We are delighted to announce the latest edition of our quarterly newsletter,Tax Justice Focus. This is The Gender Edition, and it is guest edited by Liz Nelson of TJN. It complements a new "Gender" page we've just opened up, where these materials will be permanently stored. … [Read more...]

Reports

The Tax Justice Research Bulletin 1(4)

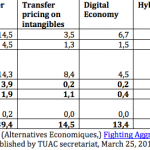

Corrected: the earlier version referring to a Banque de France Report said "$8bn revenue loss" when it should have referred to an $8bn loss in tax base. The Tax Justice Research Bulletin By Alex Cobham. TJN (April 2015) - The Tax Justice Research Bulletin is a monthly series dedicated to … [Read more...]

Two new reports challenge the OECD’s work on corporate tax cheating

The OECD, the club of rich countries that dominates international tax, is running a project known as Base Erosion and Profit Shifting (BEPS) which is supposed to fix some of the gaping holes in the international tax system. As we all know, transnational corporations (TNCs) are running rings around … [Read more...]

Report: parties rely on unsafe top tax estimates in UK election

Tax is one of the key battlegrounds in the UK’s general election due on May 7. No tax is more important than the income tax, and debates about the wisdom of cutting or hiking the top rate of income tax seem likely to heat up as polling nears. Some political parties advocate raising the top tax … [Read more...]

The Offshore Game – new TJN report on offshore finance in football

From The Guardian, a major new story whose introduction runs as follows: "Research by the Guardian and the Tax Justice Network reveals 28 English clubs with substantial shareholdings overseas, opening up the football leagues to criticism for allowing ownership structures that could be used for … [Read more...]

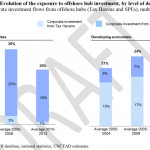

UNCTAD: multinational tax avoidance costs developing countries $100 billion+

The UN Conference on Trade and Development (UNCTAD) has just published a major new study on corporate tax in developing countries, which contains a wealth of new information analysis as well as some important headline numbers: notably that developing countries lost around $100 billion per year in … [Read more...]

BEPS Through the Looking Glass: Where Do We Stand?

Guest blog from TJN Senior Adviser Professor Sol Picciotto, Chair of the civil society BEPS Monitoring Group. … [Read more...]

Mbeki Report On Financial Crime Will Shift Global Tax Debate, Says Christian Aid

UPDATE: The report of the High Level Panel on Illicit Financil Flows chaired by President Mbeki was adopted by the African Union Summit meeting on 31st January 2015. This represents a major milestone for the global tax justice movement. Campaigners throughout Africa can now push their … [Read more...]

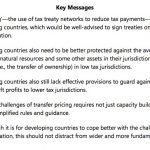

Developing countries and corporate tax – ten ways forward

Our last main blog before Christmas concerns developing countries. We are proud to publish an article by Krishen Mehta, one of our Senior Advisers, entitled The OECD's BEPS Process and Developing Countries - a way forward. This blog summarises the article, which is about how developing countries … [Read more...]

Update: report on the OECD’s information exchange standard

A month ago we published a preliminary report entitled ‘The end of bank secrecy?’Bridging the gap to effective automatic information exchange, looking at the OECD's new system of automatic information exchange. We have now completed our final technical analysis of the report. It is not very … [Read more...]

Report: a third of French banks’ foreign subsidiaries are in tax havens

From the French platform on tax havens Plateforme Paradis Fiscaux et Judiciaires, coordinated by CCFD-Terre Solidaire and Secours Catholique Caritas France, a new report looking at the first figures published by French banks this year, under requirements for country by country reporting. … [Read more...]

Hidden Profits: The EU’s role in supporting an unjust global tax system 2014

From Eurodad, an important new report, whose press release goes: Hidden Profits: The EU's role in supporting an unjust global tax system 2014 This report – the second in a series of three annual reports – brings together civil society organisations (CSOs) in 15 countries across the EU. Experts in … [Read more...]

IMF: tax havens cause poverty, particularly in developing countries

The IMF has a major new Policy Paper out entitled Spillovers in International Taxation, looking at the effects that one country’s tax rules and practices can have on others. Of course this is a Staff Report and the IMF would never be so rude to some of its most powerful member states as to … [Read more...]

The Impacts of Illicit Financial Flows on Peace and Security in Africa

From Alex Cobham of the Center for Global Development, a paper for the Tana High-Level Forum on Security in Africa 2014. It's called, as our title suggests, The Impacts of Illicit Financial Flows on Peace and Security in Africa. Published in April, it's an important contribution to the … [Read more...]

New report: developing countries want automatic information exchange

From the International Tax Review: "The Tax Justice Network (TJN) has accused the OECD of not consulting developing countries about the design of the framework for Automatic Information Exchange (AIE), which the G20 has endorsed as the global model for information exchange." Our new report was … [Read more...]