This new paper describes why beneficial ownership regulations shouldn’t exempt companies listed on a stock exchange. In essence, securities’ disclosure regulations aren’t enough to identify beneficial owners. In addition, definitions are subject to loopholes that affect identifying all relevant … [Read more...]

Reports

Exploring UK companies’ legal ownership chains to detect red flags and verify beneficial ownership information: Part 1

By Andres Knobel and Oliver Seabarron The Tax Justice Network in cooperation with the CORPNET group at the University of Amsterdam (@UvACORPNET) and the Data Analytics and Society Centre for Doctoral Training at the University of Sheffield (@DataCDT) has mined and applied advanced analytics to … [Read more...]

Addressing the tax challenges of the digitalisation of the economy: our submission to OECD consultation

Joy Ndubai, Global Tax Advisor at ActionAid Denmark today presented at the OECD in Paris on behalf of Tax Justice Network (among others) - you can watch her contribution (starting from 32:22 to 38:02) and the full discussion here or we have a clip of her speaking just below. Her full slides are … [Read more...]

The European Union, tax evasion and closing loopholes: new report

Today, a new report commissioned by the Greens/EFA group in the European Parliament and written by the Tax Justice Network's Andres Knobel demonstrates that despite progress in recent years on closing down opportunities for tax evasion, there are still significant loopholes for citizens and … [Read more...]

Ending secret ownership: we assess the progress and challenges

The richness of the Tax Justice Network’s Financial Secrecy Index is such, (conveying so much more information than just a ranking of the largest contributors to global financial secrecy), we’re now publishing a visual report describing the current state of play with legal and beneficial ownership … [Read more...]

Regulation of Beneficial Ownership in Latin America and the Caribbean

My paper - Andres Knobel - on “Regulation of Beneficial Ownership in Latin America and the Caribbean” which I wrote for the Inter-American Development Bank is now available in Spanish and English here. The paper, published in November 2017, provides an explanation on the concept, obstacles and … [Read more...]

Now you see me, now you don’t: using citizenship and residency by investment to avoid automatic exchange of banking information

On February 19th, the OECD launched a consultation entitled “Preventing abuse of residence by investment schemes to circumvent the CRS”. It was about time. Since 2014, we have written several papers and blogs (here, here, here, here and here) explaining how residency and citizenship schemes offered … [Read more...]

New report: ‘Hybrid Mismatches in Israel’

Tax Justice Network Israel (TJN IL), in cooperation with Friedrich Ebert Stiftung, has published a new report on ‘Hybrid Mismatches in Israel’. The term "hybrid mismatches" refers to discrepancies in the tax laws of two or more independent tax jurisdictions or territories in relation to the … [Read more...]

Big Four accounting firms are key drivers of tax haven use, new research says

As scandals emerge from the Paradise Papers, the Big Four accountancy firms seem to have managed to stay largely out of the spotlight once again. But research released today shows that scrutiny of their practices is justified in the public interest. The new study is authored by Dr Chris Jones and … [Read more...]

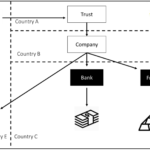

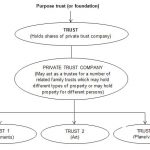

Our paper “Trusts: Weapons of Mass Injustice?” – now available in Spanish

Our paper "Trusts: Weapons of Mass Injustice?" which we released and blogged about earlier this year is now available in Spanish. The English version of the paper is available here. The paper provoked critical attention from practitioners and from tax havens. Our response to their critiques is here … [Read more...]

Technology and online beneficial ownership registries: 21st century transparency

At the Global Tax Transparency Summit meeting held in London in December 2016, a senior official from the tax haven of Jersey claimed that one of the reasons for not making their registry of company ownership available to public scrutiny was the lack of a global standard for public company … [Read more...]

Newly launched Tax Justice UK assesses party manifestos in UK’s ‘snap’ general election

We'd like to share with you a press release from the newly launched Tax Justice UK for immediate release: … [Read more...]

Beneficial Ownership: a Tax Justice Network checklist

We're pleased to say that the world is moving towards the registration of beneficial owners (BOs) who are the natural persons who ultimately own, control or benefit from legal persons (e.g. companies) and legal arrangements (e.g. trusts). If made public, these registries would increase financial … [Read more...]

New estimates reveal the extent of tax avoidance by multinationals

New figures published today by the Tax Justice Network provide a country-level breakdown of the estimated tax losses to profit shifting by multinational companies. Applying a methodology developed by researchers at the International Monetary Fund to an improved dataset, the results indicate global … [Read more...]

How could a global public database help to tackle corporate tax avoidance?

A new research report published today looks at the current state and future prospects of a global public database of corporate accounts. We are cross posting this OpenDemocracy article written by Jonathan Gray, with permission from our partners on the open data for tax justice project at Open … [Read more...]