From the BEPS Monitoring Group, a TJN-backed civil society organisation tasked with monitoring the OECD's so-called "Base Erosion and Profit Shifting" (BEPS) proposals to crack down on international corporate tax avoidance. The (wonkish but important) submission here concerns so-called "non-CIV" … [Read more...]

Information Exchange

If a person or entity resident in one jurisdiction owns income-generating assets in another jurisdiction, the resident’s tax authorities generally need to know about that asset or income, to assess their tax liabities. So jurisdictions exchange information with each other for tax (and other) purposes under a range of international schemes, agreements and protocols. Many, of course, don’t exchange or even collect that information locally – or they put up obstacles in the way of information exchange.

If a person or entity resident in one jurisdiction owns income-generating assets in another jurisdiction, the resident’s tax authorities generally need to know about that asset or income, to assess their tax liabities. So jurisdictions exchange information with each other for tax (and other) purposes under a range of international schemes, agreements and protocols. Many, of course, don’t exchange or even collect that information locally – or they put up obstacles in the way of information exchange.

Historically, the OECD, a club of rich countries that has been mandated by G20 leaders to promote the agenda, has claimed that its very weak “on request” standards for information exchange constitute the “internationally agreed standard” for information exchange. “On request” means that information is only passed over after a clear request is made, specifying the taxpayer concerned and various other bits of information about him or her. In essence, you have to already know what you are looking for before you ask for it.

However, from around 2012 a new consensus started to emerge, strongly supported by the Tax Justice Network and its allies, that the world needs far stronger standards, notably “automatic” information exchange between jurisdiction, on a multilateral basis. Various working examples of automatic information exchange are already up and running: perhaps most notably the EU’s Savings Tax Directive and the U.S. Foreign Account Tax Compliance Act (FATCA.)

This page provides links and news about information exchange. See also our information exchange archive for older stories.

Image credit: Christian Aid, with thanks.

How the OECD had a ‘bad Panama Papers’ – and why it matters

This is a long read, with three main components. First, we examine the OECD's position as an international tax organisation - and the gradual weakening of its preeminence. Second, we consider two specific aspects of the OECD's work as a watchdog for noncooperative jurisdictions, as they have played … [Read more...]

Finance ministers: “hammer blow against tax evasion” – or a feather-swipe?

. . . with new updates, April 18th The Finance Ministers of Germany, France, Britain, Italy and Spain have announced a new plan to share information about the beneficial ownership of companies, trusts, foundations and other structures, complementing existing efforts by the OECD (the Common … [Read more...]

Trove of secret Swiss bank data released to European countries: now use it!

Back in 2014 Reuters reported, in a pre-echo of the Panama scandal: "Authorities in the German state of North Rhine-Westphalia [NRW] have bought a CD containing data about several thousand German clients of a Swiss bank, German newspaper Bild am Sonntag said on Sunday without citing its … [Read more...]

Area more than three times the size of Greater London owned in UK by secret companies in offshore tax havens

From Global Witness (no further comment from us is needed): Area more than three times the size of Greater London owned by secret companies in offshore tax havens An area of British land more than three times the size of Greater London is owned by secret companies in offshore jurisdictions like … [Read more...]

Mossack Fonseca: why so few American clients? (Hold the conspiracy theories)

There has been a lot of buzz about one aspect of the Panama Papers: why have so few U.S. citizens been exposed in these leaks? Panama was set up originally as a country - and as a tax haven -- with the help of U.S. financial interests, and it has been substantially within the U.S. orbit (mainly with … [Read more...]

Panama papers help the world wake up to Tax Haven USA

We're heartened to see that the Tax Haven USA story -- one that we seem to have helped breathe new life into with this blog in January last year, and our subsequent USA report, coming into the mainstream, helped by the Panama Papers. There are many, many stories out there now, including a comment … [Read more...]

Tax haven USA, after #PanamaPapers

"Unless the United States, and other countries, lead by example in closing some of these loopholes and provisions, then in many cases you can trace what's taking place but you can't stop it... There's always going to be illicit movement of funds around the world, but we shouldn't make it easy." So … [Read more...]

Scottish Government announces historic law to end secrecy of land ownership

This topic has been building slowly in some countries, whose economies are blighted by the fact that large tracts of real estate are owned by anonymous entities and arrangements, typically linked to tax havens. We'd highlight Private Eye's searchable database of offshore-owned properties in the … [Read more...]

Indonesia’s corrupt tax amnesty – how many will follow?

From Reuters: "Business may be about to look up for the [wealth management] industry helped by President Joko Widodo's tax amnesty plan that could encourage rich Indonesians to declare assets previously concealed from the authorities, either at home or abroad." So Indonesia is contemplating a tax … [Read more...]

Switzerland rejects request from Argentina on leaked HSBC accounts

From Argentina's La Nacion newspaper: "Switzerland has denied the Argentine judicial authorities information about 4,000 or so Argentine-owned bank accounts in Switzerland, saying that Argentina's request had no solid foundation." This concerns data revealed by an HSBC whistleblower, Hervé … [Read more...]

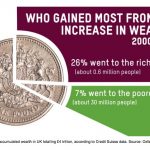

Oxfam report: Ending the Era of Tax Havens

Back in June 2000, three years before TJN's birth and at a time when nobody was talking about the issues, the charity Oxfam published a seminal document entitled Tax Havens: Releasing the hidden billions for poverty eradication. It was an important part of global tax justice history. We're … [Read more...]

“Squeaky clean” Cayman caught in the act – again

From the U.S. Department of Justice: "Cayman National Securities Ltd. (CNS) and Cayman National Trust Co. Ltd. (CNT), two Cayman Island affiliates of Cayman National Corporation . . . pleaded guilty to a criminal Information charging them with conspiring with many of their U.S. taxpayer-clients to … [Read more...]

Will the US Implement Country by Country Reporting?

The BEPS Monitoring Group, an expert body (backed by TJN and others) that works on international corporate tax issues, has published its comments on draft US Treasury Regulations on Country by Country Reporting (CbCR, for an explanation for newcomers, see here). Given the large number of … [Read more...]

Australia passes new information sharing provision

The Australian Senate has just passed the Bill that will tie Australia into the new global system of tax authorities sharing information with each other automatically. Unfortunately, this system, set up through the OECD, currently had not allowed full participation by developing countries. With … [Read more...]