As we announced last week, the OECD has published data showing that financial accounts holding more than ten trillion euros are now the subject of multilateral, automatic information exchange - a longstanding tax justice goal that the OECD had long resisted. Now James Henry - a senior adviser to Tax … [Read more...]

More

It’s got to be automatic: Trillions of dollars offshore revealed by Tax Justice Network policy success

This is a moment, in these strange times, to celebrate an ongoing success in the history of the tax justice movement. Automatic, multilateral exchange of information on financial accounts is the A of our ABC of tax transparency. It has been a campaign aim since our inception in the early 2000s, as … [Read more...]

Financial Secrecy Index: who are the world’s worst offenders? The Tax Justice Network podcast special, February 2020

In this special extended Taxcast, Naomi Fowler takes you on a whistle-stop guided tour on an express train around the world with some of the Tax Justice Network team, looking at the worst offenders selling secrecy services according to the latest Financial Secrecy Index results What can nations can … [Read more...]

Paradigm shifts on tax, and who are ‘the uncounted’? Tax Justice Network November 2019 podcast

This month on the Taxcast we speak to Tax Justice Network CEO Alex Cobham about his new book The Uncounted on the politics of counting. Who's missing from the stats, from the bottom to the very top? And how can we count better? Plus: For decades corporate tax cuts have been touted as the way to … [Read more...]

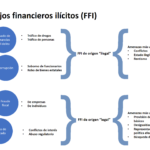

Objetivo 2030: los flujos financieros ilícitos

Las últimas dos décadas han visto el surgimiento de un poderoso movimiento de justicia fiscal a nivel mundial, liderado por la experiencia de la sociedad civil y cada vez más por los responsables políticos del Sur global. Un indicador significativo del progreso ha sido el establecimiento de un … [Read more...]

Targeting illicit financial flows in the Sustainable Development Goals

The last two decades have seen the emergence of a powerful tax justice movement globally, led by civil society expertise and increasingly by policymakers of the global South. One significant marker of progress has been the establishment of a target to address illicit financial flows, including … [Read more...]

New report: is Apple paying less than 1% tax in the EU?

We're pleased to share this new study commissioned by GUE/NGL members of the European Parliament’s TAX3 special committee on tax evasion, tax avoidance and money laundering. You can read more about their very important work here. The report was written by Emma Clancy and Martin Brehm Christensen and … [Read more...]

Podcast: Decolonisation and the Expansion of Tax Havens, 1950s-1960s

We're sharing a fascinating lecture at the University of London's Institute of Historical Research The lecture has the intriguing title 'Funk Money': Decolonisation and the Expansion of Tax Havens, 1950s-1960s and was delivered by Associate Professor Vanessa Ogle of the University of California, … [Read more...]

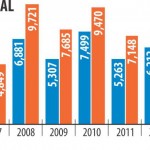

Estimates on illicit flows to and from developing countries

Our friends at Global Financial Integrity have released their latest report on what they estimate to be the latest figures from 150 countries on illicit financial flows to and from developing countries for the period 2005-2014. Most of these flows arise from fraudulent trade mis-invoicing which, as … [Read more...]

Estimating tax avoidance: New findings, new questions

By Alex Cobham There are now a range of estimates of the global scale of tax avoidance. These include: the $600 billion annual tax loss estimated by IMF researchers Crivelli et al. (2015; 2016), which divides roughly into $400 billion of OECD losses and $200 billion elsewhere; the $100 … [Read more...]

Quote of the day – the future of tax havens

From Joseph Stiglitz, writing in Vanity Fair: "It will not be long before those nations that opt to continue with old-style secrecy will be labeled pariah states and be cut off from the global financial system." New and abusive games will continue to emerge to fill the vacuum left by old-style … [Read more...]

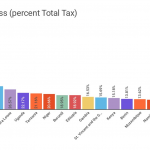

Report: new data disproves US corporations’ false narrative on taxes

From Americans for Tax Fairness, a major new report about corporate taxes in the United States. It's called Corporate Tax Chartbook: How Corporations Rig the Rules to Dodge the Taxes They Owe, and it contains many useful facts, such as this: Corporate profits are way up, and corporate taxes … [Read more...]

Switzerland is handing back looted money. How big a deal is this?

In the context of a fun Twitter fight and finger-pointing between the Swiss Bankers' Association and the German Finance Ministry, there's a newish story on Quartz entitled Swiss bankers swear they are trying to help Africa get its dirty money back. It begins like this: "It irritates Valentin … [Read more...]

TJN sparring partner caught up in Panama Papers scandal

Back in 2005 a lobby group in Washington, D.C. issued a press release entitled Tax Justice Network Sides with Europe's Tax Collectors, Ignores Critical Role of Low-Tax Jurisdiction in Protecting Human Rights and Promoting Pro-Growth Policy. The bizarre press release accused us of putting at risk … [Read more...]

Quote of the day – London and money laundering

From London's new mayor, Sadiq Khan: “I have got nothing against luxury properties being built in London. What we can’t have is London being the world’s capital for money laundering.” Ten years ago, who could have predicted this kind of comment? See more here. Just for instance. … [Read more...]