How much tax do multinational companies pay in your country? Leading tax justice campaigners (including the Tax Justice Network) and open data specialists are working on helping you find out with their open data for tax justice project. Today they're publishing a white paper entitled What Do They … [Read more...]

Reports

Trusts – Weapons of Mass Injustice: new Tax Justice Network report

It is a fact that the trust laws of some tax havens openly promote illegality. The reality that some tax havens will not enforce foreign laws (e.g. ensuring non-recognition of foreign laws and judgements that favoured legitimate heirs and former spouses) is even publicly advertised by some offshore … [Read more...]

For rich countries only: A global map of multinationals’ tax avoidance

The introduction of a key policy tool against multinational companies’ tax avoidance has been handled so badly that developing countries are now exposed to worse inequalities. In a new report published today, we call for immediate changes to limit the damage done. … [Read more...]

New Report: HMRC’s “Building our Future” programme

Yesterday the Tax Justice Network was in the UK Parliament to launch a report it co-produced with the Public and Commercial Services Union. The report, entitled "HMRC, Building an Uncertain Future" is a study of HMRC's (the UK tax authority) reform plans which it is calling "Building our … [Read more...]

Global tax reform: update on progress and next steps

The Methodist Tax Justice Network, the Global Alliance for Tax Justice and one of our senior advisors Professor Sol Picciotto have just published a very useful up-to-date account of where the OECD and G20 have got to on tax reform, along with a useful explanation of the Unitary Taxation … [Read more...]

Report: why we need to tax corporations now, more than ever

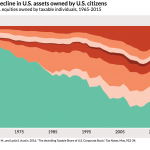

Update: now on Naked Capitalism, where it's attracted a lot of interesting commentary Last year we published a document entitled Ten Reasons to Defend the Corporate Income Tax, outlining how the tax is under constant attack, in country after country, and explaining why it is one of the most … [Read more...]

Should Europe trust trusts?

Embargoed until 6pm CET 28 June 2016 Should Europe trust trusts? Press Release: New report exposes holes in global and EU anti-money laundering rules on trusts, and explains how they can be fixed. Trusts, in the popular imagination, are mostly for family matters, such as a rich father deciding … [Read more...]

New report exposes flaws in global and EU anti-money laundering rules and explains how they can be fixed

Update: Part 2 is here. As the political dust settles on the Panama papers and the anti-corruption summit, the focus is now moving to concrete solutions. In June 2016 the European Union is expected to review its anti-money laundering directive, including controversial rules on the beneficial … [Read more...]

Automatic Information Exchange: a trove of useful new data. Here’s a template for using it

Automatic Exchange of Information (AEOI) at a global level is supposed to become effective in 2017, when many jurisdictions[1] start to exchange financial account information (e.g. bank account information) with each other, under the OECD’s Common Reporting Standard (CRS). The idea is to crack down … [Read more...]

New study: corporate tax cuts may have been ‘the greatest blunder’

The Canadian Center for Policy Alternatives has just published a new study entitled Do Corporate Income Tax Rate Reductions Accelerate Growth? It summarises: "This study examines the relationship between the Canadian corporate income tax (CIT) regime and various dimensions of economic growth. The … [Read more...]

Still Broken: major new report on global corporate tax cheating

Update, Dec 7, 2015: a new paper in the Journal of World Business, which contains this: "Home country statutory corporate tax rates have a small impact on tax haven use. In general, corporate tax rates are an important factor in driving MNEs to set up tax haven subsidiaries. However, … [Read more...]

Fifty Shades of Tax Dodging: how EU helps support unjust global tax systems

A major new report written by civil society organisations in 14 countries across the EU, co-ordinated by Eurodad. Fifty Shades of Tax Dodging: the EU's role in supporting an unjust global tax system … [Read more...]

Holes in new OECD handbook for global financial transparency

The OECD, a club of rich countries that dominates rule-setting for global financial transparency standards, recently published a Handbook for implementing its new global tool for countries to co-operate in fighting tax evasion, known as the Common Reporting Standard (CRS). The new handbook is part … [Read more...]

The Tax Justice Network podcast, August 2015

In the August 2015 Tax Justice Network Podcast: Sun, sea and tax: the Taxcast goes to Mexico and looks at how multinational tourism operates there. Plus: we ask why Luxembourg is printing euros like there's no tomorrow; whether Brazil’s offer of a tax amnesty to its tax dodgers will work; and how … [Read more...]

10 Reasons Why an Intergovernmental UN Tax Body Will Benefit Everyone

We have written for years about how the OECD, a club of rich countries has dominated the international tax system and that this inevitably skews the system in the favour of, well, rich countries. A potentially far more representative body exists -- the UN Tax Committee -- but the OECD and its member … [Read more...]