This press release was put together by a group of organisations including TJN. Expert Global Commission Responds to One-Sided Tax Debate; Inaugural Meeting to drive changes ahead of Post-2015 Ambition Responding to widespread anger about corporate tax avoidance, the impacts of such avoidance … [Read more...]

Inequality & Tax Havens

The Next Rising Tax Haven

TJN's Andres Knobel has just had his article, The Next Rising Tax Haven, published in the Spring edition of the World Policy Journal. As the following extract suggests, the rise and rise of a tiny wealthy elite, who will go to great lengths to avoid paying taxes, means that tax havens are adapting … [Read more...]

Event: can low income countries ever tax transnational corporations?

From the Institute of Development Studies: Wednesday 11 March 2015 13:00 to 14:30 IDS, Convening Space Mick Moore will talk as a political realist and Alex Cobham, Research Director of the Tax Justice Network, as a magical realist. About the series Inequalities in various forms have been … [Read more...]

How to kickstart sluggish growth: tax corporations more

The Financial Times columnist John Plender he has written an exellent article that contains a number of points - every single one of which, bar one, has previously been argued by TJN. We won't summarise them all - please read the full article, if you have a subscription, but it's almost uncanny how … [Read more...]

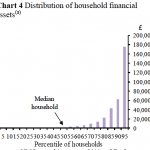

How much wealth does the median household have?

Forgive us for another UK-focused blog today, but there's a lot of British sleaze about at the moment. In this one we are going to highlight a graph, courtesy of the Bank of England (p10 here), which rather speaks for itself. Courtesy of David Quentin. Yes, yes, this ignores housing … [Read more...]

Tax transparency after #SwissLeaks

Cross-posted from Uncounted: Alex Cobham Yesterday I suggested some specific transparency measures to rebuild trust in light of #SwissLeaks. Today my colleagues at TJN pointed out that they are way ahead of me: here’s how. … [Read more...]

#SwissLeaks – Tax transparency for accountability

Cross-posted from Uncounted: Alex Cobham Much of the #SwissLeaks data has been in the hands of tax authorities for 5 years. Many of the questions raised relate to individuals and to particular regulators and governments – but there’s also a broader question that goes to the type of solutions … [Read more...]

Quote of the day: tax-evading Greek oligarchs

From an article by UK journalist Paul Mason, published on the eve of the Greek vote: "As for the Greek oligarchs, their misrule long predates the crisis. These are not only the famous shipping magnates, whose industry pays no tax, but the bosses of energy and construction groups and football … [Read more...]

Report: will top 1% have more wealth than the 99% in 2 years?

From Oxfam, a new briefing, based on updated Credit Suisse estimates. It contains the following factoids: … [Read more...]

Report: every U.S. state taxes its poorest at much higher rates than top 1%

From the U.S. Institute on Taxation and Economic Policy (ITEP), the 5th edition of Who Pays, its signature report that examines tax systems in all 50 states and the District of Columbia. Now get the highlights: Every state tax system (Washington D.C. excepted) taxes its poorest residents at … [Read more...]

Please contribute to the update of The End of Poverty?

Films play an important part in shaping new understandings about the structural causes of poverty and inequality. In 2007 we participated in the making of The End Of Poverty?, which has enjoyed huge critical success and has been watched by millions of people around the world. The makers of The … [Read more...]

British comedian Russell Brand on tax havens and hypocrisy

ISLANDS (or how to play dirty and get away with it) – preview in Reading

South Street Arts Centre, Reading, England - Thursday 6 & Friday 7 November, 8pm Caroline Horton & Co with China Plate and the Bush Theatre present 2 special preview performances. "This is my world, I am the king, I make the rules and everyone else can f**k off. This is off-shore." … [Read more...]

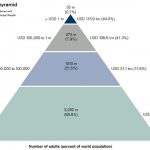

Picture of the day: the global wealth pyramid

Credit Suisse's new Global Wealth Report is out. As always, it contains a ream of useful data. For instance, it estimates that global household wealth reached US$263 trillion in mid-2014, up from $117 trillion in 2000: "Between 2008 and mid-2014, mean wealth per adult grew by 26%; but the same … [Read more...]

Direct corporate welfare costs UK taxpayers £85bn a year

We recently remarked on the good work done by Good Jobs First in highlighting state-level corporate welfare in the United States. Greg Leroy of Good Jobs First also points is towards the work by the Pew Charitable Trusts to bring more transparency to federal-level subsidies and spending. Now, from … [Read more...]