Ten years ago the Tax Justice Network was told it’d never happen, but recently British Members of Parliament voted to stop secret ownership of companies in British Overseas Territories. Unfortunately the Crown Dependencies were not included in the measure because, as we understand it, politicians … [Read more...]

Secrecy

Will the EU really blacklist the United States?

In our latest Financial Secrecy Index assessment, the United States moved up to second place. With its now unparalleled commitment to secrecy at scale, and its influence on international reforms, it has become the leading driver of tax abuse and corruption risk around the world. Years ago we … [Read more...]

Why we can’t afford the rich: our May 2018 podcast

In this month's Taxcast: We discuss why we can’t afford the rich and challenge ideas about wealth, entrepreneurialism and investment. Also: ten years ago the Tax Justice Network was told it’d never happen, but this month British Members of Parliament voted to stop secret ownership of companies in … [Read more...]

Yes, Britain is closing its tax havens. But let’s not forget it created them in the first place

This post is jointly authored by Anthea Lawson and John Christensen Tax justice campaigners celebrated this week as a nifty cross-party move from British Members of Parliament Margaret Hodge and Andrew Mitchell forced the UK’s Overseas Territories – many of them in the Caribbean – to stop hiding … [Read more...]

Making history: an end to anonymous companies in the UK’s Overseas Territories

The UK Parliament today has taken a significant step toward global tax transparency - by imposing public registers of beneficial ownership of companies on the UK's Overseas Territories (OTs). The OTs are relatively small but highly secretive financial centres, responsible for just over 4% of the … [Read more...]

OECD rules vs CRS avoidance strategies: not bad, but short of teeth and too dependent on good faith

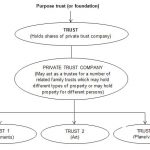

The OECD's Model Mandatory Disclosure rules for CRS avoidance strategies are not bad in our opinion, but short of teeth and far too dependent on good faith by rogue intermediaries and taxpayers... On March 9th, 2018 the OECD published the Model Mandatory Disclosure Rules for CRS Avoidance … [Read more...]

Regulation of Beneficial Ownership in Latin America and the Caribbean

My paper - Andres Knobel - on “Regulation of Beneficial Ownership in Latin America and the Caribbean” which I wrote for the Inter-American Development Bank is now available in Spanish and English here. The paper, published in November 2017, provides an explanation on the concept, obstacles and … [Read more...]

Questions raised over offshore dealings of Serbian PM’s former company.

The Croatian political magazine, Nacional, is running a story which implicates the International Finance Corporation in a deal involving offshore companies and more than a hint of a conflict of interest in Serbia. One of the main protagonists in the deal is the Serbian Prime Minister, Ana … [Read more...]

Now you see me, now you don’t: using citizenship and residency by investment to avoid automatic exchange of banking information

On February 19th, the OECD launched a consultation entitled “Preventing abuse of residence by investment schemes to circumvent the CRS”. It was about time. Since 2014, we have written several papers and blogs (here, here, here, here and here) explaining how residency and citizenship schemes offered … [Read more...]

Video: discussion on tax revenue losses, Apple’s tax avoidance and ‘state aid’

We're sharing here the opening panel discussion of the June 2017 European Financial Congress, Eastern Europe's largest finance congress in Gdansk, Poland. The theme of the panel was "Tax solidarity in the world and in the EU" and it features visiting Professor at Oxford University Philip Baker QC … [Read more...]

Trusts and the UK: half a step forward, three steps backwards

Remember our paper calling for the registration of trusts? Back then the British government opposed this. During discussions related to the EU 4th Anti-Money Laundering Directive, Treasury spokesperson Lord Newby even said: “We consider registration of trusts to be a disproportionate approach and, … [Read more...]

Enough evidence on trusts – where are the State’s actions?

Our two last papers on trusts (here and here) described trusts’ involvement in grand corruption and other cases that would anger any rational person. The Paradise Papers, and recent case law, shed outrageous new light on trusts’ role in worsening inequality, shielding assets from legitimate … [Read more...]

Our paper “Trusts: Weapons of Mass Injustice?” – now available in Spanish

Our paper "Trusts: Weapons of Mass Injustice?" which we released and blogged about earlier this year is now available in Spanish. The English version of the paper is available here. The paper provoked critical attention from practitioners and from tax havens. Our response to their critiques is here … [Read more...]

The great escape: how tax havens continue to undermine new transparency measures: guest post

We're pleased to share this blog from Senior Policy Advisor at Oxfam Novib, Francis Weyzig, originally published here on how tax havens continue to undermine the OECD’s Common Reporting Standard, an information standard for the automatic exchange of tax and financial information on a global level. … [Read more...]

“Trusts: Weapons of Mass Injustice?” A response to the critics

On February 13th, 2017 TJN published a paper titled "Trusts: Weapons of Mass Injustice?", which has attracted critical attention from practitioners and tax havens. This is our response. Our paper, “Trusts: Weapons of Mass Injustice?”[1] asks some deep and searching questions about the role trusts … [Read more...]