Update: Colombia and Panama reach agreement on information-sharing. Panama, the secret garden of the Colombian oligarchy This guest blog is written by a political news writer in Colombia, who wishes to remain anonymous. As everywhere else in the world, the disclosure of the Mossack Fonseca … [Read more...]

Capital Flight

Area more than three times the size of Greater London owned in UK by secret companies in offshore tax havens

From Global Witness (no further comment from us is needed): Area more than three times the size of Greater London owned by secret companies in offshore tax havens An area of British land more than three times the size of Greater London is owned by secret companies in offshore jurisdictions like … [Read more...]

Taxing tax havens – Foreign Affairs article

TJN Senior Adviser James S. Henry has an article in the latest edition of Foreign Affairs entitled Taxing Tax Havens: How to Respond to the Panama Papers. It makes the point, as we have, that the tax havens are about so much more than tax, and then adds that much of the wealth supposedly stashed in … [Read more...]

The Panama papers – in case you missed it

The big offshore story of the moment is a new leak of 11 million documents from the Panama law firm Mossack Fonseca. The leak was originally to the German newspaper Süddeutsche Zeitung, was shared with the International Consortium of Investigative Journalists, and involves over 100 news … [Read more...]

Switzerland’s financial secrecy brought under the human rights spotlight

Switzerland – arguably the world’s most important tax haven – may soon face scrutiny from the United Nations human rights system over its role in facilitating cross-border tax abuse. A coalition of civil society bodies has filed a submission to the Committee on the Elimination of Discrimination … [Read more...]

UN asks IMF, World Bank, to study illicit financial flows

Highlighting a powerful new(ish) study: the final report on illicit financial flows and human rights of the UN Independent Expert, Juan Pablo Bohoslavsky. It’s well worth reading the whole thing, but here are some of the top lines and just a few of the many important recommendations: Illicit … [Read more...]

Quote of the day: South Africa’s Finance Minister

From the 2016 budget speech in South Africa, from Finance Minister Pravin Gordhan: "We will continue to act aggressively against the evasion of tax through transfer pricing abuses, misuse of tax treaties and illegal money flows. Drawing on the work of the OECD, the G20 joint project on base … [Read more...]

On the closure of the Argentinian think tank Cefid-AR

TJN laments the closure of the Centro de Economía y Finanzas para el Desarrollo de la Argentina" (Cefid-ar), an Argentine organisation heavily involved in research on illicit financial flows. Their work has shed light on capital flight from Argentina, estimating the figures of hidden money held … [Read more...]

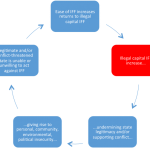

Illicit financial flows: the links to peace and security concerns

The UN Sustainable Development Goals (SDGs, the global framework guiding policy until 2030) include a target to reduce illicit financial flows (IFF), under SDG 16 on peace and security. Our research director, Alex Cobham, has written an article for the European Centre for Development Policy … [Read more...]

Apply withholding taxes to tackle tax haven USA

We get a nice name check in an article in this week's Economist, which goes after a subject we've been particularly exercised about for some time: Tax Haven USA. It cites one player in the spreading game: “It’s going nuts. Everyone is doing it or looking into it,” says a tax … [Read more...]

Call for Papers: Third Annual Amartya Sen Prize Competition

Call for Papers: Third Annual Amartya Sen Prize Competition Submission Deadline: August 29, 2016 The third Amartya Sen Prize is soliciting papers on the non-revenue impact of curbing illicit financial flows. Poor populations are hurt when rich individuals and multinational corporations … [Read more...]

Review: new book on Capital Flight from Africa

Over at Uncounted, Alex Cobham (our Research Director) has written a review of a new tome for tax justice bookshelves: Capital flight from Africa: Causes, effects and policy issues, Ibi Ajayi & Léonce Ndikumana (eds.), 2015, Oxford University Press. His review begins: "This new volume … [Read more...]

The ironic pillage of tax haven Puerto Rico by offshore hedge funds

Puerto Rico is a peculiar historical relic, whose relationship with the United States has strong echoes of the half-in-half-out relationships that the British Overseas Territories and Crown Dependencies enjoy with the mother country, the United Kingdom. This halfway-house link, which provides solid … [Read more...]

Venezuela’s rampant corruption

This guest blog from Alek Boyd explores what happens when oil, offshore financial secrecy and populist politics combine to corrupt the hopes of an entire nation. When the International Consortium of Investigative Journalists published leaked HSBC data provided by Hervé Falciani in February this … [Read more...]

New report: tax treaties in sub-Saharan Africa

Via Martin Hearson's website, here is a new report he authored for Tax Justice Network-Africa. As Hearson says, it’s based on field research done a year ago and has been a little while getting into print. Here’s a link to read it online at academia.edu Here’s a link to download the PDF Among many … [Read more...]