On February 19th, the OECD launched a consultation entitled “Preventing abuse of residence by investment schemes to circumvent the CRS”. It was about time. Since 2014, we have written several papers and blogs (here, here, here, here and here) explaining how residency and citizenship schemes offered … [Read more...]

Policy

Video: discussion on tax revenue losses, Apple’s tax avoidance and ‘state aid’

We're sharing here the opening panel discussion of the June 2017 European Financial Congress, Eastern Europe's largest finance congress in Gdansk, Poland. The theme of the panel was "Tax solidarity in the world and in the EU" and it features visiting Professor at Oxford University Philip Baker QC … [Read more...]

Bring in new tax to curb avoidance by multinationals: new report

A new report out today by Grace Blakeley from the progressive policy think tank IPPR argues for a re-balancing of the business taxation system. Titled Fair dues: Rebalancing business taxation in the UK, the report proposes: a series of reforms aimed at achieving a fairer burden of taxation between … [Read more...]

Guest blog: Stopping public contracts for tax cheats

We're pleased to share this important blog from the Fair Tax Mark's Chief Executive Paul Monaghan, orginally posted here. The Fair Tax Mark's inception was supported by the Tax Justice Network and it continues to do great work. As Ed Mayo, Secretary General of Co-operatives UK summarises very … [Read more...]

New report: ‘Hybrid Mismatches in Israel’

Tax Justice Network Israel (TJN IL), in cooperation with Friedrich Ebert Stiftung, has published a new report on ‘Hybrid Mismatches in Israel’. The term "hybrid mismatches" refers to discrepancies in the tax laws of two or more independent tax jurisdictions or territories in relation to the … [Read more...]

Trusts and the UK: half a step forward, three steps backwards

Remember our paper calling for the registration of trusts? Back then the British government opposed this. During discussions related to the EU 4th Anti-Money Laundering Directive, Treasury spokesperson Lord Newby even said: “We consider registration of trusts to be a disproportionate approach and, … [Read more...]

US tax reform and conflicts with international law: guest blog

The US tax bill will be published on Friday 15th December 2017 and will be voted on by Congress early next week. Senior Policy Advisor Didier Jacobs at Oxfam America has written this blog: The Exceptionalist Tax Bill The United States Congress is about to adopt a major tax reform that reflects … [Read more...]

Indian cess taxes: A call for accountability (Guest blog)

This piece is about cess taxes levied by the current government in India written for us by Ashrita Prasad Kotha, Assistant Professor at Jindal Global Law School whose work on ‘Cesses in the Indian Tax Regime: A Historical Analysis’ has been published as a book chapter in Studies in the History of … [Read more...]

#ParadisePapers: The Mauritian Connection

What do Angola’s sovereign wealth fund, the cast of British TV show Mrs Brown’s Boys, and Yale University’s investment in India have in common? The Paradise Papers reveal that they are all connected with offshore secrecy jurisdiction Mauritius, with the assistance of offshore law firm … [Read more...]

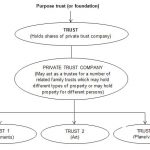

Our paper “Trusts: Weapons of Mass Injustice?” – now available in Spanish

Our paper "Trusts: Weapons of Mass Injustice?" which we released and blogged about earlier this year is now available in Spanish. The English version of the paper is available here. The paper provoked critical attention from practitioners and from tax havens. Our response to their critiques is here … [Read more...]

Tax Justice video: How can we avoid another crisis? Expert panel discussion

In this video we hear fascinating presentations and discussion from an expert panel on how another global financial crisis can be avoided, ten years after the first. They focus on the UK, not only on the financial sector itself and the finance curse, but also on the role of the wider financial … [Read more...]

Tax justice in the Arab world: new research

We're pleased to be able to share the recent work of the Arab NGO Network for Development, a regional network in 12 Arab countries. They've released research (available in English here and in Arabic here) which assesses tax systems in a number of Arab countries from an economic and social justice … [Read more...]

The great escape: how tax havens continue to undermine new transparency measures: guest post

We're pleased to share this blog from Senior Policy Advisor at Oxfam Novib, Francis Weyzig, originally published here on how tax havens continue to undermine the OECD’s Common Reporting Standard, an information standard for the automatic exchange of tax and financial information on a global level. … [Read more...]

Swiss Politicians seek to block automatic exchange of banking information with developing countries

Could we be seeing a return to the bad old days of Swiss Banking? A right wing party in Switzerland, the Swiss People’s Party, has launched an assault on the automatic exchange of banking information, according to Swiss Daily Newspaper Tages Anzeiger. … [Read more...]

Launch of international research collaboration, #AltAusterity

Today is the launch of #AltAusterity, a new, international research collaboration of which Tax Justice Network is a partner. The project aims to stimulate public debate on the subject of austerity though high quality research. It is a response to the lack of evidence which has underpinned the … [Read more...]