G20: what was achieved in 2014? Eurodad Where next for the EC tax probe? economia Green Party leader Eamon Ryan criticises Fine Gael for not backing Lux Leaks tax inquiry The Irish Times UBS France: again, the whistleblower faces her former employer Le Temps (In French) UBS whistleblower … [Read more...]

Inequality & Democracy

Luxembourg, Amazon, and the State aid connection

Earlier this month Bloomberg reported that the European Union had stated that: "Luxembourg hastily approved a “cosmetic” tax deal with Amazon.com Inc. in 11 days, allowing the company to shift profits to a tax-free unit. The EU told Luxembourg officials in a letter that the deal, based on a … [Read more...]

On the historical absence of inequality and tax in the news agenda

This guest blog from Dr Jairo Lugo-Ocando comes just a couple of days after the UK commentator George Monbiot wrote a piece in The Guardian entitled Our ‘impartial’ broadcasters have become mouthpieces of the elite, mostly from a Canadian and British perspective, in which he noted the extent of … [Read more...]

Links Jan 22

How Country By Country Reporting Could Have Made LuxLeaks Unnecessary Financial Transparency Coalition / Transparency International Are anonymous companies a ‘getaway vehicle for corruption’? The Guardian European Commission explains how Amazon made $4.5 billion in ‘stateless’ profits … [Read more...]

Links Jan 21

The Business Case for Ending Anonymous Companies: a Collective Effort The B Team Transparency: Cracking the shells - New rules in the European Union take aim at corporate secrecy The Economist Kenya’s capital gains tax stirs uproar CNBC Africa … [Read more...]

Foreign exchange turmoil brings offshore centres into focus

Moves by the Swiss National Bank to remove the Swiss Franc's currency peg to the Euro has prompted a new round of turmoil in global foreign exchange (FX) markets. We've already written about this from a tax justice perspective, but here's something else. Quite a few currency brokers have gone … [Read more...]

Links Jan 20

BEPS Action 14: Make Dispute Resolution Mechanisms More Effective BEPS Monitoring Group Review of Islands at the Bush Theatre London Londontheatre1.com Corporate Tax Behavior Can Be Changed By Public Pressure [Study] ValueWalk Richest Russians Repatriate Assets as Putin Turns Tax Screw … [Read more...]

Links Jan 19

Ex-Swiss banker found guilty in WikiLeaks trial, avoids jail Reuters See also recent blogs Will Antoine Deltour become a prisoner of conscience? and Tax haven whistleblowers: where are the human rights organisations? U.S. regulators question whether Credit Suisse has rule-breaking culture … [Read more...]

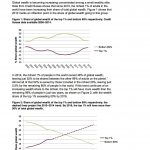

Report: will top 1% have more wealth than the 99% in 2 years?

From Oxfam, a new briefing, based on updated Credit Suisse estimates. It contains the following factoids: … [Read more...]

Links – Jan 16

Company beneficial ownership register to open in April 2016 STEP New UK corporate transparency measures allow applications for anonymity. See also: UK: Implementation of Company filing requirements and corporate transparency measures and the register of people with significant control ("PSC … [Read more...]

Will Antoine Deltour become a prisoner of conscience?

So the latest big tax haven whistleblower, Antoine Deltour, is facing the combined massed might of Luxembourg, one of the world's biggest and most aggressive tax havens, and the Big Four accounting firm PWC, one of the biggest and most aggressive lobbyists for offshore tax and secrecy … [Read more...]

Links Jan 15

Switzerland unveils draft laws to dismantle bank secrecy Financial Times (paywall) "The Swiss government has taken a further step towards dismantling its once untouchable bank secrecy laws, by unveiling draft legislation that would pave the way for automatic information exchange about offshore … [Read more...]

Links Jan 14

Tax evasion/Luxembourg leaks: EU Parliament inquiry committee gains cross-political support and must be swiftly put in place The Greens / European Free Alliance in the European Parliament See also: MEPs urge Schulz to set up inquiry committee on tax evasion EurActiv Credit Suisse to Face Nader … [Read more...]

Report: every U.S. state taxes its poorest at much higher rates than top 1%

From the U.S. Institute on Taxation and Economic Policy (ITEP), the 5th edition of Who Pays, its signature report that examines tax systems in all 50 states and the District of Columbia. Now get the highlights: Every state tax system (Washington D.C. excepted) taxes its poorest residents at … [Read more...]

Slovak govt. to enact new anti-shell company law after scandal

A guest blog by Miroslav Beblavy, Member of Slovak Parliament for the opposition party Sie?, (who has been involved in drafting the legislation) and Silvia Hudackova, assistant to Miroslav Beblavy. Slovak government committed to enact new anti-shell law after the healthcare procurement … [Read more...]