Latin America and Caribbean Tax Administration Dialogue on International Taxation in Quito Global Alliance for Tax Justice Country-by-Country regime passed by Australian Parliament Global Alliance for Tax Justice New Study: Illicit Financial Flows Hit US$1.1 Trillion in 2013 Financial … [Read more...]

Race to the Bottom

Links Dec 7

The determinants of tax haven FDI Science Direct Paper examines the determinants of a multinational enterprise's (MNEs) decision to set up tax haven subsidiaries. Cayman Islands fraudsters may have moved $450 million to Cuba Caribbean News Now! Very interesting report by Kenneth Rijock, a … [Read more...]

Links Dec 3

Revealed: how Southeast Asia’s biggest drug lord used shell companies to become a jade kingpin Global Witness For Facebook’s Zuckerberg, Charity Is in Eye of Beholder Bloomberg Gabriel Zucman points out: “A society where rich people decide for themselves how much taxes they pay and to what … [Read more...]

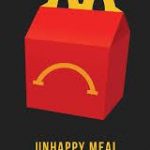

European Commission to probe McDonald’s tax deal with Luxembourg

The European Commission has just announced a formal investigation of the tax agreement struck between McDonald's and Luxembourg. Read the full press release here, also read the Unhappy Meals report on McDonald's tax avoidance schemes. There are many reasons to boycott McDonalds; add tax avoidance … [Read more...]

Links Dec 2

Art & Money Laundering in Switzerland - secrecy is weakening Bilan (In French) Article in English here. EAC states adopt new measures to curb tax loss The East African European Parliament tax investigation continued: Strong mandate for new committee to continue tax investigation Sven … [Read more...]

Links Dec 1

HSBC whistleblower given five years’ jail over biggest leak in banking history The Guardian See also: 'Sentencing Changes Nothing, Will Help Black Money Probe,' Says Herve Falciani NDTV, The Snowden Of Swiss Bank Accounts Is Sentenced To Prison While White Collar Criminals Go Free ThinkProgress, … [Read more...]

New study: corporate tax cuts may have been ‘the greatest blunder’

The Canadian Center for Policy Alternatives has just published a new study entitled Do Corporate Income Tax Rate Reductions Accelerate Growth? It summarises: "This study examines the relationship between the Canadian corporate income tax (CIT) regime and various dimensions of economic growth. The … [Read more...]

How the U.S.A. became a secrecy jurisdiction

This month we published our fourth Financial Secrecy Index (FSI), complete with a series of reports about each of the biggest tax havens and secrecy jurisdictions, looking into the political and economic histories of how and why they went offshore, who was involved, and where the bodies are … [Read more...]

Links Nov 26

An uneven playing field: inequality, human rights and taxation inesc "The Latin American experience shows that progressive tax systems are crucial to reducing inequality." EU lawmakers step up pressure to tackle tax dodging Reuters See also: EP tax investigation: EP president Schulz blocking … [Read more...]

Links Nov 25

European Parliament tax investigation: Special committee extension blocked to protect Juncker and Dijsselbloem Sven Giegold Special Report: Greek shipowners talk up their role to protect tax breaks Reuters Wanted: central bank boss to fix 1,700-year-old European tax haven Reuters So Pfizer … [Read more...]

Links Nov 24

Tackling tax across borders Public Finance International Mozambique PM rues Africa tax collection crisis Star Africa India: Are shell companies behind the over-estimation of GDP? LiveMint Bob Jessop: an historical approach to national competitiveness Fools' Gold - rethinking … [Read more...]

The Tax Justice Network’s November 2015 Taxcast

In the Tax Justice Network’s November 2015 Taxcast: Why is the City of London losing so much business to New York, Hong Kong and Singapore? Our conclusions are quite different from those of a British Bankers Association report on the subject. Listen to the Taxcast here. … [Read more...]

Links Nov 19

Crackdown on Caribbean tax havens a surprise boon for Hong Kong South China Morning Post Why we need public country by country reporting Global Alliance for Tax Justice UN Principles for Responsible Investment: Engagement guidance on corporate tax responsibility Investor Brief on Tax … [Read more...]

Links Nov 18

”Global citizenship is essentially a branding exercise” and passport shopping is big business Quartz Fascinating piece on citizenship-for-sale, and speaking on the tax issues Getting to Good – towards responsible corporate tax behaviour Discussion paper by Christian Aid, ActionAid and … [Read more...]

Links Nov 17

Tough debate with multinational companies on corporate tax practices European Parliament News Facebook, Google Quizzed by EU Lawmakers on Dutch Sandwich Deals Bloomberg UK sets out beneficial ownership register demands on territories STEP The demands stop short of a public central … [Read more...]