Asian logging companies 'use British islands for tax dodging' The Guardian "Calls for crackdown as investigation finds huge Indonesian corporations evading tax through network of secret shell companies in British Virgin Islands and other tax havens." New Zealand: the Shell Company Incorporation … [Read more...]

Inequality & Democracy

European voters: make tax dodging an election issue

From our friends at Eurodad: Eurodad … [Read more...]

African Countries Lose Billions through Misinvoiced Trade

Press Release - Global Financial Integrity African Countries Lose Billions through Misinvoiced Trade Fraudulent Trade Transactions Channeled at Least US$60.8 Billion Illegally in or out of 5 African Countries from 2002-2011 … [Read more...]

Links May 9

World Bank’s content-free report shows need for a rethink of its policy on tax havens Eurodad See also: CSO letter to IFC calls for immediate review of policy on tax havens … [Read more...]

“Western tax havens have resulted in Ukrainian deaths”

Here's something for the weekend. The American Interest has just published this article by Ben Judah, whose previous article on why Russia no longer fears the West caused such a stir earlier this year. The title says it all: How Offshore Finance Sank Western Soft Power. … [Read more...]

Links May 8

OECD: Countries commit to automatic exchange of information in tax matters The OECD's press release states "Bank secrecy for tax purposes is coming to an end". Sounds good, but is rather over-optimistic at this point. For TJN's views and briefings on information exchange see here. Kenya: Lobby … [Read more...]

Why companies put together for tax reasons will be fragile

A while ago we explained how tax avoidance by multinational corporations is like refined sugar in the human body: empty financial calories with adverse long-term health effects. Now we have an article from Financial Times columnist John Gapper, who has looked at the tax-arbitrage nonsense … [Read more...]

Ethical shareholders call on Google to stop its tax abuses

The Domini Social Equity Fund and its partners have submitted a shareholder proposal to Google for its annual meeting on May 14th urging it to do something about its systematic tax abuses. We just blogged a petition in support of this proposal, which we'd urge readers to sign. The shareholder … [Read more...]

Links May 6

G20 to talk tax in Tokyo The Australian Swiss banks follow the money to Panama swissinfo Swiss bankers might have been motivated to come to Panama because it’s “where they believe they can better protect the confidentiality of their clients”.' … [Read more...]

How Glencore made its money

From an excellent new article in Foreign Affairs, by Ken Silverstein. It concerns the commodity trading giant Glencore, which Reuters once called "the biggest company you never heard of," and which went public in May 2011. "What the IPO filing did not make clear was just how Glencore, founded four … [Read more...]

Links May 2

The political capture of rich countries in the fight against tax havens Oxfam France (In French) Ahead of the OECD's annual Forum in Paris, launch of a new report Arrangements Between Friends: Flaws in the OECD's Plan of Action Against Tax Havens India: Finance Minister Chidambaram warns … [Read more...]

Report: better tax rules could boost developing country corporate tax revenues by 100%

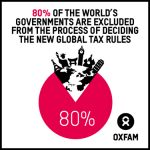

A new report from Oxfam, entitled BUSINESS AMONG FRIENDS: Why corporate tax dodgers are not yet losing sleep over global tax reform. It begins like this: "Tax dodging by big corporations deprives governments of billions of dollars. This drives rapidly increasing inequality. Recent G20 and OECD … [Read more...]

Zero hours contracts: how tax avoidance helps drive the abuses

There has been a lot of attention about a report in the UK summarised in today's Financial Times: "Unions and politicians have called for action to curb employment on a “zero-hours” basis after official data showed that UK employers are using about 1.4m contracts that do not guarantee a minimum … [Read more...]

Links May 1

Credit Suisse unit draws US tax scrutiny swissinfo "For years, Credit Suisse used a secondary Swiss banking brand, Clariden Leu, to woo clients who wanted a smaller, more personalised experience. Now, its decision to keep that little-noticed unit separate has become an issue in the long-running … [Read more...]

Links Apr 30

Credit Suisse, BNP Paribas U.S. Charges Said to Be Weighed Bloomberg Businessweek "Prosecuting the companies would break with a past practice of brokering settlements with large banks that are considered integral to the financial system." See also: Two Giant Banks, Seen as Immune, Become Targets … [Read more...]