An important new analysis from Christian Aid. Note the pull-out quote highlighting the problems with the OECD's Common Reporting Standard, or CRS. September 30 2015 NEW SWISSLEAKS ANALYSIS REVEALS HOW TAX HAVEN SECRECY HARMS DEVELOPING COUNTRIES New, detailed examination of the SwissLeaks files … [Read more...]

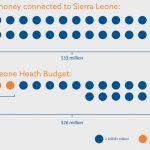

Size of the Problem

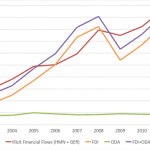

Report: Illicit Financial Flows Outpace Foreign Aid and Investment

Updated with new table: see below From Global Financial Integrity in Washington, D.C., via email: "Analysis of illicit financial flows (IFFs) by Global Financial Integrity (GFI) shows that in seven of the last ten years the global volume of IFFs was greater than the combined value of all … [Read more...]

Did NGOs invent a pot of gold? (No.)

By Alex Cobham, our research director: first posted at Uncounted. A draft paper by Maya Forstater, circulated by the Center for Global Development in time for the Financing for Development conference in Addis, attacks the integrity of many people and NGOs working on tax justice and illicit … [Read more...]

Tax Justice Research Bulletin 1(5)

May 2015. Welcome to the fifth Tax Justice Research Bulletin, a monthly series dedicated to tracking the latest developments in policy-relevant research on national and international taxation. This issue looks at a fascinating thesis on the different people and organisations that influence the … [Read more...]

The Offshore Game – new TJN report on offshore finance in football

From The Guardian, a major new story whose introduction runs as follows: "Research by the Guardian and the Tax Justice Network reveals 28 English clubs with substantial shareholdings overseas, opening up the football leagues to criticism for allowing ownership structures that could be used for … [Read more...]

New U.S. report: Offshore Tax Havens Cost Small Businesses $3,244 a Year

From the U.S. Public Interests Research Group (PIRG): As tax day approaches, it’s important to remember that small businesses end up picking up the tab for offshore tax loopholes used by many large multinational corporations. U.S. PIRG joined Senator Bernie Sanders, Bryan McGannon of the … [Read more...]

Quote of the day – tax avoidance as red flag for investors

From the Financial Times, our quote of the day: "investors were viewing the aggressiveness of a company’s tax planning as a proxy for accounting risks and the company’s broader management style." Which is just as we have always said. Tax avoidance is shortcut behaviour: the opposite of … [Read more...]

UNCTAD: multinational tax avoidance costs developing countries $100 billion+

The UN Conference on Trade and Development (UNCTAD) has just published a major new study on corporate tax in developing countries, which contains a wealth of new information analysis as well as some important headline numbers: notably that developing countries lost around $100 billion per year in … [Read more...]

New Report: Ten Reasons to Defend the Corporate Income Tax.

UPDATES 2018 - Tax incentives in mining: minimising risks to revenue, OECD/Intergovernmental forum on mining, minerals, metals, and sustainable development. "Tax incentives are costly, leading many countries to forgo vital revenues in exchange for often illusive benefits. . . there is little … [Read more...]

How the ‘competitiveness’ dogma made banks corrupt

We've come across an interview in The Atlantic with Stephen Platt, an expert on financial crime prevention, contained in an article entitled How Dirty Money Gets Into Banks. As much as anything, we've taken it as an excuse to reproduce this fabulous cartoon in Britain's Private Eye magazine, which … [Read more...]

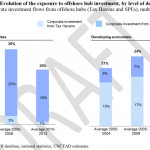

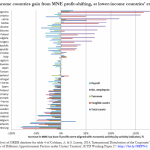

Poorer Countries Lose More from Corporate Profit-Shifting

By Alex Cobham. This post was originally published by the Center for Global Development, where I was a research fellow until leaving this month to join TJN as Director of Research. Reproduced, with CGD's permission. Poorer Countries Lose More from Corporate Profit-Shifting Lower-income … [Read more...]

Developing countries: a new government revenue dataset

From the International Centre for Tax and Development: A major obstacle to cross-country research on the role of revenue and taxation in development has been the weakness of available data. This paper presents a new Government Revenue Dataset (GRD), developed through the International Centre for … [Read more...]

The World Weekly – Infographic on the Hidden Economy

From The World Weekly: … [Read more...]

Big Bills: how our central banks nurture money launderers and kleptocrats

A question for our European readers. How many of you have ever spent or even seen a 500 Euro note? No, neither have we. Which is may seem odd, given that there are some 300 billion Euros' worth of these things out there, in circulation. Which raises the question: where are they all? … [Read more...]

The Price of Offshore Revisited – new material

We published a long rebuttal yesterday to an attack on TJN by two U.S. academics, supported by the lobbying arm of the British tax haven of Jersey, which has publicised it at a conference in London today. The attack focused quite heavily on our 2012 report The Price of Offshore Revisited, which … [Read more...]