Last December Krishen Mehta wrote us a longish article entitled Developing Countries and Tax - Ten Ways Forward. It outlines a series of measures that developing countries can consider as they seek to curb tax cheating by multinational corporations. This blog is really just a pointer to an article … [Read more...]

Aid, Tax & State-building

How Swiss banks moved their evasion experts to Latin America

An interview with Swiss banking whistleblower Stéphanie Gibaud in the Buenos Aires Herald (hat tip: Jorge Gaggero). It's fascinating. We'll post just a couple of excerpts here, and advise readers to look at the whole thing. For instance: "I did public relations for the bank, which means you … [Read more...]

Quote of the day – finance for development

From Tove Maria Ryding and María José Romero, an article in The Guardian, looking at the UN's Finance for Development process, and a high-level conference set for Adis Ababa in July: "Finance for Development (FfD) is not a fundraising event. It focuses on systemic issues such as illicit financial … [Read more...]

Tax Justice Research Bulletin 1(3)

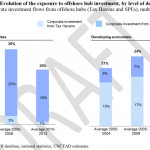

By Alex Cobham, TJN's Director of Research March 2015. Welcome to the third Tax Justice Research Bulletin, a monthly series dedicated to tracking the latest developments in policy-relevant research on national and international tax. This issue looks at new papers on the responsibilities … [Read more...]

UNCTAD: multinational tax avoidance costs developing countries $100 billion+

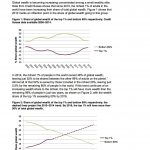

The UN Conference on Trade and Development (UNCTAD) has just published a major new study on corporate tax in developing countries, which contains a wealth of new information analysis as well as some important headline numbers: notably that developing countries lost around $100 billion per year in … [Read more...]

An African civil society perspective on Financing for Development

From the Uncounted blog, run by TJN's Director of Research, Alex Cobham The African regional consultation on Financing for Development (FfD) took place at the start of the week (like the European one). The submission from TJN-Africa puts particular emphasis on inequality, including women’s rights, … [Read more...]

The UK’s money laundering rules support debanking of poorer countries

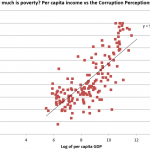

By Alex Cobham, TJN's Director of Research. Originally posted at his blog Uncounted. Poverty – a bad money-laundering risk factor The UK’s Financial Conduct Authority has revealed the basis on which it ranks jurisdictions as low or high risk for money laundering – and it seems inevitable that it … [Read more...]

New Report: Ten Reasons to Defend the Corporate Income Tax.

UPDATES 2018 - Tax incentives in mining: minimising risks to revenue, OECD/Intergovernmental forum on mining, minerals, metals, and sustainable development. "Tax incentives are costly, leading many countries to forgo vital revenues in exchange for often illusive benefits. . . there is little … [Read more...]

Where did Zimbabwe’s diamond revenues go?

From Tax Justice Network Africa, via its Afritax feed, a video showing a Zimbabwean member of parliament, James Maridadi, taking the Minister of Finance to task on revenue from Marange Diamonds. The brief exchange is worth watching, not least for the Minister's evasive manoeuvres. But it's … [Read more...]

New Expert Global Commission Responds to One-Sided Tax Debate

This press release was put together by a group of organisations including TJN. Expert Global Commission Responds to One-Sided Tax Debate; Inaugural Meeting to drive changes ahead of Post-2015 Ambition Responding to widespread anger about corporate tax avoidance, the impacts of such avoidance … [Read more...]

Event: can low income countries ever tax transnational corporations?

From the Institute of Development Studies: Wednesday 11 March 2015 13:00 to 14:30 IDS, Convening Space Mick Moore will talk as a political realist and Alex Cobham, Research Director of the Tax Justice Network, as a magical realist. About the series Inequalities in various forms have been … [Read more...]

Quote of the day: tax-evading Greek oligarchs

From an article by UK journalist Paul Mason, published on the eve of the Greek vote: "As for the Greek oligarchs, their misrule long predates the crisis. These are not only the famous shipping magnates, whose industry pays no tax, but the bosses of energy and construction groups and football … [Read more...]

New report: women, tax and economic inequality

ActionAid has just published a new report entitled Close the Gap! The Cost of Inequality in Women's Work, which does that it says on the tin. It's not just about tax, of course, but it contains much that is of interest to us. … [Read more...]

Luxembourg, Amazon, and the State aid connection

Earlier this month Bloomberg reported that the European Union had stated that: "Luxembourg hastily approved a “cosmetic” tax deal with Amazon.com Inc. in 11 days, allowing the company to shift profits to a tax-free unit. The EU told Luxembourg officials in a letter that the deal, based on a … [Read more...]

Report: will top 1% have more wealth than the 99% in 2 years?

From Oxfam, a new briefing, based on updated Credit Suisse estimates. It contains the following factoids: … [Read more...]