The big offshore story of the moment is a new leak of 11 million documents from the Panama law firm Mossack Fonseca. The leak was originally to the German newspaper Süddeutsche Zeitung, was shared with the International Consortium of Investigative Journalists, and involves over 100 news … [Read more...]

Corruption

Scottish Government announces historic law to end secrecy of land ownership

This topic has been building slowly in some countries, whose economies are blighted by the fact that large tracts of real estate are owned by anonymous entities and arrangements, typically linked to tax havens. We'd highlight Private Eye's searchable database of offshore-owned properties in the … [Read more...]

Oxfam report: Ending the Era of Tax Havens

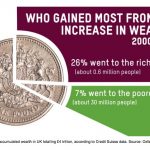

Back in June 2000, three years before TJN's birth and at a time when nobody was talking about the issues, the charity Oxfam published a seminal document entitled Tax Havens: Releasing the hidden billions for poverty eradication. It was an important part of global tax justice history. We're … [Read more...]

Tax haven Panama: giving the world the “middle finger”

Stephen Sackur and the BBC's Hard Talk programme have been talking to Panama's Vice President Isabel de Saint Malo de Alvarado. (It's only available to UK-based viewers, unfortunately.) She begins with a bout of self-congratulation about Panama, and Sackur responds with a wide number of … [Read more...]

Switzerland’s financial secrecy brought under the human rights spotlight

Switzerland – arguably the world’s most important tax haven – may soon face scrutiny from the United Nations human rights system over its role in facilitating cross-border tax abuse. A coalition of civil society bodies has filed a submission to the Committee on the Elimination of Discrimination … [Read more...]

UN asks IMF, World Bank, to study illicit financial flows

Highlighting a powerful new(ish) study: the final report on illicit financial flows and human rights of the UN Independent Expert, Juan Pablo Bohoslavsky. It’s well worth reading the whole thing, but here are some of the top lines and just a few of the many important recommendations: Illicit … [Read more...]

A Leak in Paradise – screening of this extraordinary documentary film about Swiss whistleblower Ruedi Elmer

Ana Gomes (S&D) and Fabio De Masi (GUE/NGL) Members of the Intergroup on Integrity, Transparency, Corruption and Organised Crime (ITCO) invite you to the screening of - A LEAK IN PARADISE - … [Read more...]

Quote of the day: South Africa’s Finance Minister

From the 2016 budget speech in South Africa, from Finance Minister Pravin Gordhan: "We will continue to act aggressively against the evasion of tax through transfer pricing abuses, misuse of tax treaties and illegal money flows. Drawing on the work of the OECD, the G20 joint project on base … [Read more...]

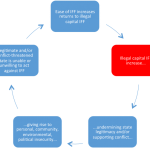

Illicit financial flows: the links to peace and security concerns

The UN Sustainable Development Goals (SDGs, the global framework guiding policy until 2030) include a target to reduce illicit financial flows (IFF), under SDG 16 on peace and security. Our research director, Alex Cobham, has written an article for the European Centre for Development Policy … [Read more...]

KPMG: Professional Chameleons Or Independent Public Auditors And Regulators?

A new guest blog by Atul K. Shah, Senior Lecturer, Suffolk Business School, University Campus Suffolk, UK. This is based on a paper Shah first presented at a Tax Justice Network Research Workshop at City University in June 2015, and it follows a more focused piece last month calling for a probe … [Read more...]

The Finance Curse: Britain and the World Economy, new paper

We've pointed to a draft of this before, but here is the final published version, in the British Journal of Politics and International Relations, a paper by two TJNers and Duncan Wigan of the Copenhagen Business School. (It's also available here.) The abstract goes like this: The Global … [Read more...]

Actor Greg Wise takes on the UK tax avoidance industry in Dispatches tonight

Actor Greg Wise was so disgusted by the evidence of how HSBC bank helped its clients evade taxes through its Swiss subsidiary, he got angry, very angry indeed. So he turned undercover investigator to expose the disgraceful lack of ethics of the tax dodging industry. As one of the tax … [Read more...]

Tax Haven USA: Congress moves to end corporate secrecy

Earlier this week we blogged a groundbreaking exposé of how US law firms advise on shifting dirty money into the USA. Now we hear that bipartisan legislation is being proposed to help stamp out corruption, money laundering and tax evasion by curbing use of anonymously-owned companies in America. … [Read more...]

Tax Haven USA – part one: 12 New York law firms advise on how to move dirty money to the USA

12 New York law firms filmed suggesting how to move suspect money into the US & avoid detection Ground-Breaking exposé by Global Witness shows how the corrupt can exploit anonymously-owned companies … [Read more...]

Review: new book on Capital Flight from Africa

Over at Uncounted, Alex Cobham (our Research Director) has written a review of a new tome for tax justice bookshelves: Capital flight from Africa: Causes, effects and policy issues, Ibi Ajayi & Léonce Ndikumana (eds.), 2015, Oxford University Press. His review begins: "This new volume … [Read more...]