This is an extract from an article by Eurodad's Mathieu Vervynckt, in which he discusses the Third UN Conference on Financing for Development (FfD), set to take place in Addis Ababa next year as a crucial opportunity to discuss both the use of scarce public resources to leverage private sector … [Read more...]

Aid, Tax & State-building

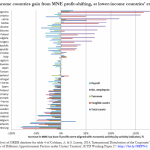

Poorer Countries Lose More from Corporate Profit-Shifting

By Alex Cobham. This post was originally published by the Center for Global Development, where I was a research fellow until leaving this month to join TJN as Director of Research. Reproduced, with CGD's permission. Poorer Countries Lose More from Corporate Profit-Shifting Lower-income … [Read more...]

Dublin event: The Human Rights Impact of Tax and Fiscal Policy

Hurry, while tickets last. One to add to our Events Page, and to our Tax Justice and Human Rights page. From Christian Aid: The Human Rights Impact of Tax and Fiscal Policy … [Read more...]

Developing countries and corporate tax – ten ways forward

Our last main blog before Christmas concerns developing countries. We are proud to publish an article by Krishen Mehta, one of our Senior Advisers, entitled The OECD's BEPS Process and Developing Countries - a way forward. This blog summarises the article, which is about how developing countries … [Read more...]

Eurodad: financial outflows from developing countries more than double the inflows

From Eurodad: The State of Finance for Developing Countries, 2014 This report provides the most comprehensive review of the quantity of different financing sources available to developing countries, and how they have changed over the past decade. … [Read more...]

Tax haven whistleblowers: where are the human rights organisations?

Update: here's another whistleblower victim of tax haven practices for human rights organisations to help defend. Antoine Deltour, of Luxleaks fame. We are big fans of human rights organisations, generally speaking, but we're going to say some uncomfortable things about some of them … [Read more...]

Financing development: NGO input for the UN meeting in 2015

Via Eurodad, a position paper on Financing for Development, co-signed by TJN and over 130 other civil society organisations. The paper is entitled UN Financing for Development negotiations: What outcomes should be agreed in Addis Ababa in 2015? and it seeks to provide input from civil society … [Read more...]

Its OK to avoid tax – we give to charity, and other b****cks!

Now here's a tricky public relations issue for our times: how does a band like Take That rebuild its image after being exposed as serial tax avoiders? The Guardian's Lost in Showbiz grapples with the problem, in light of the weak apology tweeted by Take That's Gary Barlow: “I want to apologise to … [Read more...]

New reports on OECD and developing countries: progress, but far to go

A couple of days ago the OECD published a document called The BEPS Project and Developing Countries: from Consultation to Participation which has three key elements: first, inviting ten developing countries to participate directly in its Committee on Fiscal Affairs and subsidiary bodies; second, to … [Read more...]

Why the Netherlands is the world’s largest source of FDI

Dutch FDI assets in 2012 were even larger than the United States', on some metrics. This guest blog from Francis Weyzig explains what is going on. Why the Netherlands is the world’s largest source of FDI Luxembourg is in the spotlight these days because so many multinationals shift their … [Read more...]

Denmark’s tax treaties: time for change

Tax treaties are international agreements between countries that share out taxing rights between countries when there's cross-border investment between them. The international tax treaty system is strongly based on models created by the OECD, a club of rich countries, and it shouldn't be a great … [Read more...]

Panama voices call it “Badge of Honor” to be called a tax haven

We recently blogged about Colombia's decision to blacklist Panama because of its hostile role as tax haven for all sorts of dirty, criminal and corrupt Colombian drugs money. We also noted that Panama had the temerity to be outraged. Now, from PanAm Post, something that really should stick in … [Read more...]

Occupy in London is back – many riot police, but where are the media?

By Gail Bradbrook, a TJN supporter who was at the Occupy protest: "There is currently an occupation in Parliament Square, England, in protest at the capture of democracy by financial interests; a feature of what we at TJN call the Finance Curse. TJN's director, John Christensen, was amongst … [Read more...]

Austria’s tax treaties: reducing developing countries’ revenues?

We've written a fair bit about tax treaties in the past few days, and have also updated and slightly expanded our tax treaties page. Now, in the spirit of the week, we offer a guest blog from Martina Neuwirth of the Vienna Institute for International Dialogue and Cooperation (VIDC,) highlighting a … [Read more...]

African low income countries demand fair share of tax

From Tove Maria Ryding at Eurodad, via email: At a media event in Washington last week, finance ministers of francophone low-income countries (DRC and Cameroon) demanded a "fair share of global tax revenues" and a "high-level meeting under UN auspices". … [Read more...]