From the Financial Times, in a story about a conference on the OECD's much-discussed BEPS project to reform international tax rules for transnational corporations: “The gameplan is to be positive but hope as little as possible happens,” is how Paul Oosterhuis, a tax partner of Skadden Arps, the US … [Read more...]

Tax Wars

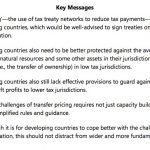

IMF: tax havens cause poverty, particularly in developing countries

The IMF has a major new Policy Paper out entitled Spillovers in International Taxation, looking at the effects that one country’s tax rules and practices can have on others. Of course this is a Staff Report and the IMF would never be so rude to some of its most powerful member states as to … [Read more...]

The UK’s ‘open for business’ tax regime: investment falls

We were going to do a job on this report but Tax Research got there first, so we'll cut and paste: UK corporation tax policy fails to attract new business as Foreign Direct Investment falls From the time that the current government came into power corporation tax reform has been one of their … [Read more...]

Campaign: Ireland’s tax model must stop hurting the global south

In 2012 ActionAid published a report estimating that a huge new tax loophole deliberately created by the UK government - which it seems is bringing in precious little in terms of jobs or tax revenues - is also likely to cost developing countries some £4 billion (US$6 billion) a year. Ireland's … [Read more...]

Euro Commission probes corporate tax arrangements of Apple, Starbucks and Fiat

From Europa.eu "The European Commission has opened three in-depth investigations to examine whether decisions by tax authorities in Ireland, The Netherlands and Luxembourg with regard to the corporate income tax to be paid by Apple, Starbucks and Fiat Finance and Trade, respectively, comply with … [Read more...]

Reuters report: the UK’s “new” corporate tax policies have failed

That's the impression you get from reading the latest story by Tom Bergin of Reuters, who has done a detailed and excellent exploration of the UK's recent moves to become more of a tax haven for multinational corporations. The harm inflicted on taxpayers elsewhere? Enormous. Just look at the … [Read more...]

Tax haven Britain: Boots Alliance and the use and abuses of Limited Liability Partnerships

Last year our friends at War on Want published a report revealing that Boots the Chemists - a fixture of most U.K. high streets - had dodged over £1 billion in the six preceding years since it was taken over by the Alliance group. War on Want have now sent a letter to HM Revenue and Customs (which … [Read more...]

Report: the black hole at the heart of London’s FTSE100

From Christian Aid, a press release: "The secrecy surrounding thousands of subsidiaries created in tax havens by leading UK companies has created a black hole at the heart of the FTSE100, a new Christian Aid report warns today. … [Read more...]

Stop press: large U.S. multinational decides to pay some tax

As expert after expert - and citizen after citizen - agrees: the international tax system is broken. Multinational corporations run rings around even the most sophisticated and well-resourced tax authorities, producing democracy-killing results such as the fact that General Electric paid a minus 11 … [Read more...]

Pfizer and Astrazeneca merger shows US and UK both lose from UK’s predatory tax regime

Update: see this must-read post from Citizens for Tax Justice in the U.S., entitled Why Does Pfizer Want to Renounce Its Citizenship? From Tax Research UK: "The financial press is full of stories about Pfizer this morning, and its planned takeover of Astrazeneca. A recurring theme is the tax … [Read more...]

Publicis and Omnicom: a merger driven by tax abuse?

Reuters is carrying a fascinating story with a less than fascinating headline: "Push for tax-avoidance curbs in G-20 threatens Publicis-Omnicom deal." Last July Paris-based Publicis and New York-headquartered Omnicom announced plans to merge to create the world's biggest advertising group, which … [Read more...]

The Offshore Wrapper: A week in tax justice

The Offshore Wrapper is written by George Turner Pfizer offshore cash pile fuels AstraZeneca bid … [Read more...]

On Piketty, mathematical silliness, inherited wealth and mysterious entities

From the book everyone's talking about, Thomas Piketty's Capital in the 21st Century, a review by Paul Krugman in the New York Review of Books: "Why does inherited wealth play as small a part in today’s public discourse as it does? Piketty suggests that the very size of inherited fortunes in a way … [Read more...]

Reports: the sorry state of U.S. tax dodging multinationals

Two major reports are worth highlighting here. First, and most recently, from the U.S. Permanent Subcommittee on Investigations (via Senator Carl Levin), a report on tax avoidance by U.S. multinational Caterpillar: "Caterpillar Inc., an American manufacturing icon, used a wholly owned Swiss … [Read more...]

Shareholders to get chance to vote on Google’s tax policy at AGM

From Responsible Investor, a story about a shareholder resolution about Google’s tax strategies has been placed by a group of responsible investors onto the agenda of its forthcoming annual shareholder meeting. "The proposal calls on the company’s board to “adopt a set of principles to address the … [Read more...]