Adapted from an email from Tove Maria Ryding, Eurodad: Good news from Tanzania - the Public Accounts Committee there has kicked off an inquiry on tax evasion and avoidance, amid severe concerns about illicit financial flows and capital flight. We might have some interesting times … [Read more...]

Tax Wars

One Direction get tax justice. Or do they?

A few days ago we were delighted to read an article about the enormously influential UK band One Direction, which began like this. "George Osborne [the UK Chancellor] can expect a bombardment from One Direction fans after the boyband urged its army of followers to lobby the Chancellor to maintain … [Read more...]

Report: US government’s vast interest payments to tech giants on their offshore billions

From the Bureau of Investigative Journalism: "The US government makes vast interest payments to technology giants including Apple and Microsoft on the billions of dollars they shelter from tax offshore. A trawl of Securities & Exchange Commission (SEC) disclosures shows that Apple, … [Read more...]

IMF launches consultation on tax ‘spillover’

In a welcome step, the International Monetary Fund has announced it will be researching the consequences of existing and proposed changes to corporation tax regimes for lower income "source" countries. … [Read more...]

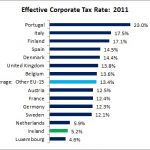

Read our lips: Ireland is a tax haven. Part xxvi

From Unite, Ireland (via Tax Research), a nice little graph showing effective corporate tax rates in Europe. We haven't seen this one before. Ireland, the Netherlands and Luxembourg - the Eurozone's three most notorious tax havens - are the clear abusers. … [Read more...]

The offshore wrapper: a week in tax justice

Welcome to this week’s Offshore Wrapper, by George Turner: a look back over the last week in tax justice. … [Read more...]

Fiat moves tax domicile to tax haven UK – but will it create jobs?

Reuters reports: "Fiat said on Wednesday it would register the holding of its newly created Fiat Chrysler Automobiles group in the Netherlands and set its tax domicile in Britain … [Read more...]

IMF: tax cuts don’t attract investment

From the IMF, a Working Paper. It doesn't make quite the sweeping claim suggested in the headline, but still. "Using manufacturing and services firm-level data for 30 sub-Saharan African (SSA) countries, this paper shows that taxation is not a significant driver for the location of foreign firms … [Read more...]

Swiss double tax agreements disadvantage poorer countries

Our attention has been drawn to a fascinating new report (sadly, in German only, an English language summary is here) on Switzerland’s double tax agreements (DTAs) with developing countries. Interestingly, although the report was produced by researchers from the renowned World Trade Institute at … [Read more...]

The Taxcast: January 2014 – Edition 25

In the January 2014 Taxcast: Tax justice goes to the Cayman Islands; the latest fall-out from #OffshoreLeaks, the expose on tax havens from the International Consortium of Investigative Journalists; and HOW much is Africa spending on corporate tax breaks??? The Taxcast looks at tax incentives, … [Read more...]

Quote of the day – Boeing

From Citizens for Tax Justice: "How worried should we be that Boeing argues it should get a tax break for performing safety tests on its new planes? … [Read more...]