Update: see this must-read post from Citizens for Tax Justice in the U.S., entitled Why Does Pfizer Want to Renounce Its Citizenship? From Tax Research UK: "The financial press is full of stories about Pfizer this morning, and its planned takeover of Astrazeneca. A recurring theme is the tax … [Read more...]

Race to the Bottom

Publicis and Omnicom: a merger driven by tax abuse?

Reuters is carrying a fascinating story with a less than fascinating headline: "Push for tax-avoidance curbs in G-20 threatens Publicis-Omnicom deal." Last July Paris-based Publicis and New York-headquartered Omnicom announced plans to merge to create the world's biggest advertising group, which … [Read more...]

The Offshore Wrapper: A week in tax justice

The Offshore Wrapper is written by George Turner Pfizer offshore cash pile fuels AstraZeneca bid … [Read more...]

On Piketty, mathematical silliness, inherited wealth and mysterious entities

From the book everyone's talking about, Thomas Piketty's Capital in the 21st Century, a review by Paul Krugman in the New York Review of Books: "Why does inherited wealth play as small a part in today’s public discourse as it does? Piketty suggests that the very size of inherited fortunes in a way … [Read more...]

Reports: the sorry state of U.S. tax dodging multinationals

Two major reports are worth highlighting here. First, and most recently, from the U.S. Permanent Subcommittee on Investigations (via Senator Carl Levin), a report on tax avoidance by U.S. multinational Caterpillar: "Caterpillar Inc., an American manufacturing icon, used a wholly owned Swiss … [Read more...]

Shareholders to get chance to vote on Google’s tax policy at AGM

From Responsible Investor, a story about a shareholder resolution about Google’s tax strategies has been placed by a group of responsible investors onto the agenda of its forthcoming annual shareholder meeting. "The proposal calls on the company’s board to “adopt a set of principles to address the … [Read more...]

Tanzania: parliamentary inquiry on tax abuses, tax havens, illicit flows

Adapted from an email from Tove Maria Ryding, Eurodad: Good news from Tanzania - the Public Accounts Committee there has kicked off an inquiry on tax evasion and avoidance, amid severe concerns about illicit financial flows and capital flight. We might have some interesting times … [Read more...]

One Direction get tax justice. Or do they?

A few days ago we were delighted to read an article about the enormously influential UK band One Direction, which began like this. "George Osborne [the UK Chancellor] can expect a bombardment from One Direction fans after the boyband urged its army of followers to lobby the Chancellor to maintain … [Read more...]

Report: US government’s vast interest payments to tech giants on their offshore billions

From the Bureau of Investigative Journalism: "The US government makes vast interest payments to technology giants including Apple and Microsoft on the billions of dollars they shelter from tax offshore. A trawl of Securities & Exchange Commission (SEC) disclosures shows that Apple, … [Read more...]

Letter on derivatives: stop the offshore race to the bottom

Wall Street banks trade perhaps half of their derivatives activities through foreign banks. For them, foreign jurisdictions are an obvious escape route from U.S. financial regulations. Last June, Marcus Stanley of Americans for Financial Reform wrote: … [Read more...]

IMF launches consultation on tax ‘spillover’

In a welcome step, the International Monetary Fund has announced it will be researching the consequences of existing and proposed changes to corporation tax regimes for lower income "source" countries. … [Read more...]

Renting Judges for Secret Rulings in Delaware

Back in 1974 William Cary wrote a widely cited article about Delaware in the Yale Law Review, where he stated: "a pygmy among the 50 states prescribes, interprets, and indeed denigrates national corporate policy as an incentive to encourage incorporation within its borders, thereby increasing its … [Read more...]

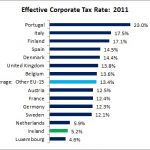

Read our lips: Ireland is a tax haven. Part xxvi

From Unite, Ireland (via Tax Research), a nice little graph showing effective corporate tax rates in Europe. We haven't seen this one before. Ireland, the Netherlands and Luxembourg - the Eurozone's three most notorious tax havens - are the clear abusers. … [Read more...]

Guernsey milking and the offshore stock exchange

The International Advisor magazine has just reported: "Guernsey chief minister Peter Harwood resigned today, in the wake of publication of a critical article in the current issue of the British satirical and investigative publication, Private Eye." This refers to an excellent report entitled … [Read more...]

The offshore wrapper: a week in tax justice

Welcome to this week’s Offshore Wrapper, by George Turner: a look back over the last week in tax justice. … [Read more...]