The United Kingdom is, in many respects, the most important single player in the world of offshore tax havens (or secrecy jurisdictions.) It has many offshore characteristics itself, and it runs a network of partly-British havens, whose laws it can strike down when it really wants to. So it is … [Read more...]

Secrecy

Links May 13

European Parliament's special tax committee running out of time The Parliament LuxLeaks special committee’s first country visit: Belgium is breaching EU tax law Sven Giegold Charged LuxLeaks journalist calls for more whistleblower protection Europe Online Magazine See also: Members of … [Read more...]

Links May 11

Upcoming EU presidency faces whistleblows and calls for transparency Eurodad See also: Letter to Ambassador of Luxembourg in Denmark, on tax avoidance and whistleblowers Exposing South Africa's "Lettergate" Scandal World Policy Blog See also: recent TJN blog South Africa’s diamond companies: … [Read more...]

Links May 8

Turkish finance minister Mehmet ?imsek: World should fight against tax evasion like it fights against terror Daily Sabah Estimating illicit funds in global tax havens moneylife Taking on the banks: a conversation with Anat Admati The New Yorker Lawmakers Embrace Patent Tax Breaks The Wall … [Read more...]

Links May 7

Optimistic about the state: Martin Wolf’s searing attack on the Competitiveness Agenda Fools' Gold - rethinking competitiveness Tax probes frustrate EU competition chief EU Observer Unitary Taxation: Tax Base and the Role of Accounting International Centre for Tax and Development Former JP … [Read more...]

The Tax Justice Research Bulletin 1(4)

Corrected: the earlier version referring to a Banque de France Report said "$8bn revenue loss" when it should have referred to an $8bn loss in tax base. The Tax Justice Research Bulletin By Alex Cobham. TJN (April 2015) - The Tax Justice Research Bulletin is a monthly series dedicated to … [Read more...]

Jersey’s foundations law is fit for money launderers: scrap it

Foundations, like trusts and anonymous shell companies, are often used as secrecy vehicles for the purposes of money laundering, tax cheating, and much more. A while ago we pointed to an offshore promoter who had this to say about foundations: "Trusts are . . . tools of the rich used to stay rich … [Read more...]

Avaaz in legal challenge to UK over Liechtenstein amnesty and HSBC scandal

From the Financial Times: "The UK tax authority faces a potential judicial review over its handling of the evasion scandal involving HSBC’s Swiss subsidiary, it emerged on Thursday. Lawyers acting for the international campaign group Avaaz have sent HM Revenue & Customs a letter asking for … [Read more...]

The Offshore Wrapper: a week in tax justice #59

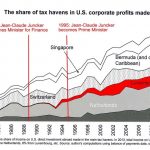

Our quirky weekly news round-up from the topsy-turvy world of tax havens. The piratical Duchy of Luxembourg charges journalist over LuxLeaks What does Jean-Claude Juncker think of this? Luxembourg, the country he led for 18 years and steered in the direction of becoming one of Europe's biggest … [Read more...]

Links Apr 24

Shock at Luxembourg’s decision to charge LuxLeaks reporter Reporters Without Borders Responsible Tax Practice by Companies: A Mapping and Review of Current Proposals ActionAid Towards a Common African Position on Financing for Development: Governments and Civil Society Debate in Addis Ababa … [Read more...]

Links Apr 23

Luxembourg court charges French journalist over LuxLeaks role Reuters See also: Charges against #LuxLeaks reporter by Luxembourg authorities threaten press freedom ICIJ, Luxembourg court charges LuxLeaks journalist EU Business, and recent ICIJ article by Edouard Perrin ‘This story is global, it … [Read more...]

The deep joy of trusts and foundations

We aren't sure whether to be horrified, flattered or entertained. Take a look at this peculiar video from a rather iffy-looking offshore promoter, complete with '80s soundtrack and faux newsroom. If you go to the original source of this video, it turns out that they are explicitly using TJN … [Read more...]

Links Apr 20

Combatting Tax Havens: What has been done, and what should be done Eva Joly and Alternatives Economiques (In French, with English version available soon) EU must pull its weight to help create a better global financial system The Guardian Indian Finance Minister Arun Jaitley: Automatic info … [Read more...]

Links Apr 17

Joint May Day statement: Working people pay taxes – corporations must pay their share! Global Alliance for Tax Justice Angola’s sovereign fund pays $100 million to a shell company index Commodity giants' Singapore trading hubs under fire in tax probes Reuters Christine Lagarde, scourge of … [Read more...]

Links Apr 16

"Developing countries" Is it or isn’t it a spillover? Martin Hearson Too much focus on ‘spillover effects’ of tax policies might lead to an too-narrow analysis of the impacts of a jurisdiction’s tax policies on developing countries. America’s Most-Wanted Swiss Bankers Aren’t Hard to Find … [Read more...]