This time it's Uganda. From Martin Hearson: "The government announced in its latest budget that it has finished formulating its new tax treaty policy, and will be renegotiating treaties that don't comply. Seatini and ActionAid Uganda will no doubt chalk this up as a success." In … [Read more...]

Tax Wars

New paper: Taxing Multinational Enterprises as Unitary Firms

A new paper by TJN Senior Adviser Sol Picciotto, for the International Center for Tax and Development (ICTD). Summary: This paper explores the issues raised for international tax rules of explicitly treating multinational enterprises (MNEs) as single or unitary firms. It first briefly explains … [Read more...]

New Research Shows Millionaires Less Mobile than the Rest of Us

From Citizens for Tax Justice, a blog that's worth reproducing in full, as yet more useful ammunition to wheel out against those who keep banging on about tax cuts and so-called 'competitiveness.' New Research Shows Millionaires Less Mobile than the Rest of Us A new study (PDF) released today … [Read more...]

HSBC opts to stay in ‘competitive’ London. (It was never going to leave anyway)

From the Fools' Gold blog, yesterday: There's been a lot of talk for a long time about a threat from globe-trotting HSBC to move its headquarters from London to Hong Kong. It seems there's been a resolution of the question for now, of sorts. As Bloomberg puts it: "HSBC Holdings Plc … [Read more...]

Google’s taxes and the economic illiteracy of the Mayor of London

No, not the Lord Mayor of London, but the Mayor of London, a certain Boris Johnson, who's frequently tipped to be Britain's next Prime Minister. Given that Britain is arguably the most important player in the global offshore system, this man's opinions deserve close scrutiny. The topic at hand is … [Read more...]

New paper: tax treaties a ‘poisoned chalice’ for developing countries

Update, Jan 20: this blog has now been adapted and expanded in a post on Naked Capitalism. In 2013 we published an article entitled Lee Sheppard: Don't sign OECD model tax treaties! which looked at a presentation by one of the U.S.' top experts in international tax. Her fiery presentation … [Read more...]

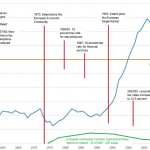

New study: corporate tax cuts may have been ‘the greatest blunder’

The Canadian Center for Policy Alternatives has just published a new study entitled Do Corporate Income Tax Rate Reductions Accelerate Growth? It summarises: "This study examines the relationship between the Canadian corporate income tax (CIT) regime and various dimensions of economic growth. The … [Read more...]

How the U.S.A. became a secrecy jurisdiction

This month we published our fourth Financial Secrecy Index (FSI), complete with a series of reports about each of the biggest tax havens and secrecy jurisdictions, looking into the political and economic histories of how and why they went offshore, who was involved, and where the bodies are … [Read more...]

How Ireland became an offshore financial centre

This month we published our fourth Financial Secrecy Index (FSI), complete with a series of reports about each of the biggest tax havens and secrecy jurisdictions, looking into the political and economic histories of how and why they went offshore, who was involved, and where the bodies are … [Read more...]

Still Broken: major new report on global corporate tax cheating

Update, Dec 7, 2015: a new paper in the Journal of World Business, which contains this: "Home country statutory corporate tax rates have a small impact on tax haven use. In general, corporate tax rates are an important factor in driving MNEs to set up tax haven subsidiaries. However, … [Read more...]

How ‘competitive’ tax and incentive policies hurt small U.S. businesses

Cross-posted from the Fools' Gold site: Recently we have written about how supposedly 'competitive' national policies on tax and the financial sector in Britain tend to favour large multinational firms over smaller, more locally-based ones, and how they also tend to lead to less competition in … [Read more...]

Developing countries and BEPS: an equal footing?

From Bloomberg BNA: "Since 2013, the Organization for Economic Cooperation and Development [OECD] has been working on a 15-item BEPS action plan under Group of 20 authority with the aim of closing “loopholes” that allow multinationals to drastically reduce their taxes. Along the way, the project … [Read more...]

Why a ‘competitive’ economy means less competition

From the Fools' Gold site: The 'competitiveness' of a country can be taken to mean many things. Many people, such as Martin Wolf or Paul Krugman, have argued forcefully that it is a meaningless or dangerous concept. On another level it's a question of language: you can make national … [Read more...]

The G20/OECD BEPS Project on corporate tax: a scorecard

In 2013 the G20 world leaders mandated the OECD, a club of rich countries, for its Base Erosion and Profit Shifting (BEPS) project to produce reforms of international tax rules that would ensure that multinational enterprises could be taxed ‘where economic activities take place and where value is … [Read more...]

Quote of the day: a tectonic shift in accounting standards

Yesterday we received an email containing our quote of the day: "this decades-overdue accounting rule is a historic development of tectonic proportions. It will enable analyses never before possible and vividly tie the opportunity costs of economic development to other public priorities." Our … [Read more...]