Book launch: Inequality, uncounted By TJN's research director Alex Cobham Malawi: ActionAid urges UK to rethink colonial-era tax deal which slashes money for health care and education The Independent Ecuador parliament debates law to prevent tax evasion on gains from bequests STEP "The main … [Read more...]

Inequality & Democracy

Links Jan 28

The movement to end tax havens is already 100,000 strong and growing Oxfam Eurodad: European Commission’s Anti Tax Avoidance Package will not stop multinationals dodging taxes See also Eurodad's Briefing: An analysis of the European Commission’s Anti-Tax Avoidance Package, and EU clamps down on … [Read more...]

Links Jan 26

Accounting experts seek independent probe into KPMG’s audit of HBOS Financial Times. Involving a number of TJNers or friends of TJN. Australia: Big business accused of using 'straw man' arguments against tax avoidance crackdown The Guardian Political commentator: 'Tax havens won't last … [Read more...]

2016 Tax Justice and Human Rights Essay Competition

Tax Justice Network and Oxfam are joining together to launch a tax justice and human rights essay competition for legal students and professionals. With tax justice rising up the human rights agenda, we want to hear your ideas on how human rights law can be used in the fight against tax dodging. … [Read more...]

Links Jan 25

Google £130m UK back-tax deal lambasted as ‘derisory’ by expert The Guardian Cites TJN Senior Adviser Prem Sikka. See also Prem's report Some Questions about Google’s UK Tax Settlement of £130 million, also MPs attack deal to let Google to pay 'relatively trivial' £130m back taxes The Guardian, … [Read more...]

Links Jan 22

Governments need to get out of their “cosy bed” with business, says Oxfam chief euronews Apple Steps Up Lobbying Efforts Against European Tax Probe Bloomberg Cites TJN's research director Alex Cobham Ireland: State may not get any Apple tax haul The Irish Examiner Number of Offshore IPOs … [Read more...]

Links Jan 21

Revenue foregone through tax treaties in context Martin Hearson's Blog Read more on Tax Treaties here. MEPs want companies tax dodges repaid into EU budget euobserver See also: MEPs Say State Aid Probe 'Windfall' Should Be Divvied Up Tax-News Greater tax transparency: Interview with … [Read more...]

Review: new book on Capital Flight from Africa

Over at Uncounted, Alex Cobham (our Research Director) has written a review of a new tome for tax justice bookshelves: Capital flight from Africa: Causes, effects and policy issues, Ibi Ajayi & Léonce Ndikumana (eds.), 2015, Oxford University Press. His review begins: "This new volume … [Read more...]

Links Jan 19

How Shell, Total and Eni benefit from tax breaks in Nigeria's gas industry Stop Switzerland Selling Secrecy, Christian Aid Urges Davos Delegates The Cayman Islands – home to 100,000 companies and the £8.50 packet of fish fingers The Guardian The ideologists of the Competitiveness … [Read more...]

Links Jan 18

Tax-dodging by the superrich is driving global inequality, Oxfam says Al Jazeera New report singles out tax havens as main cause of global inequality, urges coordinated response to widespread practice, see also Richest 62 people as wealthy as half of world's population, says Oxfam The Guardian, … [Read more...]

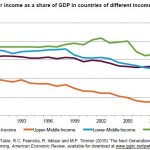

New Oxfam report: An Economy For the 1% – and how to reform it

In a new report on inequality, published today, Oxfam reveals that the richest one percent of the global population now owns more wealth that the rest of the world combined. In 2015, just 62 people had more wealth than the poorest half of the world's population, … [Read more...]

Links Jan 15

The Heavens: more accolades Treasure Islands Blog Civil Society in Zambia calls for government to adhere to beneficial ownership transparency in the new EITI principle Publish What You Pay Zambia MEP takes EU to court on tax transparency euobserver Apple May Be on Hook for $8 Billion in … [Read more...]

New paper: tax treaties a ‘poisoned chalice’ for developing countries

Update, Jan 20: this blog has now been adapted and expanded in a post on Naked Capitalism. In 2013 we published an article entitled Lee Sheppard: Don't sign OECD model tax treaties! which looked at a presentation by one of the U.S.' top experts in international tax. Her fiery presentation … [Read more...]

Tax justice and human rights: an issue that’s been hiding in plain sight

A new paper by Advocate Paul R Beckett in the Isle of Man is adding to the small but fast-growing body of work on Tax Justice and Human Rights. Its crowd-thrilling title is The Representative Impact of the Isle of Man as a Low Tax Area on the International Human Rights Continuum from a Fiscal and … [Read more...]

Links Jan 13

EC tax ruling: Belgian opportunity, big 4 at risk? Uncounted LuxLeaks whistleblowers thanked as tax probes continue ICIJ See also: LuxLeaks” trial to start on April 26th - Petition update on Support Antoine Deltour! U.S. Will Track Secret Buyers of Luxury Real Estate The New York … [Read more...]