Cross-posted from Fools' Gold: From the Association for Women's Rights in Development, a post related to a landmark meeting in Lima on tax justice and human rights: "The current “race to the bottom” in which tax competition among developing countries takes place to attract corporate and … [Read more...]

Race to the Bottom

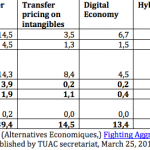

Two new reports challenge the OECD’s work on corporate tax cheating

The OECD, the club of rich countries that dominates international tax, is running a project known as Base Erosion and Profit Shifting (BEPS) which is supposed to fix some of the gaping holes in the international tax system. As we all know, transnational corporations (TNCs) are running rings around … [Read more...]

Lima: TJN director Christensen speech on tax justice and human rights

From John Christensen, TJN's director, a speech about tax justice and human rights. It begins like this: "Why the tax justice movement should embrace human rights. And vice versa The history of economic and social rights in most countries can be discovered in their tax codes. Tax is at the … [Read more...]

Adam Smith and the British East India Company: a perspective on competitiveness

This blog was originally posted at Fools' Gold, a project supported by TJN. Adam Smith was an arch-critic of the regime-hopping strategies of the exclusive stockholding corporations, the forerunners of today’s multinational corporations. The British East India Company, granted a Royal Charter, … [Read more...]

Links Apr 24

Shock at Luxembourg’s decision to charge LuxLeaks reporter Reporters Without Borders Responsible Tax Practice by Companies: A Mapping and Review of Current Proposals ActionAid Towards a Common African Position on Financing for Development: Governments and Civil Society Debate in Addis Ababa … [Read more...]

Links Apr 23

Luxembourg court charges French journalist over LuxLeaks role Reuters See also: Charges against #LuxLeaks reporter by Luxembourg authorities threaten press freedom ICIJ, Luxembourg court charges LuxLeaks journalist EU Business, and recent ICIJ article by Edouard Perrin ‘This story is global, it … [Read more...]

Tax competitiveness: was Charles Tiebout joking?

From the Fools' Gold project on 'competitiveness': Do nations or states ‘compete’ with each other in a meaningful way? We have already explored the thinking of Paul Krugman, Adam Smith, Robert Reich, and the Tax Justice Network on this question. Their answers are, to summarise broadly: ‘no – or at … [Read more...]

Links Apr 20

Combatting Tax Havens: What has been done, and what should be done Eva Joly and Alternatives Economiques (In French, with English version available soon) EU must pull its weight to help create a better global financial system The Guardian Indian Finance Minister Arun Jaitley: Automatic info … [Read more...]

Links Apr 17

Joint May Day statement: Working people pay taxes – corporations must pay their share! Global Alliance for Tax Justice Angola’s sovereign fund pays $100 million to a shell company index Commodity giants' Singapore trading hubs under fire in tax probes Reuters Christine Lagarde, scourge of … [Read more...]

Links Apr 16

"Developing countries" Is it or isn’t it a spillover? Martin Hearson Too much focus on ‘spillover effects’ of tax policies might lead to an too-narrow analysis of the impacts of a jurisdiction’s tax policies on developing countries. America’s Most-Wanted Swiss Bankers Aren’t Hard to Find … [Read more...]

Links Apr 15

How anonymously owned companies are used to rip off government budgets Global Witness Taxing Multinationals: Is There a Pot of Gold of Finance for Development? Center for Global Development CSO Response to the Zero Draft of the Outcome Document of the Third Financing for Development … [Read more...]

What competition in the Offshore Game?

This week sees the launch of The Offshore Game, a project dedicated to looking at the role of offshore financial centres in sport. TJN has written about this here and here already. Now for a bit more of an overview of this emerging project. Our first report looks at the amount of finance from … [Read more...]

Tax Justice: A Christian Response to a New Gilded Age

From the U.S. Presbyterian Church, a report written by a former World Bank economist entitled “Tax Justice: A Christian Response to a New Gilded Age”. As the summary notes, it "provides a framework for engaging in discussions about the large and growing concentration of income and wealth in … [Read more...]

Links Apr 13

‘HSBC has specifically targeted Argentina’ Buenos Aires Herald "Tax Justice Network head John Christensen warns about the bank’s lobbying power" Getting the EU response to the tax dodging scandal right Eurodad See also: Corporate Tax Avoidance Crackdown, a Missed Opportunity for the EU … [Read more...]

Links Apr 10

Despite Investment, Luxembourg Costs EU 'Billions' in Tax Breaks Sputnik International Transparency International Zambia Cautions Government Against Bending Too Much On Arriving At A Revised Tax Regime For Mines Foreign funds brace for India’s alternative tax demand FinancialTimes … [Read more...]