By Alex Cobham, TJN's Director of Research March 2015. Welcome to the third Tax Justice Research Bulletin, a monthly series dedicated to tracking the latest developments in policy-relevant research on national and international tax. This issue looks at new papers on the responsibilities … [Read more...]

More

UNCTAD: multinational tax avoidance costs developing countries $100 billion+

The UN Conference on Trade and Development (UNCTAD) has just published a major new study on corporate tax in developing countries, which contains a wealth of new information analysis as well as some important headline numbers: notably that developing countries lost around $100 billion per year in … [Read more...]

New Report: Ten Reasons to Defend the Corporate Income Tax.

UPDATES 2018 - Tax incentives in mining: minimising risks to revenue, OECD/Intergovernmental forum on mining, minerals, metals, and sustainable development. "Tax incentives are costly, leading many countries to forgo vital revenues in exchange for often illusive benefits. . . there is little … [Read more...]

How the ‘competitiveness’ dogma made banks corrupt

We've come across an interview in The Atlantic with Stephen Platt, an expert on financial crime prevention, contained in an article entitled How Dirty Money Gets Into Banks. As much as anything, we've taken it as an excuse to reproduce this fabulous cartoon in Britain's Private Eye magazine, which … [Read more...]

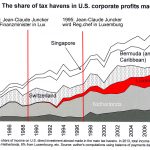

Jean-Claude Juncker and tax haven Luxembourg, in a picture

From Gabriel Zucman, an image enhanced by David Walch of Attac-Austria: Juncker, of course, has denied responsibility for his role in Luxembourg's tax haven activities such as the Luxleaks scandal. In his role at the head of the European Commission it's politically important for him to say … [Read more...]

Quote of the day: tax-evading Greek oligarchs

From an article by UK journalist Paul Mason, published on the eve of the Greek vote: "As for the Greek oligarchs, their misrule long predates the crisis. These are not only the famous shipping magnates, whose industry pays no tax, but the bosses of energy and construction groups and football … [Read more...]

Haven quote of the day: there are no activities here

From Fortune Magazine, an investigation into Luxembourg's shady corporate dealings: "The mailbox marked AIG/Lincoln—the name of a partner of the New York–based insurance and real estate giant AIG—is empty and unlocked. Moments later, in the company’s fifth-floor office, I meet AIG/Lincoln’s … [Read more...]

Quote of the day: offshore enforcement as a career killer

From Jack Blum, a Senior Adviser to the Tax Justice Network, testifying to the U.S. Senate Committee on Finance: "For years there has been very little offshore enforcement. There was a period in the 1970’s when IRS made some efforts in that direction. The cases were dismissed. The agents who … [Read more...]

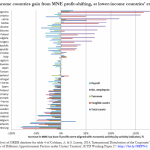

Poorer Countries Lose More from Corporate Profit-Shifting

By Alex Cobham. This post was originally published by the Center for Global Development, where I was a research fellow until leaving this month to join TJN as Director of Research. Reproduced, with CGD's permission. Poorer Countries Lose More from Corporate Profit-Shifting Lower-income … [Read more...]

Tax quotes of the day – Lewis Black, Edmund Burke

Two more, in an occasional series. You can find plenty more on our quotations page. “They're so broke that they've actually cut essential services. In many places, they've cut policemen, because, who the fuck needs them? Or firemen, son of a bitch, it's much more fun watching something burn … [Read more...]

The nonsense of shareholder ownership

Neoliberals claim that shareholders are the owners of companies. This is nonsense, argues Austin Mitchell MP and Prem Sikka, Professor of Accounting, University of Essex in this joint paper published in Left Foot Forward. … [Read more...]

Developing countries: a new government revenue dataset

From the International Centre for Tax and Development: A major obstacle to cross-country research on the role of revenue and taxation in development has been the weakness of available data. This paper presents a new Government Revenue Dataset (GRD), developed through the International Centre for … [Read more...]

The World Weekly – Infographic on the Hidden Economy

From The World Weekly: … [Read more...]

Big Bills: how our central banks nurture money launderers and kleptocrats

A question for our European readers. How many of you have ever spent or even seen a 500 Euro note? No, neither have we. Which is may seem odd, given that there are some 300 billion Euros' worth of these things out there, in circulation. Which raises the question: where are they all? … [Read more...]

Tax dodging and the birth of the British Empire

As we've documented, the United Kingdom plays a central - if not the central - role in the modern global system of offshore tax havens, or secrecy jurisdictions. Now here's a post from ActionAid, looking at (yet) another aspect of all this. Cross-posted, with permission. Tax dodging and the … [Read more...]