From Citizens for Tax Justice, a major new report:

From Citizens for Tax Justice, a major new report:

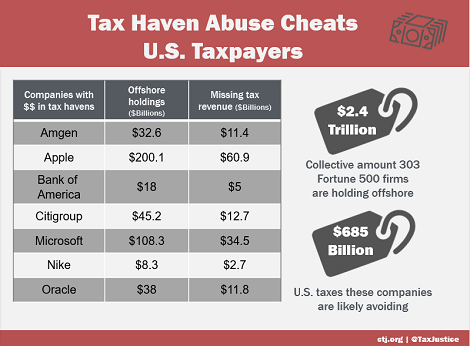

“A diverse array of companies are using offshore tax havens. . . All told, American Fortune 500 corporations are avoiding up to $695 billion in U.S. federal income taxes by holding $2.4 trillion of “permanently reinvested” profits offshore. In their latest annual financial reports, 27 of these corporations reveal that they have paid an income tax rate of 10 percent or less in countries where these profits are officially held, indicating that most of these monies are likely in offshore tax havens.”

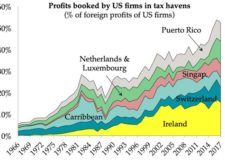

And that number is rising, fast.

The press release is here.

The full report is here.

This is total baloney. if their company made money in country other than the USA why do they have to pay tax on the money they made twice?

ummm, err, the point is that until they repatriate (which often means ‘never’) they don’t pay tax on it at all if they stash it e.g. in a tax haven.

That is not necessarily true. The income earned within a given country will be tagged and charged taxes by that country. Most countries do not tax income that was made outside their borders. However, the USA does. Thus, there is an incentive for the company to then transfer these funds to a holding spot outside the USA to avoid double taxation. It only makes sense for them to find the lowest cost options for paying taxes on any sort of interest income on that cash.

From a reasonable view, the US sets this situation up by having an exceptional policy of taxing profits made outside its borders. From a patriotic view, this is a company avoiding their “duty” to pay US taxes.