The Corporate Europe Observatory has a report out today which is well worth reading. We've written and commented extensively on the Big Four accountancy firms and the damage they do, you can read more in our 'enablers and intermediaries' section. As our CEO Alex Cobham has said, they're "not the … [Read more...]

Tax Avoidance

#LuxLeaks verdict: hope for whistleblowers as Antoine Deltour is acquitted

We've always said that the #LuxLeaks whistleblowers Antoine Deltour, Raphaël Halet and investigative journalist Edouard Perrin should never have been charged because the disclosures they were involved in were so obviously in the public interest, helping to expose the industrial scale on which … [Read more...]

Unhappy meal: tax avoidance still on the menu at McDonald’s

We're sharing this press release from EPSU, the European Public Service Union which comprises 8 million public service workers from over 265 trade unions. Here's their joint statement on their new research on McDonald’s, entitled Unhappy Meal report. Today we release a new report on McDonald’s … [Read more...]

Video discussion: ‘Taming Digital Capitalism’ through public country by country reporting

There were some important debates in Brussels recently where Hans Böckler Stiftung held a two-day symposium with the European Trade Union Institute looking at the changes citizens in Europe are facing in the workplace and examining the challenges for the new leaders who will be in place as a result … [Read more...]

Yes, Britain is closing its tax havens. But let’s not forget it created them in the first place

This post is jointly authored by Anthea Lawson and John Christensen Tax justice campaigners celebrated this week as a nifty cross-party move from British Members of Parliament Margaret Hodge and Andrew Mitchell forced the UK’s Overseas Territories – many of them in the Caribbean – to stop hiding … [Read more...]

Now you see me, now you don’t: using citizenship and residency by investment to avoid automatic exchange of banking information

On February 19th, the OECD launched a consultation entitled “Preventing abuse of residence by investment schemes to circumvent the CRS”. It was about time. Since 2014, we have written several papers and blogs (here, here, here, here and here) explaining how residency and citizenship schemes offered … [Read more...]

Video: discussion on tax revenue losses, Apple’s tax avoidance and ‘state aid’

We're sharing here the opening panel discussion of the June 2017 European Financial Congress, Eastern Europe's largest finance congress in Gdansk, Poland. The theme of the panel was "Tax solidarity in the world and in the EU" and it features visiting Professor at Oxford University Philip Baker QC … [Read more...]

Guest blog: Tax Avoidance and Evasion in Africa

We're pleased to share this blog post (first published here) written by Nataliya Mykhalchenko for the Review of African Political Economy: Tax avoidance, tax evasion, tax heavens, illicit financial flows and global tax governance are real buzzwords that have come to dominate current international … [Read more...]

#ParadisePapers: The onshore heart of the offshore industry

We're sharing this blog in its entirety from Icelandic journalist Sigrun Davidsdottir's excellent Icelog. The Paradise Papers emphasises, yet again, that the damaging effect of offshore is much more pervasive that robbing countries of tax. Offshore creates a two-tier business environment, hiding … [Read more...]

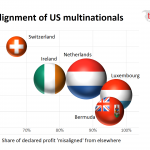

Big Four accounting firms are key drivers of tax haven use, new research says

As scandals emerge from the Paradise Papers, the Big Four accountancy firms seem to have managed to stay largely out of the spotlight once again. But research released today shows that scrutiny of their practices is justified in the public interest. The new study is authored by Dr Chris Jones and … [Read more...]

#ParadisePapers: residency for sale to the rich and famous

Among the scandals exposed by the Paradise Papers is that of residency for sale, something I covered just last month (along with passports for sale) as a special feature in our monthly podcast and radio show, the Taxcast, which you can listen to below. The name Shakira Isabel Mebarak Ripoll showed … [Read more...]

Enough evidence on trusts – where are the State’s actions?

Our two last papers on trusts (here and here) described trusts’ involvement in grand corruption and other cases that would anger any rational person. The Paradise Papers, and recent case law, shed outrageous new light on trusts’ role in worsening inequality, shielding assets from legitimate … [Read more...]

European Commission orders Luxembourg to claim back 250 million in taxes from Amazon – TJN Reaction

There are two very welcome pieces of tax justice news today. Firstly, the European Commission has ordered the tax haven of Luxembourg to recover 250 million euros in taxes from Amazon, finding that the benefits extended to the company amount to illegal state aid. The support Amazon received, allowed … [Read more...]

Beginning of the end for the arm’s length principle?

The European Commission has released a statement which could well signal the beginning of the end for the OECD’s international tax rules, and the arm's length principle on which they are based. The current rules, which date to decisions taken at the League of Nations in the inter-war years, are … [Read more...]

Will the G20 ever end the global problem of tax avoidance and tax evasion?

Ahead of the G20 Summit in Hamburg this week our own George Turner has published this op-ed in the German newspaper Die Tageszeitung today. The article discusses why, despite sustained political engagement from world leaders, we are still some way from solving the problem of tax avoidance and tax … [Read more...]