Cross-posted from Fools' Gold: From the Association for Women's Rights in Development, a post related to a landmark meeting in Lima on tax justice and human rights: "The current “race to the bottom” in which tax competition among developing countries takes place to attract corporate and … [Read more...]

Tax Wars

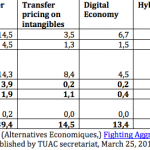

Two new reports challenge the OECD’s work on corporate tax cheating

The OECD, the club of rich countries that dominates international tax, is running a project known as Base Erosion and Profit Shifting (BEPS) which is supposed to fix some of the gaping holes in the international tax system. As we all know, transnational corporations (TNCs) are running rings around … [Read more...]

Lima: TJN director Christensen speech on tax justice and human rights

From John Christensen, TJN's director, a speech about tax justice and human rights. It begins like this: "Why the tax justice movement should embrace human rights. And vice versa The history of economic and social rights in most countries can be discovered in their tax codes. Tax is at the … [Read more...]

Tax competitiveness: was Charles Tiebout joking?

From the Fools' Gold project on 'competitiveness': Do nations or states ‘compete’ with each other in a meaningful way? We have already explored the thinking of Paul Krugman, Adam Smith, Robert Reich, and the Tax Justice Network on this question. Their answers are, to summarise broadly: ‘no – or at … [Read more...]

What competition in the Offshore Game?

This week sees the launch of The Offshore Game, a project dedicated to looking at the role of offshore financial centres in sport. TJN has written about this here and here already. Now for a bit more of an overview of this emerging project. Our first report looks at the amount of finance from … [Read more...]

Tax Justice: A Christian Response to a New Gilded Age

From the U.S. Presbyterian Church, a report written by a former World Bank economist entitled “Tax Justice: A Christian Response to a New Gilded Age”. As the summary notes, it "provides a framework for engaging in discussions about the large and growing concentration of income and wealth in … [Read more...]

‘National Competitiveness’: a crowbar for corporate and financial interests

This was originally posted yesterday at the new Fools' Gold site, which is dedicated to understanding how nations do or don't 'compete'. The term "UK PLC" -- the 'PLC' bit standing for Public Limited Company -- evokes notions that whole countries behave like corporations. It is routinely trotted … [Read more...]

What is competitiveness? #1 – Robert Reich

From the Fools' Gold blog, an article that speaks for itself What is Competitiveness? #1 Robert Reich This is the first in an ongoing series of articles we are planning, to explore what competitiveness is, from the perspective of particular public figures or intellectuals. For the first in this … [Read more...]

Meet TJN in Oxford to discuss the fallacy of tax “competitiveness”

New Report: Ten Reasons to Defend the Corporate Income Tax.

UPDATES 2018 - Tax incentives in mining: minimising risks to revenue, OECD/Intergovernmental forum on mining, minerals, metals, and sustainable development. "Tax incentives are costly, leading many countries to forgo vital revenues in exchange for often illusive benefits. . . there is little … [Read more...]

New study outlines trillions handed out in U.S. corporate welfare bonanza

From Good Jobs First in the U.S., a new study looking at the many and varied grants, tax credits and subsidies harvested by large companies. (Also see our Taxcast interview of Greg Leroy, along with an interview with Kevin Farnsworth, who has done similar work on corporate welfare for the … [Read more...]

How the ‘competitiveness’ dogma made banks corrupt

We've come across an interview in The Atlantic with Stephen Platt, an expert on financial crime prevention, contained in an article entitled How Dirty Money Gets Into Banks. As much as anything, we've taken it as an excuse to reproduce this fabulous cartoon in Britain's Private Eye magazine, which … [Read more...]

The “Miracle of Minneapolis” and a local ceasefire in tax wars

From The Atlantic in the U.S., an article entitled "The Miracle of Minneapolis" which looks at the demonstrable outperformance of this mid-sized U.S. city, in terms of being a good place to live. It's summed up in an old adage: ‘It’s really hard to get people to move to Minneapolis, and it’s … [Read more...]

HSBC, tax evasion and the link to lax financial regulation

Two quotes of the day, both from an article by Prof. Bill Black, a former U.S. bank regulator: "Taxes were once termed the price we paid for civilization, but they now represent the price the wealthy brag to each other about refusing to pay as they pillage civilization." Quite so. And then, … [Read more...]

Quote of the day: we are entering the age of tax wars

From Mark Textor, adviser to Australian Prime Minister Tony Abbott: "We are entering the period of tax wars instead of trade wars," he said. "People vote in governments to solve the problem, and giant multinationals not paying tax is a problem." One for the Tax Wars page. Hat tip: Mark … [Read more...]