Civil society and allies are pushing for real (and useful) transparency when it comes to disclosing the beneficial owners (BOs) of companies, meaning the individuals who ultimately own and control the companies that operate in our economies, and that could be involved in illegal activities (e.g. tax … [Read more...]

Secrecy

UK Parliament fails to tackle financial secrecy in its overseas territories

So near and yet so far… Hopes were riding high yesterday that UK parliamentarians might seize the opportunity to take historic action to end decades of financial secrecy in the UK’s Overseas Territories. We blogged about this yesterday highlighting the fact that a lot of ongoing Parliamentary … [Read more...]

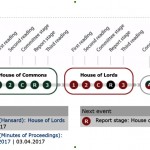

Two days left to end financial secrecy in the UK’s Overseas Territories?

UK parliamentarians have the opportunity to take historic action over the next two days, ending decades of financial secrecy in the UK's Overseas Territories. As Parliament closes down before the General Election which will take place on the 8th June, a lot of ongoing business is now at risk. A … [Read more...]

Beneficial Ownership: a Tax Justice Network checklist

We're pleased to say that the world is moving towards the registration of beneficial owners (BOs) who are the natural persons who ultimately own, control or benefit from legal persons (e.g. companies) and legal arrangements (e.g. trusts). If made public, these registries would increase financial … [Read more...]

Open Cayman: Reputation, rhetoric and reality

By Alex Cobham https://youtu.be/2An-A4U00DU?t=23m16s Last week I took up the kind invitation of the government of Cayman to speak at their conference on 'Tax Transparency in the Global Financial Services Ecosystem', and to meet with staff from the monetary authority, statistics office and … [Read more...]

Germany moves forward on corporate transparency

The Bundesrat has today voted to recommend implementing a public register of the beneficial ownership of companies and trusts. Great news from Germany, as the country takes an important step forward towards corporate transparency. … [Read more...]

Links Mar 17

The problems with measuring tax systems SPERI 'In debates about tax policy we need to de-emphasise the role of economics and measurement and rekindle the politics'. Blog by TJN's Nicholas Shaxson, author of Treasure Islands: Tax Havens and the Men Who Stole the World. Re-framing tax spillover … [Read more...]

#LuxLeaks appeal verdict: tax justice heroes convicted again

The #LuxLeaks whistleblowers appeal verdict is in and once again it demonstrates what an upside down world we're living in, when whistleblowers on the frontline of tax justice find themselves convicted for a second time for exposing information that was so clearly in the public interest. Disclosure … [Read more...]

Links Mar 13

Corporate taxation key to protecting human rights in the global economy CESR UN urges US to not exploit American Samoa The Guam Daily Post 'The United Nations has "strongly urged" the United States to refrain from using American Samoa as, among other things, a tax haven'. A significant shift? … [Read more...]

Links Mar 10

Public Beneficial Ownership Registries- A Shot In The Arm In The Fight Against Illicit Financial Flows Financial Transparency Coalition European Parliament takes on financial crime with tough proposals Sven Giegold More evidence in the case against Luxembourg FT Alphaville … [Read more...]

Links Mar 9

Taxes & Women's Rights? Global Alliance for Tax Justice See also: Happy International Women’s Day wrapup We managed tax transparency in Pakistan. Why not everywhere else?The Guardian By Umar Cheema. See Politicians and their tax returns: a new project from Finance Uncovered MEPs vote to … [Read more...]

Good news from Slovakia: light cast onto shell companies

Second time lucky? About a year ago in Slovakia some opposition politicians pushed hard for a promising law to shed light onto anonymous ownership through shell companies. The Tax Justice Network supported their efforts by writing a letter to the Prime Minster at the time. Despite widespread public … [Read more...]

Links Mar 3

Trusting the Process Kleptocracy Initiative KleptoCast interview with TJN's Andres Knobel about how trusts became the next frontier in dodging taxes and shielding assets Panama Papers: European Parliament tax avoidance fact-finding mission in Luxembourg Luxemburger Wort See also: MEPs’ mission to … [Read more...]

Links Mar 1

Book Review: Capital Without Borders: Wealth Managers and the One Percent by Brooke Harrington LSE Blogs "... an important work for our increasingly unequal world". - Listen to an interview with Brooke Harrington in our December 2015 podcast MP's from Africa and Asia pledge to collaborate in … [Read more...]

Links Feb 27

Trusts – the hole in the EU’s response to the Panama Papers? Global Witness See also, our report Trusts – Weapons of Mass Injustice HSBC discloses tax evasion probes in India other countries Economic Times Probes in U.S., France, Belgium, Argentina ... See also: HSBC Sets Aside $773 Million for … [Read more...]