How do we empower rural women through tax justice policies? That’s what we at the Tax Justice Network were at the 62nd session of the UN Commission on the Status of Women to discuss recently at the UN Headquarters in New York City. This annual session is an opportunity for State delegations and … [Read more...]

Inequality & Tax Havens

Human rights costs of the proposed U.S. tax cuts

The UN Special Rapporteur on Extreme Poverty and Human Rights Philip Alston is making an official visit to the United States to investigate the links between the growing phenomenon of poverty and human rights deprivations. This comes at a time when the current administration is working on passing … [Read more...]

The Bogota Declaration on Tax Justice for Women’s Rights

The Bogota Declaration on Tax Justice for Women’s Rights is being launched around the world today (7 December 2017) through online platforms and at tax justice events in Argentina and Chile. You can read the Declaration text in English, Spanish, French, Portuguese, Arabic and Swahili here: EN / ES … [Read more...]

#ParadisePapers: UN human rights experts react: States must act against abusive tax conduct

The United Nations Independent Expert on the effects of foreign debt and human rights has released a strong statement on the ethical responsibility of corporations in the wake of the Paradise Papers revelations. The current Independent Expert, Juan Pablo Bohoslavsky has said ““Corporate tax abuse … [Read more...]

Passports and residency for sale in our October 2017 podcast

In this month’s Taxcast we look at the booming business of passports and residency for sale, and why it should worry us all. Also: even the IMF now advocates wealth taxes to combat inequality, yet governments around the world – most recently President Macron of France – are going in the … [Read more...]

Tax Justice video: How can we avoid another crisis? Expert panel discussion

In this video we hear fascinating presentations and discussion from an expert panel on how another global financial crisis can be avoided, ten years after the first. They focus on the UK, not only on the financial sector itself and the finance curse, but also on the role of the wider financial … [Read more...]

Hurricanes, disaster capitalism, bitcoin and over-reliance on unhelpful economic measures: our Sept 2017 podcast

In edition 69 of our monthly podcast, the September 2017 Taxcast we look at our over-reliance on unhelpful economic measures like Gross Domestic Product and how it constrains us. Also: we discuss hurricanes, tax havens and disaster capitalism the bitcoin bubble - China may be closing its … [Read more...]

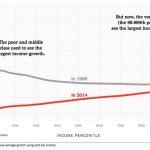

Inequality and the broken economy demonstrated in one graph

UPDATE (please see below for a UK graph) If you ever believed that the inequality levels we're seeing today in most so-called developed economies are inevitable, not so very remarkable, and not as extreme as some might have us believe, economists Thomas Piketty, Emmanuel Saez and Gabriel Zucman … [Read more...]

Women’s Rights and Tax Justice: Conference in Bogotá, Colombia

On June 13th, 14th, and 15th, 2017 the Tax Justice Network will be taking part in an important conference of people coming together in Bogotá to discuss the little-understood and under-reported impacts of political decisions on taxation and financial secrecy on women and girls around the … [Read more...]

Ownership Avoidance, the Great Escape in the Tax Justice Network December 2016 Podcast

In our December 2016 Taxcast: In trusts we trust? We look at the new game in town: beneficial ownership avoidance, the booming industry in alternative escape vehicles from public registers and why we must shine the spotlight on all of them. Plus: we discuss two big stories we think will define … [Read more...]

UN report recommends: go after tax havens, and protect whistleblowers

From the United Nations General Assembly, the fifth report of the Independent Expert on the promotion of a democratic and equitable international order. The summary goes like this: "The report focuses on impacts of taxation on human rights and explores the challenges posed to the international … [Read more...]

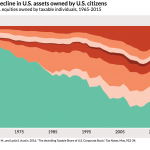

Report: new data disproves US corporations’ false narrative on taxes

From Americans for Tax Fairness, a major new report about corporate taxes in the United States. It's called Corporate Tax Chartbook: How Corporations Rig the Rules to Dodge the Taxes They Owe, and it contains many useful facts, such as this: Corporate profits are way up, and corporate taxes … [Read more...]

Report: why we need to tax corporations now, more than ever

Update: now on Naked Capitalism, where it's attracted a lot of interesting commentary Last year we published a document entitled Ten Reasons to Defend the Corporate Income Tax, outlining how the tax is under constant attack, in country after country, and explaining why it is one of the most … [Read more...]

More evidence of the links between tax and inequality

The economists Thomas Piketty, Emmanuel Saez, Facundo Alvaredo and Anthony Atkinson have played a big role in helping analyse and popularise the role that tax rate cuts for wealthy folk play in fostering economic inequality, particularly the income shares of the top 1 percent of people compared to … [Read more...]

Anti-tax, anti-regulation sirens already emerging after Brexit

Just before the Brexit vote we quoted Adam Posen, President of the Peterson Institute for International Economics, about what might happen in a post-Brexit Britain: "If you’re anti-regulation fantasists to begin with, you start going down the path, ‘Oh we can become an even more offshore center. We … [Read more...]