FemLaw [a collaborative research network of the Law and Society Association (LSA)] is seeking expressions of interest in presenting papers in its program at two interdisciplinary international conferences being sponsored by the Law and Society Association: the New Orleans LSA conference (June 2-5, … [Read more...]

Inequality & Democracy

Links Jul 10

Addis #FFD: An intergovernmental tax body? Uncounted Financing development: Tax them and they will grow The Economist "Poor countries need to get better at raising tax, and multinational firms need to get better at paying it" Building Tax Capacity in Developing Countries - Policy Briefing … [Read more...]

Links Jul 9

Tax Inspectors Shrug Off Borders to Track Multinational Evasion Bloomberg Cites TJN Director John Christensen Could tax breaks be on the agenda for big oil companies? World Finance Cites TJN's Nicholas Shaxson 'Corporate tax deals are robbing poor countries of teachers and nurses' The … [Read more...]

From Russia with cash: the London laundry exposed

From Britain's Channel 4, a superb exposé of Britain's high-end property circus market and the willingness of sellers to accept money from all sources, no matter how dubious. It is hilarious and ghastly, at the same time. This is money stolen from some of the world's poorest people, going into … [Read more...]

Links Jul 8

European Parliament sets the stage for Europe to embrace more corporate fiscal transparency Financial Transparency Coalition See also: The EU Parliament votes for public country-by-country reporting Tax Research UK The £93bn handshake: businesses pocket huge subsidies and tax breaks The … [Read more...]

Stop the bleeding: new African tax justice campaign

Via the Global Alliance for Tax Justice: Last week the Interim Working Group of the African IFF Campaign Platform launched the “Stop the Bleeding” campaign in Uhuru park, a place historically associated with the struggle for freedom in Nairobi, Kenya. … [Read more...]

Guest blog: how Switzerland corrupted its courts to nail Rudolf Elmer

Update, Oct 10, 2018 - Swiss top court knocks down bid to extend banking secrecy. Good news for Elmer, following his partial victory in 2016. Update, Jan 4, 2016: Elmer has won a partial victory, underlining the main point of this blog. In a civil suit brought by Elmer, the Swiss Federal Court … [Read more...]

Tax Justice Research Bulletin 1(6)

June 2015. Surprising everyone by actually arriving within the stated month, here’s the sixth Tax Justice Research Bulletin – a monthly series dedicated to tracking the latest developments in policy-relevant research on national and international tax, available in full over at TJN. This issue … [Read more...]

Links Jun 26

Stop the Bleeding campaign launched in Nairobi Global Alliance for Tax Justice See also: Stop Africa's $50 billion a year illicit outflow, campaigners say Reuters ActionAid: Tax Competition’s Impact on Developing Countries – Panel Discussion, 7 July, London Tax havens and tax evasion: a … [Read more...]

Links Jun 25

A “historic day” for the Fair Tax Mark UN estimates on tax dodging: Offshore tax zones cost developing countries $100 bln a year - U.N. Reuters, and Companies Avoid Paying $200 Billion in Tax The Wall Street Journal How could you not be excited by the Palma? Uncounted - Alex Cobham's … [Read more...]

The Lima Declaration on Tax Justice and Human Rights

Please endorse the Lima Declaration on Tax Justice and Human Rights! The initial list of signatories will be announced on World Public Services Day, 23 June 2015, the culmination of the Global Week of Action for #TaxJustice. Additional signatories will be continue … [Read more...]

Links Jun 23

Global Week of Action: final push for #TaxJustice Global Alliance for Tax Justice Tax Justice to fund free, quality Public Services Global Alliance for Tax Justice French Economist Piketty: Europe’s Stance on Greek Tax Reform Is Hypocritical Greek Reporter Tax matters - Greece bailout deal … [Read more...]

Tax and the Death of Democracy – interview from The Renegade Economist

In this excerpt from an interview recorded in June 2015, Ross Ashcroft talks with film-maker Harold Crooks (The Corporation, Surviving Progress, The Price We Pay) and TJN's director, John Christensen, about the threat posed by tax havens to parliamentary democracy. … [Read more...]

Links Jun 22

The parallel financial universe of the Cayman Islands Cayman Reporter "...the people of these islands are waking up to the reality that has been kept masked under many shrouds for decades." US official says British government undermined progress on tax avoidance The Guardian See also: Could UK … [Read more...]

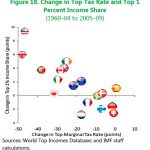

New IMF research: tax affects inequality; inequality affects growth

This new graph from the IMF is just the latest piece of research that follows on from the in-depth work of Thomas Piketty and others looking at the relationship between top income tax rates and inequality. The graph here makes the point adequately. Put crudely, the lower the top tax rate, the more … [Read more...]