As we announced last week, the OECD has published data showing that financial accounts holding more than ten trillion euros are now the subject of multilateral, automatic information exchange - a longstanding tax justice goal that the OECD had long resisted. Now James Henry - a senior adviser to Tax … [Read more...]

Size of the Problem

It’s got to be automatic: Trillions of dollars offshore revealed by Tax Justice Network policy success

This is a moment, in these strange times, to celebrate an ongoing success in the history of the tax justice movement. Automatic, multilateral exchange of information on financial accounts is the A of our ABC of tax transparency. It has been a campaign aim since our inception in the early 2000s, as … [Read more...]

Financial Secrecy Index: who are the world’s worst offenders? The Tax Justice Network podcast special, February 2020

In this special extended Taxcast, Naomi Fowler takes you on a whistle-stop guided tour on an express train around the world with some of the Tax Justice Network team, looking at the worst offenders selling secrecy services according to the latest Financial Secrecy Index results What can nations can … [Read more...]

Paradigm shifts on tax, and who are ‘the uncounted’? Tax Justice Network November 2019 podcast

This month on the Taxcast we speak to Tax Justice Network CEO Alex Cobham about his new book The Uncounted on the politics of counting. Who's missing from the stats, from the bottom to the very top? And how can we count better? Plus: For decades corporate tax cuts have been touted as the way to … [Read more...]

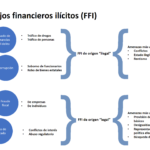

Objetivo 2030: los flujos financieros ilícitos

Las últimas dos décadas han visto el surgimiento de un poderoso movimiento de justicia fiscal a nivel mundial, liderado por la experiencia de la sociedad civil y cada vez más por los responsables políticos del Sur global. Un indicador significativo del progreso ha sido el establecimiento de un … [Read more...]

Targeting illicit financial flows in the Sustainable Development Goals

The last two decades have seen the emergence of a powerful tax justice movement globally, led by civil society expertise and increasingly by policymakers of the global South. One significant marker of progress has been the establishment of a target to address illicit financial flows, including … [Read more...]

New report: is Apple paying less than 1% tax in the EU?

We're pleased to share this new study commissioned by GUE/NGL members of the European Parliament’s TAX3 special committee on tax evasion, tax avoidance and money laundering. You can read more about their very important work here. The report was written by Emma Clancy and Martin Brehm Christensen and … [Read more...]

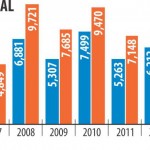

Estimates on illicit flows to and from developing countries

Our friends at Global Financial Integrity have released their latest report on what they estimate to be the latest figures from 150 countries on illicit financial flows to and from developing countries for the period 2005-2014. Most of these flows arise from fraudulent trade mis-invoicing which, as … [Read more...]

Estimating tax avoidance: New findings, new questions

By Alex Cobham There are now a range of estimates of the global scale of tax avoidance. These include: the $600 billion annual tax loss estimated by IMF researchers Crivelli et al. (2015; 2016), which divides roughly into $400 billion of OECD losses and $200 billion elsewhere; the $100 … [Read more...]

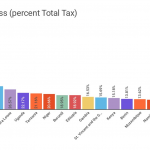

Report: new data disproves US corporations’ false narrative on taxes

From Americans for Tax Fairness, a major new report about corporate taxes in the United States. It's called Corporate Tax Chartbook: How Corporations Rig the Rules to Dodge the Taxes They Owe, and it contains many useful facts, such as this: Corporate profits are way up, and corporate taxes … [Read more...]

Switzerland is handing back looted money. How big a deal is this?

In the context of a fun Twitter fight and finger-pointing between the Swiss Bankers' Association and the German Finance Ministry, there's a newish story on Quartz entitled Swiss bankers swear they are trying to help Africa get its dirty money back. It begins like this: "It irritates Valentin … [Read more...]

More than $12 trillion stuffed offshore, from developing countries alone

From The Guardian: "More than $12tn has been siphoned out of Russia, China and other emerging economies into the secretive world of offshore finance, new research has revealed, as David Cameron prepares to host world leaders for an anti-corruption summit. . . . The analysis, carried out by … [Read more...]

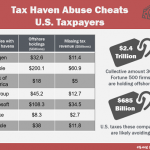

US Fortune 500 cos hold $2.4trn offshore, dodging up to $695bn in tax

From Citizens for Tax Justice, a major new report: "A diverse array of companies are using offshore tax havens. . . All told, American Fortune 500 corporations are avoiding up to $695 billion in U.S. federal income taxes by holding $2.4 trillion of “permanently reinvested” profits offshore. In … [Read more...]

Still Broken: major new report on global corporate tax cheating

Update, Dec 7, 2015: a new paper in the Journal of World Business, which contains this: "Home country statutory corporate tax rates have a small impact on tax haven use. In general, corporate tax rates are an important factor in driving MNEs to set up tax haven subsidiaries. However, … [Read more...]

New study: U.S. Fortune 500 cos have $2.1 trillion offshore

From Citizens for Tax justice, via email: "Today Citizens for Tax Justice and the U.S. PIRG Education Fund released, "Offshore Shell Games," a new study which found that nearly three-quarters of Fortune 500 companies maintained at least one tax haven subsidiary in 2014, with just 30 companies … [Read more...]