In 2012 ActionAid published a report estimating that a huge new tax loophole deliberately created by the UK government - which it seems is bringing in precious little in terms of jobs or tax revenues - is also likely to cost developing countries some £4 billion (US$6 billion) a year. Ireland's … [Read more...]

Aid, Tax & State-building

How Seychelles became a paradise for dirty money and corruption

In 2012 Al Jazeera published a remarkable undercover television investigation into the Seychelles, where two African journalists posing as wealthy Zimbabweans were brazenly offered the sleaziest secrecy services. It's a classic of offshore undercover investigation, and we at TJN have referenced it … [Read more...]

Quote of the day: on corporate tax policy making

From Martin Hearson: “What my clients are concerned about,” said my friend, “is political interference in corporate tax policymaking.” I found this quite startling. Is it possible that businesses consider corporate tax policy to be a matter for private negotiations between them and the government, … [Read more...]

On the non-perils of information exchange

Update: see TJN writer Nicholas Shaxson's Five Myths about Tax Havens, in the Washington Post, April 2016. Back in 2009 we wrote a long blog looking at tax havens' arguments that if they give up information to countries with poor governance, all sorts of disasters will ensue. We think it's … [Read more...]

Why did the Australian government keep this tax symposium secret? (updated)

May 26: Updated with new details from the Sydney Morning Herald This concerns a meeting in Tokyo, hosted by the Australian Treasury, to discuss the G20's tax agenda. This involves not just the OECD's "BEPS" project to reform the international rules for taxing multinational corporations, but also … [Read more...]

European voters: make tax dodging an election issue

From our friends at Eurodad: Eurodad … [Read more...]

Report: better tax rules could boost developing country corporate tax revenues by 100%

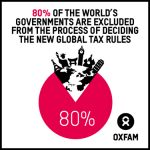

A new report from Oxfam, entitled BUSINESS AMONG FRIENDS: Why corporate tax dodgers are not yet losing sleep over global tax reform. It begins like this: "Tax dodging by big corporations deprives governments of billions of dollars. This drives rapidly increasing inequality. Recent G20 and OECD … [Read more...]

New report: Inequality, Tax and a Rising Africa?

From Tax Justice Network for Africa and Christian Aid, a new report entitled Africa rising? Inequalities and the essential role of fair taxation. It investigates income inequality in Ghana, Kenya, Malawi, Nigeria, Sierra Leone, South Africa, Zambia and Zimbabwe: there has been little definitive … [Read more...]

Mailbox companies and human rights: the Dutch connection

From our colleagues at SOMO in the Netherlands, an excellent article translated from the original in the Volkskrant newspaper. While it focuses on the Netherlands, it is another sign of the growing global awareness of the links between human rights and tax haven and secrecy jurisdiction abuses. Read … [Read more...]

Barclay promoting tax havens: protest at its AGM

Tomorrow (Thursday) Barclays Bank holds its Annual General Meeting in London. This will mark the culmination of ActionAid's ‘Clean Up Barclays’ campaign, which focuses on the bank’s promotion of the use of tax havens – notably Mauritius – for multinational companies looking to invest in Africa. … [Read more...]

Tanzania: parliamentary inquiry on tax abuses, tax havens, illicit flows

Adapted from an email from Tove Maria Ryding, Eurodad: Good news from Tanzania - the Public Accounts Committee there has kicked off an inquiry on tax evasion and avoidance, amid severe concerns about illicit financial flows and capital flight. We might have some interesting times … [Read more...]

Swiss tax treaty policy thwarts new era of automatic information exchange

We recently wrote about a new double tax agreement (DTA) signed on March 20th with Argentina. This is the latest in a series of worrying DTAs that Switzerland has been signing with countries from the Global South, despite the OECD Global Forum’s explicit criticism of Switzerland for signing only … [Read more...]

Guest blog: should Argentina sign a tax treaty with Switzerland?

Not long ago we published a Switzerland edition of our newsletter Tax Justice Focus, in which a contributor wrote: "Developing countries wanting OECD-type tax agreements with Switzerland risk being forced into tax concessions on Swiss foreign investments, in exchange for information sharing on tax … [Read more...]

New campaign: End Anonymous Companies

Tax justice is good for growth: IMF

We recently briefly blogged an IMF report describing how economic inequality leads to slower economic growth. Now, in the Financial Times, a fascinating comment article by the IMF Deputy Research Director Jonathan Ostry, whose subtitle is "A more redistributive tax system appears to lead to … [Read more...]