There's been a lot of debate about the $2.6 billion (possibly tax-deductible, despite claims to the contrary) fine that Credit Suisse has paid for its systematic policies of attacking the U.S. tax system and fostering and, by implication, encouraging, criminal behaviour by thousands of U.S. … [Read more...]

Inequality & Democracy

Links May 23

US senators say more needs to be done after Credit Suisse conviction The Guardian See also: Credit Suisse Seen Keeping U.S. Bank License Bloomberg video - talks of the penalty being "political card playing", in that Credit Suisse are seen to be punished but they are still continuing as a bank in … [Read more...]

Tax haven operators hope to persuade China to block global transparency moves

From the BVI Beacon in the British Virgin Islands, a Special Report entitled Under pressure, BVI fears big impact on financial services. The BVI, and particularly a number of mostly white, male expatriate workers, have made a living out of secrecy. They don't like all this transparency stuff that … [Read more...]

Links May 22

Finnwatch report on tax responsibility of Finnish Pension Fund investments Report finds that Finnish pension funds tend to ignore global tax responsibility issues related to their investment activities. (Report in Finnish, with English language executive summary) Special Report: Under pressure, … [Read more...]

Why did the Australian government keep this tax symposium secret? (updated)

May 26: Updated with new details from the Sydney Morning Herald This concerns a meeting in Tokyo, hosted by the Australian Treasury, to discuss the G20's tax agenda. This involves not just the OECD's "BEPS" project to reform the international rules for taxing multinational corporations, but also … [Read more...]

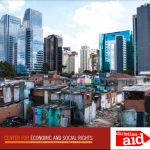

Human Rights Policy Brief: a Post-2015 Fiscal Revolution

The New York-based Center for Economic and Social Research (CESR) and Christian Aid have just published an important new paper entitled A Post-2015 Fiscal Revolution: Human Rights Policy Brief. It is a most useful contribution to the fast-growing community of researchers and research on the … [Read more...]

How Putin’s comrades washed their money in Switzerland and the UK

This is about an excellent Reuters investigation into a Russian state scheme to buy expensive medical equipment - and send money to Swiss bank accounts. It is worth reading in its entirety, but we will hone in on this bit: … [Read more...]

How ‘competitiveness’ became one of the great unquestioned virtues of contemporary culture

This headline is drawn from an important article at the London School of Economics website by Will Davies, Senior Lecturer at Goldsmiths, University of London. We've not had contact with Davies, but it seems we have been thinking along similar lines. … [Read more...]

Links May 20

DoJ Does Victory Lap on Credit Suisse Guilty Plea on Single Criminal Charge naked capitalism Very important insights. See also Credit Suisse escapes worst as it pleads guilty to U.S. charges Reuters - New York regulator decides not to revoke the bank's license, and top management stay in place, … [Read more...]

Report: Switzerland’s role in Shell’s tax avoidance

From SOMO in the Netherlands: "There is not one drop of oil coming out of the Swiss mountains, but still Royal Dutch Shell has eight subsidiaries in Switzerland. Between 2001 and 2005 the Dutch-British oil multinational set up a range of subsidiaries in the country, although these entities are not … [Read more...]

The Offshore Wrapper: a week in tax justice

The Offshore Wrapper is written by George Turner Credit Swindle? "We were running a criminal enterprise, but we didn't know," is what reportedly Credit Suisse will soon admit in its long running dispute with the United States Justice Department over alleged involvement in assisting US … [Read more...]

Programme: Tax Justice and Human Rights Symposium, McGill University, Montreal 18-20 June 2014

Tax Justice and Human Rights Research Collaboration Symposium Faculty of Law, McGill University, Montreal, 18-20 June 2014 Day 1: Emerging Scholars Symposium Wednesday 18 June … [Read more...]

Links May 19

Joining the Club: The United States Signs Up for Reciprocal Tax Cooperation Center for Global Development New Zealand: the Shell Company Incorporation Franchises (II) (and Ukraine) naked capitalism … [Read more...]

Links May 15

Companies fear BEPS “tax chaos” Economia See also: Global business tax clamp-down could sting U.S. -IRS official Reuters - Is the U.S. undermining the interests of developing countries? See TJN Briefing on BEPS here and information on The BEPS Monitoring Group here. … [Read more...]

Links May 13

U.S. Congress Moves To Strengthen US Anti-Inversion Rules Tax-News See also: Want Ad: 'Foreign Corporate Spouses Needed For U.S. Companies, Preferably From Low Tax Country' Forbes, and A Deal to Dodge the Tax Man in America Dealb%k Countries slow race to bottom on tax competition Financial … [Read more...]