Even before the Coronavirus pandemic hit, international tax abuse was pillaging government coffers all over the world of resources desperately needed to fund essential public services like health care. Now that the world is struggling to tackle both the direct health impacts of the crisis and the … [Read more...]

Wealth Tax

Systemic racism and tax justice: the Tax Justice Network podcast, July 2020

In this episode of the Tax Justice Network’s monthly podcast, the Taxcast we bring you part 2 on how tax justice can help address systemic racism in the US: Author Shawn Rochester, (The Black Tax: the cost of being Black in America) does some number crunching on the historic denial of equality … [Read more...]

It’s got to be automatic: Trillions of dollars offshore revealed by Tax Justice Network policy success

This is a moment, in these strange times, to celebrate an ongoing success in the history of the tax justice movement. Automatic, multilateral exchange of information on financial accounts is the A of our ABC of tax transparency. It has been a campaign aim since our inception in the early 2000s, as … [Read more...]

Another Great Depression or tax justice and transparency? The Tax Justice Network January 2020 podcast

The Taxcast kicks off the new decade with: the French strikes - tax justice and pensions vs financialisationthe EU countries who've missed the deadline on publishing registers of real corporate ownersthe effect of Brexit on poorer (aka plundered) countriesAnd the IMF's stark warnings about the … [Read more...]

New website: massive rise in tax injustice in the US

Gabriel Zucman has developed a high profile creating new data on tax systems, tax havens and inequality. To coincide with the release of his new book The Triumph of Injustice: How the rich dodge taxes and how to make them pay, he has launched a new, user-friendly website, Tax Justice Now. It's … [Read more...]

We asked our stakeholders to challenge us on our work

Should we at the Tax Justice Network be doing more to engage with organisations in the global south? Should we be focusing more on high-level advocacy or talking more about progressive taxes instead of tax avoidance? These questions and more were put to us at our organisational retreat this spring … [Read more...]

Oligopoly Capitalism: economic and democratic threats: the Tax Justice Network’s January 2019 podcast

In Edition 85 of the January 2019 Tax Justice Network’s monthly podcast/radio show, the Taxcast (available on iTunes, Stitcher, Spotify and other podcast platforms): Naomi Fowler talks to investor and author Jonathan Tepper who’s co-written a book called ‘The Myth of Capitalism: Monopolies and … [Read more...]

Brussels celebrates ‘tax freedom’ for billionaires on 4th January 2019

Our colleagues in Belgium have decided to celebrate the fourth of January as the day when billionaires in Belgium will have earned sufficient to pay their tax bill for the whole of 2019. In an era of preposterous inequality, social fragmentation and political crisis, what's not to celebrate? … [Read more...]

It’s time to tax wealth properly

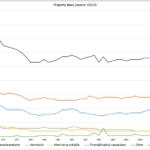

Wealth taxes are now rising fast up the global political agenda. For OECD countries, taxes on "property" have declined as a share of all taxes, from close to eight percent of all taxes in the 1960s, to a little over five percent in 1980, a level at which they have stagnated ever since. … [Read more...]

Tax justice, the new Washington consensus?

I had the honour of giving a keynote address at the World Bank/International Monetary Fund annual meetings on 15th October 2017, for an event entitled 'Technical challenges and solutions for taxing wealth in developing countries' - which gave the impression that a new Washington consensus on tax … [Read more...]