Yes, we can build an open and transparent tax system that works fairly for everyone. Do you know how multinationals shift their profits to dodge their taxes and how we can stop them? Our beautifully illustrated new videos tell you how, narrated in five different languages by our tax justice podcast … [Read more...]

Tax Avoidance

Join the Global Days of Action for Tax Justice!

Even before the Coronavirus pandemic hit, international tax abuse was pillaging government coffers all over the world of resources desperately needed to fund essential public services like health care. Now that the world is struggling to tackle both the direct health impacts of the crisis and the … [Read more...]

Developing countries, take note: how much money do your residents hold in Australia, the most transparent country on bank account information

Australia has become the first country to publish statistics on automatic exchange of information for all jurisdictions, especially those that cannot join the automatic exchange system. Here’s what they reveal and why it has more potential than statistics published by the Bank for International … [Read more...]

Taking Panama to task: Women’s rights trampled by financial secrecy

Just over four years have passed since a huge archive of secret documents from the Panamanian law firm Mossack Fonseca, containing wide-ranging details of fraud, tax evasion and other illegal financial schemes, were leaked to a German newspaper provoking a global scandal. The public outcry that … [Read more...]

Pandemic of tax injustice in Ukraine

The Ukrainian government took the pandemic as an opportunity to further shift the tax burden from the rich to the poor, while Tax Justice Network's new illicit financial flows tool confirms the country is vulnerable to profits shifting to tax havens and bank deposits outflows. Guest blog from … [Read more...]

US blows up global project to tax multinational corporations. What now?

"(Other nations) had all come together" via the OECD to "screw America and that’s just not something we’re ever going to be a part of".~ US Trade Representative Robert Lighthizer addressing Congress, 17 June 2020, per Sydney Morning Herald. Boom. The US has blown up 'BEPS 2.0', the OECD's tax … [Read more...]

Tax, reparations and ‘Plan B’ for the UK’s tax haven web

The killing of George Floyd by US police in Minnesota, on 25 May 2020, has sparked a public response both more powerful and more international than almost any of the previous cases in a very long line - including Breonna Taylor in Kentucky, 13 March 2020. The demands for justice extend far beyond … [Read more...]

Financial Secrecy Index: who are the world’s worst offenders? The Tax Justice Network podcast special, February 2020

In this special extended Taxcast, Naomi Fowler takes you on a whistle-stop guided tour on an express train around the world with some of the Tax Justice Network team, looking at the worst offenders selling secrecy services according to the latest Financial Secrecy Index results What can nations can … [Read more...]

Tax Justice November 2019 Portuguese podcast: Penalidade máxima: a sonegação no futebol #7

Welcome to our seventh monthly tax justice podcast/radio show in Portuguese. Bem vindas e bem vindos ao É da sua conta, nosso podcast em português, o podcast mensal da Tax Justice Network, Rede de Justiça Fiscal. É da sua conta é o podcast mensal em português da Tax Justice Network, com … [Read more...]

Taxing wealth – how to triumph over injustice: Tax Justice Network October 2019 podcast

In this month's episode we speak to Gabriel Zucman about his new book with co-author Emmanuel Saez - The Triumph of Injustice: How the Rich Dodge Taxes and How to Make Them Pay. Plus, as Extinction Rebellion holds protests around the world over the climate emergency, we point the finger at the … [Read more...]

The UAE and Mauritius are the most corrosive corporate tax havens against African countries – Tax Justice Network Africa

Following the Tax Justice Network's publication of the Corporate Tax Haven Index earlier this week, Tax Justice Network Africa released the following statement highlighting the damage wrought by corporate tax havens on African countries. Press Release - UAE and Mauritius are the most corrosive … [Read more...]

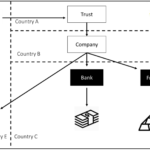

India and the renegotiation of its double tax agreement with Mauritius: an update

A few years ago we featured a guest blog by award winning essay writer and legislative aide to a Member of Parliament in India Abdul Muheet Chowdhary. He wrote here about the Double Taxation Avoidance Agreement with Mauritius, a favourite tax haven for Indians, which we're sharing in full below, … [Read more...]

World’s biggest monopolist pays negative taxes

Via the Washington Post: According to an analysis by the Institute for Taxation and Economic Policy (ITEP,) a leading US tax justice group, Amazon got a $129 million tax rebate last year, equivalent to a minus one per cent US federal tax rate, its second year running of negative taxes. (Its … [Read more...]

The European Union, tax evasion and closing loopholes: new report

Today, a new report commissioned by the Greens/EFA group in the European Parliament and written by the Tax Justice Network's Andres Knobel demonstrates that despite progress in recent years on closing down opportunities for tax evasion, there are still significant loopholes for citizens and … [Read more...]

Public Services and Economic Injustice in Tax Break Ireland

The reality of ill-health leaves little time to dwell on rights and justice, or on what might turn out to be empty promises - as the Irish Examiner reports. And while the experience of living with ill health might be said to be something of a leveller, it is not. There is no ‘level playing field’ if … [Read more...]