World leaders agree to close multinationals' tax loopholes Yahoo News But measures are not yet enough. See: Still Broken: major new report on global corporate tax cheating TJN Africa’s challenge to “loophole-ridden” Kenya-Mauritius tax agreement to be heard in Kenya High Court MNE … [Read more...]

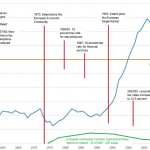

Race to the Bottom

Links Nov 13

ECOSOC published a shocking report indicating that national governments lose billions in uncollected global corporate income tax revenues each year. New Europe Zimbabwe Revenue Authority Opposes Tax Incentives The Herald Two states ordered to recover unpaid corporation tax The Irish … [Read more...]

Links Nov 12

Bangladeshi rights groups demand Tax Transparency Global Alliance for Tax Justice Brazil lower house passes amnesty for unreported offshore assets Reuters Australia: Senate repeals tax secrecy law after 'astroturf' revelations Cootamundra Herald "It's a great day for democracy when a sneaky … [Read more...]

How Ireland became an offshore financial centre

This month we published our fourth Financial Secrecy Index (FSI), complete with a series of reports about each of the biggest tax havens and secrecy jurisdictions, looking into the political and economic histories of how and why they went offshore, who was involved, and where the bodies are … [Read more...]

Links Nov 10

Who runs our countries: us, or global finance? Fools' Gold - rethinking competition UK’s bank levy reforms will cost £4.2bn in tax over 5 years Fools' Gold - rethinking competition G20 Among Biggest Losers in Large-Scale Tax Abuse but Poor Countries Relatively Hardest Hit Oxfam Great new … [Read more...]

Still Broken: major new report on global corporate tax cheating

Update, Dec 7, 2015: a new paper in the Journal of World Business, which contains this: "Home country statutory corporate tax rates have a small impact on tax haven use. In general, corporate tax rates are an important factor in driving MNEs to set up tax haven subsidiaries. However, … [Read more...]

Links Nov 9

#Luxleaks protest in support of whistleblowers Video: Tax campaigners protesting outside the European Commission and Council, in support of the whistleblowers who exposed the Luxleaks scandal, and against tax dodging multinational corporations. Internal EU Documents: How the Benelux Blocked … [Read more...]

Links Nov 6

Video summaries of #LuxLeaks stunts Global Alliance for Tax Justice See also: #LuxLeaks anniversary marked with protests, calls for action ICIJ, A year after LuxLeaks, it is high time for EU action on corporate tax-dodging The Guardian, and A Year On, Europe's Tax Affairs Are Still A Mystery New … [Read more...]

Links Nov 5

Note: tomorrow we'll be posting news of worldwide media coverage on our newly launched 2015 Financial Secrecy Index LuxLeaks anniversary: activists call for transparency Global Alliance for Tax Justice See also: Global Week of Action for #TaxJustice, Nov 2-6! 1 year on from #LuxLeaks - … [Read more...]

Links Oct 29

Ten years in the campaign for tax justice - we have a long way to go Open Democracy By TJN Director John Christensen. See our recent blog New publication: The Greatest Invention – Tax and the Campaign for a Just Society Fighting tax evasion: EU and Liechtenstein sign new tax transparency … [Read more...]

Links Oct 26

Inside the Secretive World of Tax-Avoidance Experts The Atlantic Challenges for family offices in emerging markets IFC Review / Financial Times Reporting on a trend in developing economies - wealthy families setting up their own trust companies. Corruption and natural resources - A fight for … [Read more...]

Links Oct 22

Video: Taxation (ICTD/UNU-WIDER Special Session) 1/5 - 30th Anniversary Conference Extracting minerals, extracting wealth: how Zambia is losing $3 billion a year from corporate tax dodging War on Want After Blow to Europe Tax Havens, Some Promise More Staying Power Bloomberg Large-scale … [Read more...]

Links Oct 21

Starbucks and Fiat sweetheart tax deals with EU nations ruled unlawful The Guardian See also: Apple Stakes Raised as EU Orders Starbucks, Fiat Tax Repayments Bloomberg, and earlier blog European Commission determines state sponsored tax avoidance schemes illegal Switzerland Must Seize … [Read more...]

European Commission determines state sponsored tax avoidance schemes illegal

Today the European Commission is expected to announce that the 'comfort letters' signed between European tax havens and companies are a form of illegal state aid. … [Read more...]

Links Oct 19

Analysis: Can we beat tax avoiding multinationals? - Finance Uncovered/ Byline How to lose $4billion Global Witness New report, coming ahead of a pivotal meeting of the Extractive Industries Transparency Initiative (EITI). "Credibility test for global transparency standard as $4bn lost to … [Read more...]