A question for our European readers. How many of you have ever spent or even seen a 500 Euro note? No, neither have we. Which is may seem odd, given that there are some 300 billion Euros' worth of these things out there, in circulation. Which raises the question: where are they all? … [Read more...]

Reports

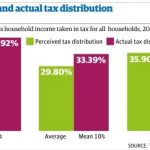

Unequal Britain: tax system is much less progressive than people believe

More evidence, if this was needed, that people can be fooled most of the time by the repetitive drip, drip feed of tax nonsense coming from much of the media, some parts of academia and think-tanks, and from far too many politicians. … [Read more...]

Civil society letter to OECD on its corporate tax project

The OECD's so-called Base Erosion and Profit Shifting (BEPS) project which aims to reform the hopelessly outdated international tax system, has been progressing, and TJN and others have been monitoring it. Civil society organisations, including those coordinated through the Global Alliance for … [Read more...]

The Offshore Wrapper: a week in tax justice

The Offshore Wrapper is written by George Turner The Togo triangle: where stolen Nigerian oil disappears Nigeria: the land of lost opportunity. Billions of dollars from oil revenue has literally been siphoned out of the country. The story – and corruption - has run for decades. … [Read more...]

Tax Justice Focus – the Human Rights edition

The latest edition of our newsletter Tax Justice Focus focuses on the theme of tax justice and human rights, perhaps the fastest-growing area of interest in the rapidly expanding global tax justice community. Click here for the full edition of Tax Justice Focus, the Human Rights edition. You … [Read more...]

The Price of Offshore Revisited – new material

We published a long rebuttal yesterday to an attack on TJN by two U.S. academics, supported by the lobbying arm of the British tax haven of Jersey, which has publicised it at a conference in London today. The attack focused quite heavily on our 2012 report The Price of Offshore Revisited, which … [Read more...]

Tax haven of Jersey to attack TJN with funded study. We respond.

June 6: updated with details of book project. Jersey Finance, the lobbying arm of the finance industry in the offshore tax haven of Jersey, tomorrow will host a media event in London attacking TJN and our estimates for the size of the offshore industry, and publicising a supposedly independent … [Read more...]

The UK’s shadow economy: £40 billion lost to treasury

The Financial Times reports this morning: The Treasury is losing more than £40bn of tax a year because of evasion and the hidden economy, nearly four times official estimates, according to a tax campaigner. Richard Murphy of Tax Research UK, a research group, called for tougher checks on hundreds … [Read more...]

Report: $300 billion in Argentina’s offshore assets

From the Buenos Aires Herald: The total value of Argentines’ offshore assets as a result of capital flight reached US$298.891 billion in 2012, rising more than 250 percent from 1991, the latest report by the Economics and Finance Centre for Argentine Development (CEFID-AR) revealed. … [Read more...]

Submission to OECD on transfer pricing and developing countries

The BEPS Monitoring Group, which TJN took the lead in establishing last year in the wake of the OECD's ground-breaking initiative, has just published this report: BMG Submission to OECD on Transfer Pricing Comparability Data and Developing Countries. This report responds to the OECD Report on … [Read more...]

New book: The Political Economy of Offshore Jurisdictions

This new book adds further insights into the political economy of offshore, raising questions about why offshore has been off-limits for serious political discussion for so many decades and opening up discussion around offshore secrecy. A welcome addition to the emerging debate. … [Read more...]

TJN response: the UK Law Commission and investment intermediaries

PRESS RELEASE The UK Law Commission consultation on the fiduciary duties of investment intermediaries: Response from the Tax Justice Network … [Read more...]

New report: OECD’s new info exchange standard a watershed moment?

A month ago we published a short, quick reaction to a new report by the OECD, outlining the nuts and bolts of a major new international system for information exchange. We have now spent quite some time exploring the OECD's report, and have written a much more detailed response. Our new report … [Read more...]

Links Mar 7

Swiss parliament relaxes terms for tax data exchange swissinfo "Parliament has approved a legal amendment that tax evaders will not always have to be told if Switzerland sends information about them to other countries." But to what extent is this just lip-service? How do trusts, foundations and … [Read more...]

Links Mar 4

Black money: Switzerland refuses to share information on bank account holders, Delhi mulls strong response The Economic Times India, US to intensify cooperation in tax evasion cases The Economic Times … [Read more...]