Updated, Oct 10, with additional analysis from the Swiss "Q and A": Switzerland has grudgingly made some important concessions on secrecy in recent years - although we've always been at pains to stess that it has happened an inch at a time, and usually bilaterally. Typically, this means making … [Read more...]

Inequality & Democracy

The words ‘tax’ and ‘human rights’ – now appearing often in the same sentence

From Mauricio Lazala, Deputy Director, Business & Human Rights Resource Centre: "Recently, I participated in the annual sustainability forum of a global food & beverage company that is highly regarded for its social responsibility policies. The Chairman confidently spoke about their … [Read more...]

Links Oct 7

ActionAid Says Mines Arm Twisting Zambia Over Tax Refunds allAfrica See also: ActionAid Accuses Glencore of Strong-Arm Tactics allAfrica Get ready for UK extractive industries disclosure rules The FCPA Blog Indian, Swiss tax authorities expected to meet over controversial 'HSBC list' The … [Read more...]

Developing countries and tax treaties: learning from mistakes

From Martin Hearson, whom we quoted recently on a related topic: "One big theme from the interviews I conducted on my recent African trip is that tax officials in developing countries are really starting to raise concerns about some of their tax treaties. This is particularly true of treaties with … [Read more...]

Links Oct 6

Asia-Pacific's developing nations raise low government revenue: United Nations The Economic Times Switzerland Gives France Documents on 300 UBS Customers International Business Times See also: UBS whistleblower criticises banking’s ‘code of silence’ swissinfo, UBS criticises Paris over tax … [Read more...]

Links Oct 3

Eurodad - Tax and transparency fact-finding mission Mopani-Glencore claim to Zambia tax refund cannot be taken seriously Christian Aid 'Illegal state aid' and offshore 'sinners' in Euro tax probes The ICIJ Global Muckraker … [Read more...]

Links Oct 2

Australia: Business leaders to face parliamentary inquiry on tax avoidance The Sydney Morning Herald See also: Global crackdown on tax havens fails to sway Australian companies, Government warned that ATO not up to catching tax avoiders, and our earlier blog Third of Australia’s big corporations … [Read more...]

Links Oct 1

Taxing the digital economy is (going to be) an African issue Martin Hearson's Blog Andorra news: Tax haven secrets uncovered Financial Secrecy Media Monitor Crackdown on Apple in Ireland Opens Front on Tax Avoidance War Bloomberg See also: EU Takes Forward Irish Advance Tax Ruling Probe … [Read more...]

Links Sep 29

Hong Kong: In battle against tax evasion, our reputation must come before politics South China Morning Post Editorial with very interesting viewpoint. Thomas Piketty recommends progressive taxation for South Korea The Hankyoreh South Koreans, firms invest nearly US$23 bln in tax havens … [Read more...]

Argentina tax bureau gets Swiss data, while others skulk in shadows

This is a sight for sore eyes. Argentina, a country that has suffered more than most under the scourge of predatory Swiss banking practices (not to mention the banking practices of the UK, United States and others), is making a very public stand. The head of Argentina's tax bureau, Ricardo … [Read more...]

Links Sep 25

Mauritius, India in talks to address tax treaty concerns: FSC The Economic Times Mauritius is apparently aiming to dispel 'misperceptions' that it is a tax haven. Corporations may be people — but they can be used to hide criminals too The Washington Post Australian Taxation Office amnesty … [Read more...]

Links Sep 24

A Good Deal Better: Uganda's Secret Oil Contracts Explained Global Witness Taxation and Organized State Criminality - the Case of Zambia Pambazuka News See also: Friendly judge rescues M’membe from ZRA over K26.8 m tax evasion Zambian Watchdog Brazil, U.S. sign tax pact frozen by spy scandal … [Read more...]

Quote of the day: tax and the rule of law

From Cassandra Does Tokyo, a blogger we've not come across, via FT Alphaville: "Why is it so seemingly difficult for the uber-beneficiaries of the rule of law to reconcile their (mostly fiscal) responsibilities to the entente with The People which is the very fount that allows them, and … [Read more...]

Tax + transparency fact-finding mission: report from Asian, African, Latin American experts

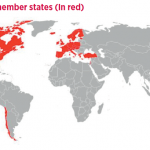

This newly published report is the outcome of a Tax and Transparency Fact-finding Mission carried out by a delegation of independent experts from Asia, Africa and Latin America in October and November 2013, based on visits to Switzerland, France, Norway, United Nations, The OECD, and the European … [Read more...]

On the new Asian Tax Justice Alliance

From our colleagues at Kepa in Finland, describing the birth of a region-wide consolidation of the previously scattered tax justice movements in Asia. "Over 60 leaders of people´s movements, civil society organizations and trade unions came together in Bangkok and took up the task of building a … [Read more...]