We’re pleased to share the seventh edition of the Tax Justice Network’s monthly podcast/radio show for francophone Africa by finance journalist Idriss Linge in Cameroon. The podcast is called Impôts et Justice Sociale, ‘tax and social justice.’ It’s available for anyone who wants to listen to it, … [Read more...]

Tax Havens

Immigration as reparations: the Tax Justice Network July 2019 podcast

In this month’s July 2019 podcast we speak with multiple award winning Suketu Mehta about his new book: This Land Is Our Land: An Immigrant’s Manifesto on the fastest way to fix global inequalities and injustices. (A UK version of the book will be published in August 2019.) Plus: we discuss … [Read more...]

Whistleblower Rudolf Elmer: legal opinion on latest ruling

We’ve written many times about Swiss whistleblower Rudolf Elmer’s long legal battles against Swiss banking secrecy here, here, here here and here. He’s endured 48 prosecutorial interrogations, 6 months in solitary confinement and 70 court rulings. Of one thing you can be sure – if the Swiss bank … [Read more...]

Rising inequality and dysfunction in the tax haven of Jersey: a Taxcast special edition

In this special extended edition of the April 2019 Taxcast, broadcast from the tax haven of Jersey: we explore Jersey's poor showing in the OECD's Better Life Index and ask why Jersey's spending so much money on improving its bad image instead of setting up public registers of beneficial … [Read more...]

The Tax Justice Network’s March 2019 Spanish language podcast: Justicia ImPositiva, nuestro podcast, marzo 2019

Welcome to this month’s latest podcast and radio programme in Spanish with Marcelo Justo and Marta Nuñez, free to download and broadcast on radio networks across Latin America and Spain. ¡Bienvenidos y bienvenidas a nuestro podcast y programa radiofónica! (abajo en Castellano). In this month’s … [Read more...]

When will the British government impose public registries on its tax havens?

UPDATED Not so long ago Lee Sheppard, one of the US's top experts in international tax, gave a pithy and accurate explanation of why powerful countries don't just close down the tax havens that are undermining their tax and criminal justice and regulatory systems. We don't shut [these financial … [Read more...]

Brexit and the future of tax havens

This week the Tax Justice Network's John Christensen spoke at this event at the European Parliament organised by the European Free Alliance of the Greens on Brexit and the future of tax havens. Here's more information on the event and you can watch the whole thing here. John spoke on the impact of … [Read more...]

Desperate marketing: Jersey Finance trolls The Spider’s Web film

Viewers of Michael Oswald's seminal film on Britain's tax haven empire have been bemused in recent days by a pop-up ad put out by Jersey Finance, the finance industry lobby in tax haven Jersey. The ad, running under the title 'Reality Check - Dispelling the Tax Haven Myth', plays the usual tax … [Read more...]

Leaving Jersey – an island cursed by finance

The Tax Justice Network was set up in 2003, after three Jerseyfolk, Pat Lucas, Jean Andersson and Frank Norman, traveled to London to see John Christensen, the island's former economic adviser. Christensen had left the island in 1998, appalled at the corruption and malfeasance he had encountered … [Read more...]

The Spider’s Web film – now available for free online

Michael Oswald's seminal documentary film on Britain and its tax haven empire is available now on YouTube. Released in 2017 to considerable critical acclaim, The Spider's Web has been screened across the world, from USA to New Zealand. It is now available for free download by anyone who wishes … [Read more...]

Could the World Trade Organisation see a challenge to tax havenry?

The Open Society Justice Initiative, part of the Open Society Foundations, focuses on strategic litigation possibilities that can have catalytic impact on achieving human rights around the world. Recently, they've been looking at the idea of a World Trade Organisation challenge, in the name of tax … [Read more...]

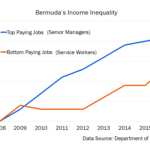

Bermuda: inequality and poverty in UK Overseas Territory

We're very pleased to share this important report on the British Overseas territory of Bermuda, written by Bermudian economist Robert Stubbs, formerly Head of Research for Bank of Bermuda. There are more details on him and his work at the end of this fascinating and timely report. which we reproduce … [Read more...]

Will the EU really blacklist the United States?

In our latest Financial Secrecy Index assessment, the United States moved up to second place. With its now unparalleled commitment to secrecy at scale, and its influence on international reforms, it has become the leading driver of tax abuse and corruption risk around the world. Years ago we … [Read more...]

Yes, Britain is closing its tax havens. But let’s not forget it created them in the first place

This post is jointly authored by Anthea Lawson and John Christensen Tax justice campaigners celebrated this week as a nifty cross-party move from British Members of Parliament Margaret Hodge and Andrew Mitchell forced the UK’s Overseas Territories – many of them in the Caribbean – to stop hiding … [Read more...]

The EU Tax Haven Blacklist – a toothless whitewash

Continuing our coverage of the EU Tax Haven Blacklist, we are reposting this article which first appeared in Public Finance International. The original can be found here: http://www.publicfinanceinternational.org/opinion/2017/12/eu-tax-blacklist-whitewash … [Read more...]