There’s A Huge New Corporate Corruption Scandal. Here’s Why Everyone Should Care HuffPost See also: The Bribe Factory The Age / HuffPost - "An extraordinary case of bribery and corruption in the oil industry, centred on Monaco-based company Unaoil". Canada Joins 21st Century Fight against Tax … [Read more...]

Secrecy

Links Mar 29

The gnomes of Zurich are silent no longer Financial Times "Past actions are catching up with some Swiss banking clients". On links between Brazil's Petrobras, Malaysia's 1MDB, Fifa, and Spanish political slush fund scandals... Swiss banks to cooperate in probe of Venezuela’s state oil and gas … [Read more...]

Links Mar 24

Financial Transparency Coalition Newsletter January - March 2016 Credit Suisse, the Jailed Banker and an Oligarch's Millions Bloomberg Swiss Banks Land in Middle of Money-Laundering Probe -- Again Bloomberg "U.S. said to seek banking records in widening Venezuela probe" OECD warns that … [Read more...]

Links Mar 23

How Much International Tax Evasion is There? naked capitalism $181 billion Indian black money in tax havens? The Times of India Head of joint OECD/UNDP Tax Inspectors Without Borders initiative appointed – James Karanja, of the Kenya Revenue Authority OECD For background, read our August … [Read more...]

Links Mar 21

HSBC’s Money Laundering Nightmare (2): Mossack Fonseca, a Year in Words and Pictures, March 2015-March 2016 naked capitalism Story involves Panama, Brazil, Moldova, Malta, New Zealand, Azerbaijan, Germany, Luxembourg, USA, Hong Kong ... Global tax enforcement puts Cayman in the crosshairs The … [Read more...]

Scottish Government announces historic law to end secrecy of land ownership

This topic has been building slowly in some countries, whose economies are blighted by the fact that large tracts of real estate are owned by anonymous entities and arrangements, typically linked to tax havens. We'd highlight Private Eye's searchable database of offshore-owned properties in the … [Read more...]

Indonesia’s corrupt tax amnesty – how many will follow?

From Reuters: "Business may be about to look up for the [wealth management] industry helped by President Joko Widodo's tax amnesty plan that could encourage rich Indonesians to declare assets previously concealed from the authorities, either at home or abroad." So Indonesia is contemplating a tax … [Read more...]

Switzerland rejects request from Argentina on leaked HSBC accounts

From Argentina's La Nacion newspaper: "Switzerland has denied the Argentine judicial authorities information about 4,000 or so Argentine-owned bank accounts in Switzerland, saying that Argentina's request had no solid foundation." This concerns data revealed by an HSBC whistleblower, Hervé … [Read more...]

Oxfam report: Ending the Era of Tax Havens

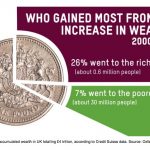

Back in June 2000, three years before TJN's birth and at a time when nobody was talking about the issues, the charity Oxfam published a seminal document entitled Tax Havens: Releasing the hidden billions for poverty eradication. It was an important part of global tax justice history. We're … [Read more...]

“Squeaky clean” Cayman caught in the act – again

From the U.S. Department of Justice: "Cayman National Securities Ltd. (CNS) and Cayman National Trust Co. Ltd. (CNT), two Cayman Island affiliates of Cayman National Corporation . . . pleaded guilty to a criminal Information charging them with conspiring with many of their U.S. taxpayer-clients to … [Read more...]

Links Mar 9

You're A Rich Tax Dodger? No Problem, Says Canada Revenue Authority Canadians for Tax Fairness See also: Critics want public hearings into Canada Revenue amnesty for KPMG offshore tax dodgers CBC US and EU clash over tax practice clampdown The Irish Times "Washington urges Brussels to … [Read more...]

Links Mar 8

Time To Kill Corporate Tax? Tax-News See also our report Ten Reasons to Defend the Corporate Income Tax ECOFIN agreement a missed chance, campaigners say Financial Transparency Coalition E.U. Ministers Agree to Share Tax Details on Multinationals The New York Times See also: European … [Read more...]

Links Mar 7

The Billionaires’ Loophole The New Yorker EU competition chief warns Apple tax challenge will take a while BDlive Facebook looks set to pay more UK tax but it might not be as much as you think The Conversation By TJN senior adviser Prem Sikka. See also Facebook to award staff £280m in … [Read more...]

Links Mar 4

AEoI as the new global standard: OECD Standard and EU Tax Cooperation, Keynote presentation at 2nd Turkish-German Biennial on International Tax Law, by TJN's Markus Meinzer, Istanbul Switzerland's Financial Secrecy Brought Under Human Rights Spotlight Center for Economic and Social … [Read more...]

Will the US Implement Country by Country Reporting?

The BEPS Monitoring Group, an expert body (backed by TJN and others) that works on international corporate tax issues, has published its comments on draft US Treasury Regulations on Country by Country Reporting (CbCR, for an explanation for newcomers, see here). Given the large number of … [Read more...]