From Tove Maria Ryding and María José Romero, an article in The Guardian, looking at the UN's Finance for Development process, and a high-level conference set for Adis Ababa in July: "Finance for Development (FfD) is not a fundraising event. It focuses on systemic issues such as illicit financial … [Read more...]

Capital Flight

UNCTAD: multinational tax avoidance costs developing countries $100 billion+

The UN Conference on Trade and Development (UNCTAD) has just published a major new study on corporate tax in developing countries, which contains a wealth of new information analysis as well as some important headline numbers: notably that developing countries lost around $100 billion per year in … [Read more...]

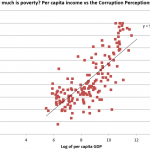

The UK’s money laundering rules support debanking of poorer countries

By Alex Cobham, TJN's Director of Research. Originally posted at his blog Uncounted. Poverty – a bad money-laundering risk factor The UK’s Financial Conduct Authority has revealed the basis on which it ranks jurisdictions as low or high risk for money laundering – and it seems inevitable that it … [Read more...]

Where did Zimbabwe’s diamond revenues go?

From Tax Justice Network Africa, via its Afritax feed, a video showing a Zimbabwean member of parliament, James Maridadi, taking the Minister of Finance to task on revenue from Marange Diamonds. The brief exchange is worth watching, not least for the Minister's evasive manoeuvres. But it's … [Read more...]

New report: how corrupt capital is used to buy property in the UK

From Transparency International, a landmark study looking at the role the UK's real estate sector has played in laundering the world's money. We don't have time to do this justice, but the world's media has done a good job covering it. Unmask the Corrupt: How UK Property Launders the Wealth of … [Read more...]

The Mbeki panel on illicit financial flows: Africa leads the way

Former South African president Thabo Mbeki panel has presented the findings of his panel to the African Union summit, where they were adopted directly into the declaration. Now, we’re biased for all sorts of reasons (more on that below), but this is an historic moment – and probably the most … [Read more...]

Quote of the day: tax-evading Greek oligarchs

From an article by UK journalist Paul Mason, published on the eve of the Greek vote: "As for the Greek oligarchs, their misrule long predates the crisis. These are not only the famous shipping magnates, whose industry pays no tax, but the bosses of energy and construction groups and football … [Read more...]

Please contribute to the update of The End of Poverty?

Films play an important part in shaping new understandings about the structural causes of poverty and inequality. In 2007 we participated in the making of The End Of Poverty?, which has enjoyed huge critical success and has been watched by millions of people around the world. The makers of The … [Read more...]

Developing countries and corporate tax – ten ways forward

Our last main blog before Christmas concerns developing countries. We are proud to publish an article by Krishen Mehta, one of our Senior Advisers, entitled The OECD's BEPS Process and Developing Countries - a way forward. This blog summarises the article, which is about how developing countries … [Read more...]

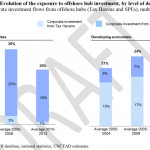

Eurodad: financial outflows from developing countries more than double the inflows

From Eurodad: The State of Finance for Developing Countries, 2014 This report provides the most comprehensive review of the quantity of different financing sources available to developing countries, and how they have changed over the past decade. … [Read more...]

GFI: Illicit Financial Flows Drained $991bn from Developing Economies in 2012

From Global Financial Integrity: Crime, Corruption, Tax Evasion Drained a Record US$991.2 Billion in Illicit Financial Flows from Developing Economies in 2012 Illicit Flows from Developing & Emerging Countries Growing at 9.4% per Year US$6.6 Trillion Stolen from Developing World from … [Read more...]

Tax haven whistleblowers: where are the human rights organisations?

Update: here's another whistleblower victim of tax haven practices for human rights organisations to help defend. Antoine Deltour, of Luxleaks fame. We are big fans of human rights organisations, generally speaking, but we're going to say some uncomfortable things about some of them … [Read more...]

Switzerland signs up for automatic info exchange. But there’s a catch

So we have this announcement from the OECD. "Switzerland has today become the 52nd jurisdiction to sign the Multilateral Competent Authority Agreement [MCAA], which will allow it to go forward with plans to activate automatic exchange of financial account information in tax matters with other … [Read more...]

Argentina’s capital flight and transfer pricing: new report

A new report from Argentina's CEFID-AR looks into the evolution of Argentina's transfer pricing legislation. A short summary follows. From the dictatorship that began in 1976 and lasted until 1983, the OECD's so-called 'arm's length method' for tackling transfer pricing was explicitly … [Read more...]

Panama voices call it “Badge of Honor” to be called a tax haven

We recently blogged about Colombia's decision to blacklist Panama because of its hostile role as tax haven for all sorts of dirty, criminal and corrupt Colombian drugs money. We also noted that Panama had the temerity to be outraged. Now, from PanAm Post, something that really should stick in … [Read more...]