss is equivalent to more than twice the annual cost of running San Raffaele Hospital, one of the largest hospitals in Italy with approximately 1350 beds7.

The report highlights the stark inefficiencies of the Dutch tax haven model. In return for costing EU members $10 billion in lost corporate tax a year, the Netherlands collects just $2.2 billion in additional corporate tax a year. For every $1 dollar the Netherlands collected from the shifted profits of US corporations, the EU as a whole lost nearly $4 in corporate tax from the corporations.

US firms booked more profit in the Netherlands alone than the rest of the EU, excluding the corporate tax havens of Ireland and Luxembourg. However, the Netherlands’ low effective tax rate and its frequent use as a conduit for profit shifting to other corporate tax havens like Bermuda, results in a huge transfer of wealth out of Europe and into the offshore bank accounts of the world’s richest corporations and individuals.

The report highlights three main measures that the EU can, and should, take to end the abuses of its own tax havens. First, the long-delayed introduction of unitary taxation (the Common Consolidated Corporate Tax Base) would end the opportunity to separate taxable profits from the real economic activity that generates them. Second, a minimum corporate tax rate of 25 per cent or above would remove most incentives for profit shifting; and an excess profits tax of 50 per cent or 75 per cent during the crisis would ensure that companies making profits from the pandemic are sharing those fully with the states where they derive them. Lastly, the introduction of public country by country reporting would ensure transparency for multinational companies and member states alike, ensuring accountability for any continuing profit shifting.

Alex Cobham, chief executive at the Tax Justice Network, said:

“The coronavirus pandemic has exposed the grave costs of so-called “tax competition” between countries. For years, the Netherlands has provoked a race to the bottom within the EU, handing over more and more wealth and power to the biggest corporations – and taking it away from the nurses and public service workers risking their lives today across Europe to protect ours.

“Now more than ever, EU countries must work together to prioritise the wellbeing of society over the interests of the wealthiest corporations. The EU cannot rebuild its economy on top of a tax haven trapdoor. To stop the loss of billions in tax to corporations shifting profit into tax havens like the Netherlands, EU governments must shift to a unitary tax approach that makes corporations pay tax based on where their employees do real work, and not where their accountants hide their profits. Tax revenues must arise where the real activity is – just as health needs do.”

-ENDS-

Contact the press team: media@taxjustice.net or +44 (0)7562 403078

Notes to editor

- The report published by the Tax Justice Network today, titled Time for the EU to close its own tax havens, analyses country by country reporting data published the US Internal Revenue Service (https://www.irs.gov/statistics/soi-tax-stats-country-by-country-report). Revenue losses were calculated in two steps. In the first step we estimated the relationship between log-profit and log-employees, log-sales and log-assets using a linear regression (R2 = 0.863). We used this model to calculate the expected profits in each country. In order to maintain the total profits constant, the extra profits (real profits minus expected profits) were distributed to all countries according to the estimated model. This allows us to obtain the profit shifted (real profits minus expected profits, including redistribution). In the second step, revenue loss is calculated as the product of profit shifted and the effective tax rate in the country. To calculate revenue losses and profit shifted that can be directly attributable to the Netherlands, we multiplied the estimated value by the share of profit shifted to the Netherlands (44%).

- Tax revenue losses per country due to the Netherlands:

| Country | Cases8 | Cases per million | Profit shifted to Netherlands ($ millions) | Revenue loss ($ millions) | Revenue loss as % of healthcare expenditures9 |

| Spain | 135,032 | 2,890 | 4,192 | 993 | 0.99% |

| Italy | 132,547 | 2,193 | 6,208 | 1,555 | 1.04% |

| Germany | 99,225 | 1,196 | 7,051 | 1,545 | 0.44% |

| France | 74,390 | 1,110 | 7,783 | 2,731 | 1.07% |

| Belgium | 20,814 | 1,822 | 4,586 | 1,038 | 2.37% |

| Netherlands | 18,803 | 1,091 | -43,785 | -2,156 | -2.96% |

| Austria | 12,297 | 1,389 | 1,670 | 539.00 | 1.45% |

| Portugal | 11,730 | 1,140 | 1,081 | 258 | 1.53% |

| Sweden | 7,206 | 707 | 1,230 | 282 | 0.56% |

| Ireland | 5,364 | 1,105 | 1,987 | 254 | 1.26% |

- Eurozone fails to agree deal on €540bn coronavirus rescue plan: https://www.theguardian.com/business/2020/apr/08/eurozone-fails-to-agree-on-540bn-coronavirus-rescue-plan

- Fierce backlash to Dutch hard line on Eurobonds: https://www.irishtimes.com/business/economy/fierce-backlash-to-dutch-hard-line-on-eurobonds-1.4217157

- The Tax Justice Network’s Corporate Tax Haven Index ranks countries by their complicity in global corporate tax havenry. The countries ranked the highest by the index are those that have done the most proliferate corporate tax avoidance and break down the global corporate tax system. View the full ranking here: https://corporatetaxhavenindex.org/introduction/cthi-2019-results

- Dutch propose emergency fund for coronavirus nations: https://www.reuters.com/article/uk-health-coronavirus-netherlands-europe/dutch-propose-emergency-fund-for-coronavirus-nations-idUKKBN21J6RI

- The total operating cost of Italy’s San Raffaele Hospital was last reported to be €659,740,265 in 2018: https://www.hsr.it/strutture/ospedale-san-raffaele/trasparenza

- Data on coronavirus cases comes from the European Centre for Disease Prevention and Control.

- Data on healthcare expenditures comes from Eurostat (table hlth_sha11_hf).

If the Netherlands are a tax paradise, which I doubt, they are because these Mediterranean countries, like Spain and Italy, are tax HELLS. I have lived in Spain for 25 years and I can assure there is a lot of unnecessary and inefficient government spending there, as well as an awkward tax regime. Only the Portuguese seem to have understood it: they are slowly reducing the tax burden for their citizens and our neighbours are doing better.

Maybe Spain wouldn’t be “tax hell” if it wasn’t robbed of tax revenue by the Netherlands?

Dear Frans,

It’s true that tax and bureaucracy are very easy in Luxemburg and The Netherlands. I’m Dutch and living in Spain since 1985, BBA/SPD. As a Corporate Accountant for a US firm €3 mrd – €3.000.000.000 consolidated profit tax was posted at a Tax rate: 5,25% (2004 ACJA).

Tax collected – U.S.: €157,5 Million (USA) – 5,25%

Tax ‘due’in the E.U.: €750,0 Million (E.U). -25,00% average

Tax saved by the CO : €592,5 Million (Corporation) -19,75%

TJN states that saved tax by Corporate Accountants in this case would be a loss for the E.U.

My company complied with all legal and tax issues. It was as you say very, very easy to manage this saving thru Luxemburg (or The Netherlands).

That’s exactly the issue TJN is dealing with here. It’s just too easy in The Netherlands and Luxemburg.

In the 2000 -2020 period Spain has lost €120 Billion Profit Tax through the axis of tax avoidance. (Estimation as a CO Accountant).

= 8% of GDP from Spain, and equals the loss due to the Corona in 2020.

= In the period 2000-2020 €1,280 Billion should now be reclassified (my best etimate).

This Reclassification Fund equals the Recovery Fund which is now under discussion in the E.U.

But Reclassification Fund are Inter-country transfers.

While rceovery Fund will be other loans.

My best estimate for the amount The Netherlands is due is €457 Billion

I.e.: The Netherlands is due 50% of GDP 2019 in cash to be transferred to countries as Belgium, Germany, France, Spain, Denmark.

Luxemburg is due €549 Billion. At least 8 times their GDP.

This is NOT the amount these EU – Tax Havens collected, but is something like 50% of all the financial damage the EU – Tax Havens caused to third countries within the EU.

All EU countries should agree on this Loss of Profit Tax, and audit the whole period 2000 – 2020.

Luxemburg is no suddenly getting very excited on Eurobonds, and Jean-Claude Juncker becomes a friend of Greece and insists to Mark Rutte from The Netherlands to push forward on Eurobonds as well.

If EU-countries B/S were to be reclassified duely for these amounts Spain would have no structural deficit for five years (2020-2025). The Netherlands would lose nearly all public savings.

This is reasonable, because the collected tax + damage in Holland = €457 Billion

is the amount another 20+ No Tax haven countries are now in debt = ca. 5% total debt.

Best Regards,

Martien Hellinga (Spain)

It’s a hell just because of countries such as Netherlands, Cayman, Belize, Liechtenstein keep on stealing what’s produced in Italy and Spain.