In 2012 ActionAid published a report estimating that a huge new tax loophole deliberately created by the UK government - which it seems is bringing in precious little in terms of jobs or tax revenues - is also likely to cost developing countries some £4 billion (US$6 billion) a year. Ireland's … [Read more...]

Capital Flight

Big Bills: how our central banks nurture money launderers and kleptocrats

A question for our European readers. How many of you have ever spent or even seen a 500 Euro note? No, neither have we. Which is may seem odd, given that there are some 300 billion Euros' worth of these things out there, in circulation. Which raises the question: where are they all? … [Read more...]

The Offshore Wrapper: a week in tax justice

The Offshore Wrapper is written by George Turner The Togo triangle: where stolen Nigerian oil disappears Nigeria: the land of lost opportunity. Billions of dollars from oil revenue has literally been siphoned out of the country. The story – and corruption - has run for decades. … [Read more...]

Brazilians will pay heavily for FIFA’s “obscene” tax abuses

Four years ago we wrote about FIFA's so-called African "tax bubble" where FIFA was forcing a poor African country to forego its potential football tax revenues in order to funnel yet more money into FIFA's gilded Zürich headquarters and its lucrative empire. We quoted Professor Han Kogels of … [Read more...]

On the non-perils of information exchange

Update: see TJN writer Nicholas Shaxson's Five Myths about Tax Havens, in the Washington Post, April 2016. Back in 2009 we wrote a long blog looking at tax havens' arguments that if they give up information to countries with poor governance, all sorts of disasters will ensue. We think it's … [Read more...]

Credit Suisse: most of its victims haven’t seen any justice at all

There's been a lot of debate about the $2.6 billion (possibly tax-deductible, despite claims to the contrary) fine that Credit Suisse has paid for its systematic policies of attacking the U.S. tax system and fostering and, by implication, encouraging, criminal behaviour by thousands of U.S. … [Read more...]

Tax haven operators hope to persuade China to block global transparency moves

From the BVI Beacon in the British Virgin Islands, a Special Report entitled Under pressure, BVI fears big impact on financial services. The BVI, and particularly a number of mostly white, male expatriate workers, have made a living out of secrecy. They don't like all this transparency stuff that … [Read more...]

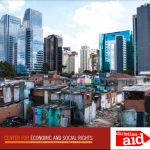

Human Rights Policy Brief: a Post-2015 Fiscal Revolution

The New York-based Center for Economic and Social Research (CESR) and Christian Aid have just published an important new paper entitled A Post-2015 Fiscal Revolution: Human Rights Policy Brief. It is a most useful contribution to the fast-growing community of researchers and research on the … [Read more...]

How Putin’s comrades washed their money in Switzerland and the UK

This is about an excellent Reuters investigation into a Russian state scheme to buy expensive medical equipment - and send money to Swiss bank accounts. It is worth reading in its entirety, but we will hone in on this bit: … [Read more...]

Report: Switzerland’s role in Shell’s tax avoidance

From SOMO in the Netherlands: "There is not one drop of oil coming out of the Swiss mountains, but still Royal Dutch Shell has eight subsidiaries in Switzerland. Between 2001 and 2005 the Dutch-British oil multinational set up a range of subsidiaries in the country, although these entities are not … [Read more...]

African Countries Lose Billions through Misinvoiced Trade

Press Release - Global Financial Integrity African Countries Lose Billions through Misinvoiced Trade Fraudulent Trade Transactions Channeled at Least US$60.8 Billion Illegally in or out of 5 African Countries from 2002-2011 … [Read more...]

How Glencore made its money

From an excellent new article in Foreign Affairs, by Ken Silverstein. It concerns the commodity trading giant Glencore, which Reuters once called "the biggest company you never heard of," and which went public in May 2011. "What the IPO filing did not make clear was just how Glencore, founded four … [Read more...]

The Offshore Wrapper: A week in Tax Justice

The Offshore Wrapper is written by George Turner "In Formula One, everyone cheats. The trick is not to get caught." … [Read more...]

Russia and Ukraine: how secrecy jurisdictions undermine international sanctions

From the Financial Times: "Wealthy Russians and Ukrainians are trying to shift more cash into London property, say estate agents, amid indications that eastern European oligarchs are using the capital’s housing market to conceal their assets from international sanctions." … [Read more...]

New report: Inequality, Tax and a Rising Africa?

From Tax Justice Network for Africa and Christian Aid, a new report entitled Africa rising? Inequalities and the essential role of fair taxation. It investigates income inequality in Ghana, Kenya, Malawi, Nigeria, Sierra Leone, South Africa, Zambia and Zimbabwe: there has been little definitive … [Read more...]