Are the rich and famous at risk of blackmail, extortion or kidnapping if their names are disclosed in public beneficial ownership registries, as they like to argue in tax havens like Jersey? This was a question put to me last week at a conference tackling tax injustice in Nairobi, Kenya, organised … [Read more...]

Secrecy

When will the British government impose public registries on its tax havens?

UPDATED Not so long ago Lee Sheppard, one of the US's top experts in international tax, gave a pithy and accurate explanation of why powerful countries don't just close down the tax havens that are undermining their tax and criminal justice and regulatory systems. We don't shut [these financial … [Read more...]

Hey EU Council! think again on whistleblower protection

The Tax Justice Network is a signatory to the following letter, sent this morning to the EU Council. We argue that the proposed EU Directive on the protection of whistleblowers does not adequately protect public interest, and will inhibit whistleblowers from revealing information about employers … [Read more...]

How to assess the effectiveness of automatic exchange of banking information?

In December 2018 the OECD’s Global Forum published the new terms of reference to assess compliance with the OECD’s Common Reporting Standard (CRS) for automatic exchange of information. Two weeks later, the EU Commission published a report about automatic exchange of information within the EU. Both … [Read more...]

Research fellow in financial secrecy, for new research grant

We're delighted to announce the start of a 'Does Transparency bring Cleanliness? Offshore Financial Secrecy Reform and Corruption Controlnew', a Global Integrity-DFID Anti-Corruption Evidence (GI-DFID-ACE) research project with Dr Daniel Haberly of the University of Sussex. And that means we're … [Read more...]

Whistleblower Rudolf Elmer’s court victory: the long arm of Swiss secrecy law gets shorter

We've written many times about Swiss whistleblower Rudolf Elmer's (pictured above) long legal battles against Swiss banking secrecy here, here, here and here. He's endured 48 prosecutorial interrogations, 6 months in solitary confinement and 70 court rulings. Of one thing you can be sure - if the … [Read more...]

The European Union, tax evasion and closing loopholes: new report

Today, a new report commissioned by the Greens/EFA group in the European Parliament and written by the Tax Justice Network's Andres Knobel demonstrates that despite progress in recent years on closing down opportunities for tax evasion, there are still significant loopholes for citizens and … [Read more...]

Moneyland: plutocracy, contagion and crisis in the Tax Justice Network’s September 2018 podcast

In the September 2018 Tax Justice Network monthly podcast/radio show, the Taxcast: we talk to journalist Oliver Bullough about his new book, just out 'Moneyland: why thieves and crooks now rule the world, and how to take it back' We discuss the transnational elite that have broken free of … [Read more...]

Extreme inequality levels in Bermuda despite its offshore services centre, in the Tax Justice Network’s August 2018 podcast

In the August 2018 Tax Justice Network monthly podcast/radio show, the Taxcast: Why are so many Bermudians leaving their beautiful island? And why have inequality levels become so extreme despite it's huge offshore services centre? We speak to Bermudian economist Robert Stubbs and hear from … [Read more...]

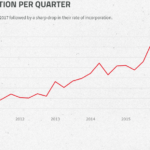

The abuse of Limited Partnerships in the UK: predicting the future with the Financial Secrecy Index

The Tax Justice Network’s Financial Secrecy Index assesses jurisdictions on their transparency levels in their legal framework by looking into 20 different indicators including banking secrecy, beneficial ownership registration, anti-money laundering, etc. One of the key principles of the index … [Read more...]

Blacklist, whitewashed: How the OECD bent its rules to help tax haven USA

We’ve criticised for years the farcical nature of ‘tax haven’ blacklists, whether EU or OECD ones. They all turn out to be politicised, misleading and ineffective. If you want an objectively verifiable ranking you need look no further than the Tax Justice Network’s Financial Secrecy Index. But … [Read more...]

UK to introduce 5th Anti-Money Laundering Directive: eyes turn to Crown Dependencies and Overseas Territories

The UK government has confirmed to campaigning MP Margaret Hodge that, Brexit notwithstanding, the UK will introduce the major tax transparency measures in the European Union's 5th anti money laundering directive. As the Guardian highlights, these include the following crucial measures: Public … [Read more...]

Country by country reports: why “automatic” is no replacement for “public”

A critical battle is currently being waged in the international tax policy arena over the implementation of country by country reporting, a reporting process that deters and detects tax avoidance by multinational companies, among other things, by requiring companies to provide a global picture of … [Read more...]

It’s time for countries to start publishing the data they’re collecting under OECD’s Common Reporting Standard

Some financial centres already publish detailed data on cross-border bank account holdings. The OECD’s Common Reporting Standard is now underway, generating lots of this data: it’s time to publish it all. This would cost nothing, breach no confidentiality, and deliver large benefits. Another 50 … [Read more...]

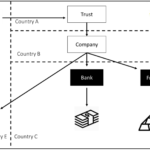

Ending secret ownership: we assess the progress and challenges

The richness of the Tax Justice Network’s Financial Secrecy Index is such, (conveying so much more information than just a ranking of the largest contributors to global financial secrecy), we’re now publishing a visual report describing the current state of play with legal and beneficial ownership … [Read more...]