From The Guardian: "More than $12tn has been siphoned out of Russia, China and other emerging economies into the secretive world of offshore finance, new research has revealed, as David Cameron prepares to host world leaders for an anti-corruption summit. . . . The analysis, carried out by … [Read more...]

More

US Fortune 500 cos hold $2.4trn offshore, dodging up to $695bn in tax

From Citizens for Tax Justice, a major new report: "A diverse array of companies are using offshore tax havens. . . All told, American Fortune 500 corporations are avoiding up to $695 billion in U.S. federal income taxes by holding $2.4 trillion of “permanently reinvested” profits offshore. In … [Read more...]

Still Broken: major new report on global corporate tax cheating

Update, Dec 7, 2015: a new paper in the Journal of World Business, which contains this: "Home country statutory corporate tax rates have a small impact on tax haven use. In general, corporate tax rates are an important factor in driving MNEs to set up tax haven subsidiaries. However, … [Read more...]

New study: U.S. Fortune 500 cos have $2.1 trillion offshore

From Citizens for Tax justice, via email: "Today Citizens for Tax Justice and the U.S. PIRG Education Fund released, "Offshore Shell Games," a new study which found that nearly three-quarters of Fortune 500 companies maintained at least one tax haven subsidiary in 2014, with just 30 companies … [Read more...]

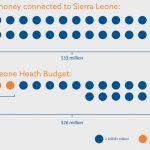

Christian Aid: new Swissleaks analysis shows harm to developing countries

An important new analysis from Christian Aid. Note the pull-out quote highlighting the problems with the OECD's Common Reporting Standard, or CRS. September 30 2015 NEW SWISSLEAKS ANALYSIS REVEALS HOW TAX HAVEN SECRECY HARMS DEVELOPING COUNTRIES New, detailed examination of the SwissLeaks files … [Read more...]

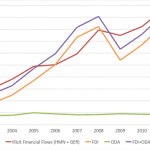

Report: Illicit Financial Flows Outpace Foreign Aid and Investment

Updated with new table: see below From Global Financial Integrity in Washington, D.C., via email: "Analysis of illicit financial flows (IFFs) by Global Financial Integrity (GFI) shows that in seven of the last ten years the global volume of IFFs was greater than the combined value of all … [Read more...]

Is it time to assess the financial secrecy of the Vatican?

The Vatican-based Istituto per le Opere di Religione (the Institute for Religious Works or IOR, a.k.a. the Vatican Bank) probably falls into the category of the world's most controversial bank. Now, according to this long read article in today's Guardian, the bank's unaccountable bureaucracy and … [Read more...]

The power of corporate propaganda: review of ‘The Mythology of Business’

Why did the vibrant social democratic traditions of Europe and North America collapse so swiftly in the face of the pervasive propaganda of the neoliberal project? … [Read more...]

Did NGOs invent a pot of gold? (No.)

By Alex Cobham, our research director: first posted at Uncounted. A draft paper by Maya Forstater, circulated by the Center for Global Development in time for the Financing for Development conference in Addis, attacks the integrity of many people and NGOs working on tax justice and illicit … [Read more...]

Quote of the day: JFK and secrecy

The quote is from John F. Kennedy, speaking in 1961 (hat tip: the Cayman Reporter): "The very word "secrecy" is repugnant in a free and open society; and we are as a people inherently and historically opposed to secret societies, to secret oaths and to secret proceedings. We decided long ago that … [Read more...]

Tax Justice Research Bulletin 1(5)

May 2015. Welcome to the fifth Tax Justice Research Bulletin, a monthly series dedicated to tracking the latest developments in policy-relevant research on national and international taxation. This issue looks at a fascinating thesis on the different people and organisations that influence the … [Read more...]

Stiglitz to tax haven UK: you are aiding and abetting theft

Our quote of the day, from Nobel prize winning economist Joseph Stiglitz, commenting in the wake of the UK election: “Some of these people are just using your rule of law to protect money they have stolen in other countries . . . From a global point of view, you are aiding and abetting theft.” … [Read more...]

The Offshore Game – new TJN report on offshore finance in football

From The Guardian, a major new story whose introduction runs as follows: "Research by the Guardian and the Tax Justice Network reveals 28 English clubs with substantial shareholdings overseas, opening up the football leagues to criticism for allowing ownership structures that could be used for … [Read more...]

New U.S. report: Offshore Tax Havens Cost Small Businesses $3,244 a Year

From the U.S. Public Interests Research Group (PIRG): As tax day approaches, it’s important to remember that small businesses end up picking up the tab for offshore tax loopholes used by many large multinational corporations. U.S. PIRG joined Senator Bernie Sanders, Bryan McGannon of the … [Read more...]

Quote of the day – tax avoidance as red flag for investors

From the Financial Times, our quote of the day: "investors were viewing the aggressiveness of a company’s tax planning as a proxy for accounting risks and the company’s broader management style." Which is just as we have always said. Tax avoidance is shortcut behaviour: the opposite of … [Read more...]