Rudolf Elmer, the Cayman-based Swiss whistleblower who went to prison after spilling secrets relating to the Swiss bank Julius Baer, has long been victimised not only by the Swiss banking establishment, and Switzerland's courts (which as we've extensively documented, seem to have played fast and … [Read more...]

Human Rights

Advocacy tools on tax policy and international cooperation for human rights

Our friends at Righting Finance have released their fourth in a series of advocacy tools on tax policy and international cooperation for human rights. The aim of these advocacy tools is to assist education and dissemination of the standards on tax policy and human rights contained in a report … [Read more...]

UN calls UK to account over impact of unjust tax laws

A United Nations body has called on the single largest financial secrecy jurisdiction in the world – the United Kingdom and its Overseas Territories and Crown Dependencies – to account for the human rights impacts of its unjust tax policies at home and abroad. The call was issued by the UN … [Read more...]

New tools for tax policies and human rights

From Righting Finance: The connection between civil and political rights and tax policy is so strong, that in a 2014 report on tax policy and human rights (“the report”), the UN Special Rapporteur on Extreme Poverty and Human Rights in 2014 said that the link runs both ways. That is, civil and … [Read more...]

Mauritius: India cracks down on a major tax evasion route

Update on this story available below on more recent developments India cracks down on a major tax evasion route A guest blog by Abdul Muheet Chowdhary The issue My award winning essay, written for a competition jointly held by the Tax Justice Network and Oxfam International, focused on how … [Read more...]

What if tax reform was a fundamental human right?

In January we blogged our 2016 Tax Justice and Human Rights essay competition, in partnership with Oxfam. It was a competition aimed at legal students and professionals, seeking ideas on how human rights law can be used in the fight against tax dodging. The winning student submission was from … [Read more...]

Why is the CEO of IKEA Switzerland head of a UN panel on gender?

On March the UN Secretary-General’s High-Level Panel on Women’s Economic Empowerment held their inaugural meeting. The panel: “intends to put women’s economic empowerment at the top of the international agenda, including by defining actions to speed up progress under the 2030 Agenda for … [Read more...]

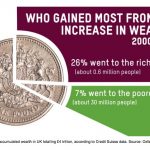

Oxfam report: Ending the Era of Tax Havens

Back in June 2000, three years before TJN's birth and at a time when nobody was talking about the issues, the charity Oxfam published a seminal document entitled Tax Havens: Releasing the hidden billions for poverty eradication. It was an important part of global tax justice history. We're … [Read more...]

Switzerland’s financial secrecy brought under the human rights spotlight

Switzerland – arguably the world’s most important tax haven – may soon face scrutiny from the United Nations human rights system over its role in facilitating cross-border tax abuse. A coalition of civil society bodies has filed a submission to the Committee on the Elimination of Discrimination … [Read more...]

UN asks IMF, World Bank, to study illicit financial flows

Highlighting a powerful new(ish) study: the final report on illicit financial flows and human rights of the UN Independent Expert, Juan Pablo Bohoslavsky. It’s well worth reading the whole thing, but here are some of the top lines and just a few of the many important recommendations: Illicit … [Read more...]

Civil society calls on African Union to prioritise financing human rights for women

We've just received a copy of the final Communiqué of the 6th Citizen's Continental Conference which took place in late January in Addis Ababa. This year the conference, which precedes the African Union Summit, had human rights as its core focus, with a particular focus on the rights of women. … [Read more...]

2016 Tax Justice and Human Rights Essay Competition

Tax Justice Network and Oxfam are joining together to launch a tax justice and human rights essay competition for legal students and professionals. With tax justice rising up the human rights agenda, we want to hear your ideas on how human rights law can be used in the fight against tax dodging. … [Read more...]

Tax justice and human rights: an issue that’s been hiding in plain sight

A new paper by Advocate Paul R Beckett in the Isle of Man is adding to the small but fast-growing body of work on Tax Justice and Human Rights. Its crowd-thrilling title is The Representative Impact of the Isle of Man as a Low Tax Area on the International Human Rights Continuum from a Fiscal and … [Read more...]

Colombia and civil war: the role of tax

A guest blog By Thomas Mortensen, with thanks. A bilateral ceasefire is due in Colombia in the coming weeks, hopefully December 16th. Tax is not the most obvious remedy for civil war but in the case of Colombia, it could go a long way. The country has suffered an internal armed conflict for more … [Read more...]

Fiscal Policy and Human Rights in the Americas: mobilizing resources to guarantee rights

There is a new initiative emerging from the international strategy meeting, “Advancing Tax Justice through Human Rights,” held in Lima, Peru in April 2015: Via email from Niko Lusiani of the Center for Economic and Social Rights (CESR): The first-ever thematic audience of the Inter-American … [Read more...]