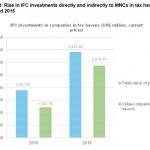

Monday 11th April Oxfam has launched a new briefing on the IFC and tax havens. This briefing will also be presented and discussed at our event at the World Bank CSO forum on Friday 15th of April at 11 am-12.30 in Washington DC. … [Read more...]

Inequality & Tax Havens

Oxfam report: Ending the Era of Tax Havens

Back in June 2000, three years before TJN's birth and at a time when nobody was talking about the issues, the charity Oxfam published a seminal document entitled Tax Havens: Releasing the hidden billions for poverty eradication. It was an important part of global tax justice history. We're … [Read more...]

International Women’s Day: tax justice is a feminist issue, every day.

Women's Budget Group (UK): showing how gender issues can be addressed International Women’s Day: Tax Justice is a feminist issue, every day. By Liz Nelson On International Women's Day, let’s remember that tax justice is a feminist issue - every day. We’d like to use today to signal some … [Read more...]

How do top rate income tax cuts affect women?

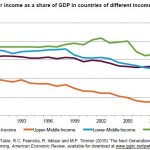

On International Women's Day, this is the first of two blogs on the subject of tax justice and gender. The short answer to the question in our headline is that cuts to the top rate of income tax hit women particularly hard, not just because their disproportionate role in childcare and other … [Read more...]

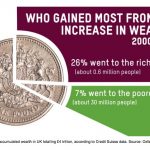

New Oxfam report: An Economy For the 1% – and how to reform it

In a new report on inequality, published today, Oxfam reveals that the richest one percent of the global population now owns more wealth that the rest of the world combined. In 2015, just 62 people had more wealth than the poorest half of the world's population, … [Read more...]

Tax justice and human rights: an issue that’s been hiding in plain sight

A new paper by Advocate Paul R Beckett in the Isle of Man is adding to the small but fast-growing body of work on Tax Justice and Human Rights. Its crowd-thrilling title is The Representative Impact of the Isle of Man as a Low Tax Area on the International Human Rights Continuum from a Fiscal and … [Read more...]

Wealth management: tax avoidance is just the tip of the iceberg

Recently we wrote a blog about some rather unique research carried out by Brooke Harrington, an Associate Professor at Copenhagen Business School who trained to become a wealth manager in order to study it properly. This week, Naomi Fowler interviewed her for our latest Taxcast. We think it is worth … [Read more...]

Quote of the day – on Mark Zuckerberg’s ‘charitable donation’

For those who don't know, Facebook founder Mark Zuckerberg this week pledged, on the birth of his daughter, to donate 99 percent of his billion-worth of Facebook stock to good causes. Which has generated adulation and love, from around the world: just look at the Great and the Good lining up to … [Read more...]

Colombia and civil war: the role of tax

A guest blog By Thomas Mortensen, with thanks. A bilateral ceasefire is due in Colombia in the coming weeks, hopefully December 16th. Tax is not the most obvious remedy for civil war but in the case of Colombia, it could go a long way. The country has suffered an internal armed conflict for more … [Read more...]

Who ultimately pays the corporate income tax? (Again.)

We have written many times about the 'incidence' (or, if you like) burden of the corporate income tax. When you tax corporations, who ultimately pays it: the workers, through lower wages? The consumers, through higher prices? Or is it the shareholders and owners of capital? It's a crucial … [Read more...]

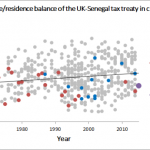

Will civil society shake up the world of tax treaties?

When a multinational company makes a cross-border investment, the relevant tax treaty between the two countries will generally sort out which country gets to tax which part of the ensuing activity and income streams. (Read more about tax treaties here.) A key question is this: how do the ensuing … [Read more...]

On tax credits, economic misunderstandings and the poor

The UK economics writer Chris Dillow has an excellent post making some basic points about tax credits, following a recent speech by the UK's finance minister (or "Chancellor") George Osborne, where he says: "We simply can’t subsidise incomes with ever-higher welfare and tax credit bills the … [Read more...]

World Bank president: corporate tax dodging ‘a form of corruption’

From a speech by World Bank President Jim Yong Kim: "Some companies use elaborate strategies to not pay taxes in countries in which they work, a form of corruption that hurts the poor." That is a powerful statement from a powerful individual. This is indeed something that we've been arguing … [Read more...]

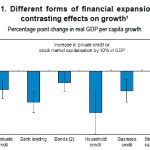

OECD: too much finance hurts growth — more on latest paper supporting Finance Curse thesis

From The Guardian: "Countries with bigger banking sectors suffer weaker growth and worse inequality, according to a report from the Organisation for Economic Co-operation and Development (OECD). After analysing 50 years of data across its 34 member-countries, economists at the Paris-based … [Read more...]

The Heavens: a photographic exploration of tax havens

In his essay on what he termed 'Conspicuous Leisure', economist Thorstein Veblen observed that "In order to gain and hold the esteem of men it is not sufficient merely to possess wealth or power. The wealth or power must be put to evidence, for esteem is only awarded on evidence. And not only does … [Read more...]