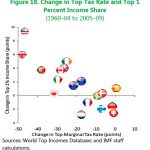

This new graph from the IMF is just the latest piece of research that follows on from the in-depth work of Thomas Piketty and others looking at the relationship between top income tax rates and inequality. The graph here makes the point adequately. Put crudely, the lower the top tax rate, the more … [Read more...]

Inequality & Tax Havens

Quote of the day – tax incentives as official tax evasion

This headline may seem odd. Conventionally tax evasion involves cutting taxes by breaking laws; using tax incentives is a different creature altogether: it involves cutting taxes by using the law. But this useful new report from the European parliament contains a twist on the conventional … [Read more...]

Stiglitz to tax haven UK: you are aiding and abetting theft

Our quote of the day, from Nobel prize winning economist Joseph Stiglitz, commenting in the wake of the UK election: “Some of these people are just using your rule of law to protect money they have stolen in other countries . . . From a global point of view, you are aiding and abetting theft.” … [Read more...]

Should tax targets for post-2015 be rejected?

From Alex Cobham, TJN Research Director, writing at Uncounted: "In a strident blog at the International Centre for Tax and Development, Mick Moore, Nora Lustig, Richard Bird, Nancy Birdsall, Odd-Helge Fjeldstad, Richard Manning and Wilson Prichard have called for the rejection of post-2015 tax … [Read more...]

The Tax Justice Research Bulletin 1(4)

Corrected: the earlier version referring to a Banque de France Report said "$8bn revenue loss" when it should have referred to an $8bn loss in tax base. The Tax Justice Research Bulletin By Alex Cobham. TJN (April 2015) - The Tax Justice Research Bulletin is a monthly series dedicated to … [Read more...]

Why Gender Equality Requires More Tax Revenue

This is the third post this week on the topic of gender, and to celebrate our arrival in the modern world we have created a new topic page, where you will permanently be able to access news and analysis in this area. Now we're delighted to host a guest blog by Diane Elson, Chair of the UK … [Read more...]

How do tax wars affect women?

Cross-posted from Fools' Gold: From the Association for Women's Rights in Development, a post related to a landmark meeting in Lima on tax justice and human rights: "The current “race to the bottom” in which tax competition among developing countries takes place to attract corporate and … [Read more...]

How do the UK parties’ promises on tax measure up on gender equality?

Ahead of the UK General Election due on May 7th, we are delighted to post a guest blog by Professor Sue Himmelweit of the Women’s Budget Group. The blog explains clearly just how important these issues are, and it also soon becomes clear that although this is a UK-focused blog, it has obvious … [Read more...]

Lima: TJN director Christensen speech on tax justice and human rights

From John Christensen, TJN's director, a speech about tax justice and human rights. It begins like this: "Why the tax justice movement should embrace human rights. And vice versa The history of economic and social rights in most countries can be discovered in their tax codes. Tax is at the … [Read more...]

BBC still using ideological evidence on top UK income taxes

HSBC whistleblower Falciani, on tax havens and whistleblowing

This video comes from The Guardian: "HSBC files whistleblower Hervé Falciani: 'This money comes from mafia, http://premier-pharmacy.com/product-category/anti-inflammatories/ drug traffickers, blood diamonds and tax evasion' " Alternatively, you can watch it here. … [Read more...]

The deep joy of trusts and foundations

We aren't sure whether to be horrified, flattered or entertained. Take a look at this peculiar video from a rather iffy-looking offshore promoter, complete with '80s soundtrack and faux newsroom. If you go to the original source of this video, it turns out that they are explicitly using TJN … [Read more...]

Report: parties rely on unsafe top tax estimates in UK election

Tax is one of the key battlegrounds in the UK’s general election due on May 7. No tax is more important than the income tax, and debates about the wisdom of cutting or hiking the top rate of income tax seem likely to heat up as polling nears. Some political parties advocate raising the top tax … [Read more...]

The Offshore Game – new TJN report on offshore finance in football

From The Guardian, a major new story whose introduction runs as follows: "Research by the Guardian and the Tax Justice Network reveals 28 English clubs with substantial shareholdings overseas, opening up the football leagues to criticism for allowing ownership structures that could be used for … [Read more...]

New Report: Ten Reasons to Defend the Corporate Income Tax.

UPDATES 2018 - Tax incentives in mining: minimising risks to revenue, OECD/Intergovernmental forum on mining, minerals, metals, and sustainable development. "Tax incentives are costly, leading many countries to forgo vital revenues in exchange for often illusive benefits. . . there is little … [Read more...]