The Southern African Catholics Bishops Conference has written an open letter to 21 mining companies operating in South Africa asking each to explain why they use tax havens. Their full letter is here and it's worth reading. They point out, "we are not accusing companies of anything. We believe it … [Read more...]

Tax Havens

Podcast: Decolonisation and the Expansion of Tax Havens, 1950s-1960s

We're sharing a fascinating lecture at the University of London's Institute of Historical Research The lecture has the intriguing title 'Funk Money': Decolonisation and the Expansion of Tax Havens, 1950s-1960s and was delivered by Associate Professor Vanessa Ogle of the University of California, … [Read more...]

#ParadisePapers: UN human rights experts react: States must act against abusive tax conduct

The United Nations Independent Expert on the effects of foreign debt and human rights has released a strong statement on the ethical responsibility of corporations in the wake of the Paradise Papers revelations. The current Independent Expert, Juan Pablo Bohoslavsky has said ““Corporate tax abuse … [Read more...]

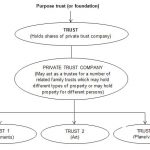

Enough evidence on trusts – where are the State’s actions?

Our two last papers on trusts (here and here) described trusts’ involvement in grand corruption and other cases that would anger any rational person. The Paradise Papers, and recent case law, shed outrageous new light on trusts’ role in worsening inequality, shielding assets from legitimate … [Read more...]

Our paper “Trusts: Weapons of Mass Injustice?” – now available in Spanish

Our paper "Trusts: Weapons of Mass Injustice?" which we released and blogged about earlier this year is now available in Spanish. The English version of the paper is available here. The paper provoked critical attention from practitioners and from tax havens. Our response to their critiques is here … [Read more...]

European Commission orders Luxembourg to claim back 250 million in taxes from Amazon – TJN Reaction

There are two very welcome pieces of tax justice news today. Firstly, the European Commission has ordered the tax haven of Luxembourg to recover 250 million euros in taxes from Amazon, finding that the benefits extended to the company amount to illegal state aid. The support Amazon received, allowed … [Read more...]

The Spider’s Web film wins ARFF Global Award

We're delighted that Michael Oswald's documentary film The Spider's Web: Britain's Second Empire has won the monthly Global Award from the Berlin Around International Film Festival (ARFF). The Spider's Web, which was co-produced by TJN's John Christensen, draws inspiration from Nicholas Shaxson's … [Read more...]

Swiss Politicians seek to block automatic exchange of banking information with developing countries

Could we be seeing a return to the bad old days of Swiss Banking? A right wing party in Switzerland, the Swiss People’s Party, has launched an assault on the automatic exchange of banking information, according to Swiss Daily Newspaper Tages Anzeiger. … [Read more...]

New research on key role major economies play in global tax avoidance

An important new study on Offshore Financial Centres (OFCs) from the University of Amsterdam has made some fascinating discoveries, challenging, as the Financial Secrecy Index has, the popular misconception that tax havens are only palm fringed little islands and exposing that in fact major … [Read more...]

RB tax avoidance – company calls for public country by country reporting after Oxfam report reveals profit shifting

Oxfam has today released a report on tax dodging by RB, the company formerly known as Reckitt Benckiser and the maker of thousands of well known household products. The report looks at the 2012 restructuring of the company which saw it set up ‘hubs’ in the Netherlands, Dubai and Singapore, all … [Read more...]

Will the G20 ever end the global problem of tax avoidance and tax evasion?

Ahead of the G20 Summit in Hamburg this week our own George Turner has published this op-ed in the German newspaper Die Tageszeitung today. The article discusses why, despite sustained political engagement from world leaders, we are still some way from solving the problem of tax avoidance and tax … [Read more...]

Whistleblower Ruedi Elmer vs. the Swiss ‘Justice’ System

We've regularly covered the battles of whistleblower Rudolf Elmer against the Swiss “justice” system. As we've said before, and as has so often been the case with those brave enough to risk all to challenge injustice and corruption, the bank was the criminal, not Rudolf Elmer. He wrote a guest blog … [Read more...]

Forthcoming book: Tax Havens and International Human Rights Law

Tax havens cause enormous damage, not least because they block governments from fulfilling their human rights obligations. When rich people and powerful businesses evade paying taxes by using offshore tax havens they deprive states of the revenues they need to deliver on their commitments to … [Read more...]

Coming Soon: The Spider’s Web – a film about Britain’s tax haven empire

#RogueLondon Film maker Michael Oswald and TJN's John Christensen have co-produced a new film about Britain's tax haven empire. Titled The Spider's Web: Britain's Second Empire, the film is ready for release. It draws heavily on Nick Shaxson's ground-breaking book Treasure Islands and uses … [Read more...]

UK Parliament fails to tackle financial secrecy in its overseas territories

So near and yet so far… Hopes were riding high yesterday that UK parliamentarians might seize the opportunity to take historic action to end decades of financial secrecy in the UK’s Overseas Territories. We blogged about this yesterday highlighting the fact that a lot of ongoing Parliamentary … [Read more...]