In this episode of the Tax Justice Network’s monthly podcast, the Taxcast: We look at the terrible Beirut explosion and how the story of tracing those responsible tells us everything that's wrong with our world.Plus, we discuss what President-elect Biden's win could mean for tax and economic … [Read more...]

The Mechanics of Secrecy

Financial Secrecy Index: who are the world’s worst offenders? The Tax Justice Network podcast special, February 2020

In this special extended Taxcast, Naomi Fowler takes you on a whistle-stop guided tour on an express train around the world with some of the Tax Justice Network team, looking at the worst offenders selling secrecy services according to the latest Financial Secrecy Index results What can nations can … [Read more...]

US half-shuts door to financial secrecy, opens new window

The US is the world’s second greatest contributor to global financial secrecy, according to the Tax Justice Network’s Financial Secrecy Index, only faring better than Switzerland in complicity in enabling financial secrecy schemes that foster tax abuse, money laundering and the financing of … [Read more...]

Enough evidence on trusts – where are the State’s actions?

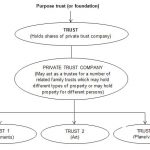

Our two last papers on trusts (here and here) described trusts’ involvement in grand corruption and other cases that would anger any rational person. The Paradise Papers, and recent case law, shed outrageous new light on trusts’ role in worsening inequality, shielding assets from legitimate … [Read more...]

Our paper “Trusts: Weapons of Mass Injustice?” – now available in Spanish

Our paper "Trusts: Weapons of Mass Injustice?" which we released and blogged about earlier this year is now available in Spanish. The English version of the paper is available here. The paper provoked critical attention from practitioners and from tax havens. Our response to their critiques is here … [Read more...]

Why the Swiss case against whistleblower Elmer may hurt the bankers

Rudolf Elmer, the Cayman-based Swiss whistleblower who went to prison after spilling secrets relating to the Swiss bank Julius Baer, has long been victimised not only by the Swiss banking establishment, and Switzerland's courts (which as we've extensively documented, seem to have played fast and … [Read more...]

Will the OECD tax haven blacklist be another whitewash?

Finance Ministers from the G20 countries meet in China on July 23-24 - this weekend. Amid sessions that will focus heavily on Brexit-related issues, there will be an important tax component. At their previous meeting they mandated the OECD to "establish objective criteria . . . to identify … [Read more...]

Luxembourg backing down on supporting tax haven USA

A month ago we wrote an article entitled Now Luxembourg, Switzerland are working to bolster Tax Haven USA. This concerns a global scheme to share banking information, the OECD-led Common Reporting Standard, (CRS, which starts up next year and complements separate schemes and campaigns to see public … [Read more...]

New EU Directive on Money Laundering – a curate’s egg

The European Union, amid all the Brexit turmoil, has issued a proposal for a new Directive on money laundering and terrorist financing. Transparency, of course, is at the core of it. The Panama Papers scandal has given new urgency to the task of unmasking the corrupt, the crooks and other financial … [Read more...]

Now Luxembourg, Switzerland are working to bolster Tax Haven USA

Update: making clear that the Swiss text we cited is a provisional test. As we've often said before, it is counterproductive (and an analytical error) to see the fight against tax havens in purely geographical terms. When the U.S. Justice Department started taking action against Swiss bankers, … [Read more...]

Anti-corruption summit: UK climbdown, but momentum grows

The UK government has failed to deliver a decisive blow against financial secrecy at its Anti-Corruption Summit. David Cameron failed to convince or compel leaders of British overseas territories and crown dependencies to end their hidden ownership vehicles, despite having called for such a move … [Read more...]

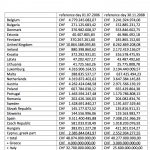

Trove of secret Swiss bank data released to European countries: now use it!

Back in 2014 Reuters reported, in a pre-echo of the Panama scandal: "Authorities in the German state of North Rhine-Westphalia [NRW] have bought a CD containing data about several thousand German clients of a Swiss bank, German newspaper Bild am Sonntag said on Sunday without citing its … [Read more...]

Area more than three times the size of Greater London owned in UK by secret companies in offshore tax havens

From Global Witness (no further comment from us is needed): Area more than three times the size of Greater London owned by secret companies in offshore tax havens An area of British land more than three times the size of Greater London is owned by secret companies in offshore jurisdictions like … [Read more...]

Mossack Fonseca: why so few American clients? (Hold the conspiracy theories)

There has been a lot of buzz about one aspect of the Panama Papers: why have so few U.S. citizens been exposed in these leaks? Panama was set up originally as a country - and as a tax haven -- with the help of U.S. financial interests, and it has been substantially within the U.S. orbit (mainly with … [Read more...]

As #PanamaPapers break, Europe plans to water down company ownership transparency

Press Release: As Panama Papers break, Europe plans to water down company ownership transparency Just as the Panama papers reveal the mayhem that can be caused by secret shell companies, the European Union is set to relax ownership transparency requirements for shell companies in its forthcoming … [Read more...]